Dow Inc. (DOW): Price and Financial Metrics

DOW Price/Volume Stats

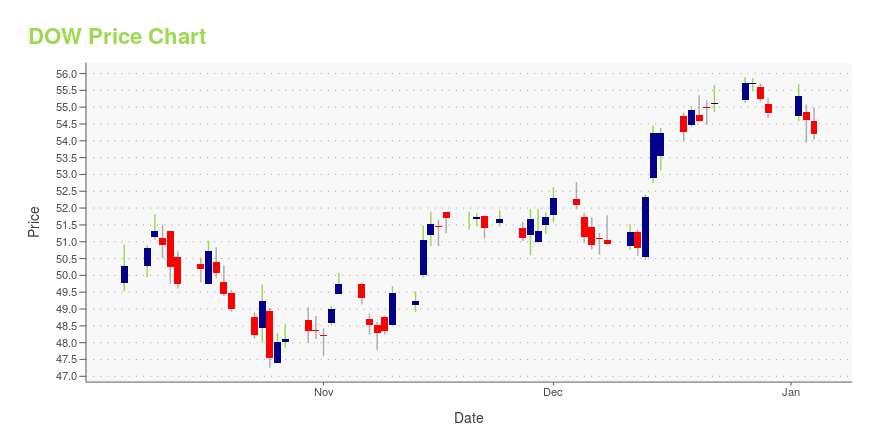

| Current price | $52.86 | 52-week high | $60.69 |

| Prev. close | $52.85 | 52-week low | $47.26 |

| Day low | $52.36 | Volume | 4,087,414 |

| Day high | $53.20 | Avg. volume | 4,629,767 |

| 50-day MA | $55.05 | Dividend yield | 5.18% |

| 200-day MA | $54.48 | Market Cap | 37.17B |

DOW Stock Price Chart Interactive Chart >

Dow Inc. (DOW) Company Bio

Dow Inc. manufactures and supplies products that are used as raw materials in the manufacture of customer's products and services worldwide. It operates in five segments: Agricultural Sciences, Consumer Solutions, Infrastructure Solutions, Performance Materials & Chemicals, and Performance Plastics segments. The Agricultural Sciences segment provides crop protection and seed/plant biotechnology products and technologies, urban pest management solutions, and healthy oils. The Consumer Solutions segment develops and markets customized materials using technology and chemistries for specialty applications, such as semiconductors and organic light-emitting diodes, adhesives, and foams for use in the transportation industry; cellulosics and other polymers for pharmaceutical formulations and food solutions; and silicone solutions used in consumer goods and automotive applications. The Infrastructure Solutions segment provides architectural and industrial coatings, construction material ingredients, building insulation products, adhesives, and microbial protection products for the oil and gas industry, telecommunications, and light and water technologies. The Performance Materials & Chemicals segment offers chlorine and caustic soda; industrial solutions; and isocyanates, polyols, polyurethane systems, and propylene oxide/propylene glycols. The Performance Plastics segment provides elastomers, polyolefin plastomers, and ethylene propylene diene monomer elastomers; wire and cable insulation, semiconductive, and jacketing compound solutions, as well as bio-based plasticizers; acrylics, polyethylene, and polyolefin plastomers; and ethylene, propylene, benzene, butadiene, octane, aromatics co-products, and crude c4 products, as well as products for power, steam, and other utilities. It primarily serves packaging, infrastructure, transportation, consumer care, electronics, and agriculture sectors. The company, based in Midland, Michigan, employs more than 39,000 people and was founded in 1897.

Latest DOW News From Around the Web

Below are the latest news stories about DOW INC that investors may wish to consider to help them evaluate DOW as an investment opportunity.

A Focus on Promoting Health and Wellness at DowOriginally published in Dow's 2022 INtersections Progress Report NORTHAMPTON, MA / ACCESSWIRE / December 27, 2023 / Dow is committed to the health and well-being of our people and offers a range of preventive, educational, consulting and medical services. ... |

7 Best Dow Jones Stocks to Buy for Conservative InvestorsWith the Federal Reserve seemingly open to the idea of interest rate cuts next year, the narrative for the best Dow Jones stocks for conservative investors appears overly cautious. |

Dow Inc. (DOW) Rises But Trails Market: What Investors Should KnowIn the closing of the recent trading day, Dow Inc. (DOW) stood at $54.97, denoting a +0.71% change from the preceding trading day. |

Decarbonization: The Key To Transform and Grow the Cable IndustryWe have set ambitious sustainability targets, and we are committed to helping accelerate the global sustainable energy transition and transform the future of our industry for a better, more sustainable tomorrow. NORTHAMPTON, MA / ACCESSWIRE / December ... |

A Focus on Continuous Improvement in Safety at DowNORTHAMPTON, MA / ACCESSWIRE / December 18, 2023 / DOW Originally published in Dow's 2022 INtersections Progress Report Two key initiatives were launched in 2022 to reduce unplanned events, in particular, Process Safety Containment Events (PSCEs). ... |

DOW Price Returns

| 1-mo | -0.64% |

| 3-mo | -6.59% |

| 6-mo | 0.24% |

| 1-year | 1.27% |

| 3-year | -0.86% |

| 5-year | 39.93% |

| YTD | -1.18% |

| 2023 | 14.71% |

| 2022 | -6.65% |

| 2021 | 6.81% |

| 2020 | 7.88% |

| 2019 | N/A |

DOW Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching DOW

Here are a few links from around the web to help you further your research on Dow Inc's stock as an investment opportunity:Dow Inc (DOW) Stock Price | Nasdaq

Dow Inc (DOW) Stock Quote, History and News - Yahoo Finance

Dow Inc (DOW) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...