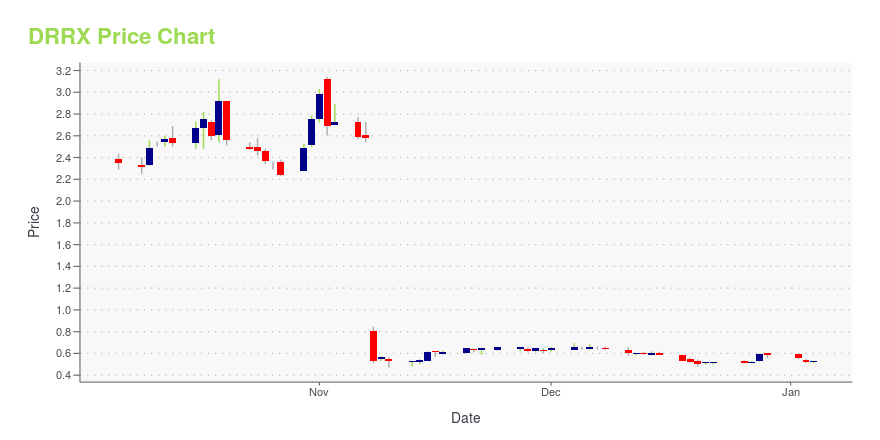

DURECT Corporation (DRRX): Price and Financial Metrics

DRRX Price/Volume Stats

| Current price | $1.67 | 52-week high | $3.60 |

| Prev. close | $1.65 | 52-week low | $0.47 |

| Day low | $1.64 | Volume | 33,089 |

| Day high | $1.69 | Avg. volume | 174,551 |

| 50-day MA | $1.41 | Dividend yield | N/A |

| 200-day MA | $1.16 | Market Cap | 51.84M |

DRRX Stock Price Chart Interactive Chart >

DURECT Corporation (DRRX) Company Bio

DURECT Corporation, a specialty pharmaceutical company, focuses on the development of pharmaceuticals products based on its proprietary drug formulations and delivery platform technologies in the United States, Europe, Japan, and internationally. The company was founded in 1998 and is based in Cupertino, California.

Latest DRRX News From Around the Web

Below are the latest news stories about DURECT CORP that investors may wish to consider to help them evaluate DRRX as an investment opportunity.

Q3 2023 DURECT Corp Earnings CallQ3 2023 DURECT Corp Earnings Call |

DURECT Corporation Reports Third Quarter 2023 Financial Results and Business UpdateDURECT Corporation (Nasdaq: DRRX) today announced financial results for the three months ended September 30, 2023 and provided a corporate update. |

Analysts Estimate Enanta Pharmaceuticals (ENTA) to Report a Decline in Earnings: What to Look Out forEnanta Pharmaceuticals (ENTA) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations. |

DURECT Corporation to Announce Third Quarter 2023 Financial Results and Provide a Business UpdateDURECT Corporation (Nasdaq: DRRX), a late-stage biopharmaceutical company pioneering the development of epigenetic therapies to transform the treatment of serious and life-threatening conditions, including acute organ injury and cancer, today announced that the company will report its financial results for the three months ended September 30, 2023 on Monday, November 13, 2023. Management will also host a conference call and webcast with investors to discuss financial results and provide a corpor |

Cantor Fitzgerald Is Souring on Lucid Motors (LCID) StockLucid Motors stock is falling after Cantor Fitzgerald analysts downgraded LCID shares and cut their price target following its Q3 earnings. |

DRRX Price Returns

| 1-mo | 27.00% |

| 3-mo | 79.32% |

| 6-mo | 114.10% |

| 1-year | -45.25% |

| 3-year | -87.72% |

| 5-year | -82.87% |

| YTD | 183.05% |

| 2023 | -82.95% |

| 2022 | -64.91% |

| 2021 | -52.37% |

| 2020 | -45.53% |

| 2019 | 691.67% |

Continue Researching DRRX

Here are a few links from around the web to help you further your research on Durect Corp's stock as an investment opportunity:Durect Corp (DRRX) Stock Price | Nasdaq

Durect Corp (DRRX) Stock Quote, History and News - Yahoo Finance

Durect Corp (DRRX) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...