Dynex Capital, Inc. (DX): Price and Financial Metrics

DX Price/Volume Stats

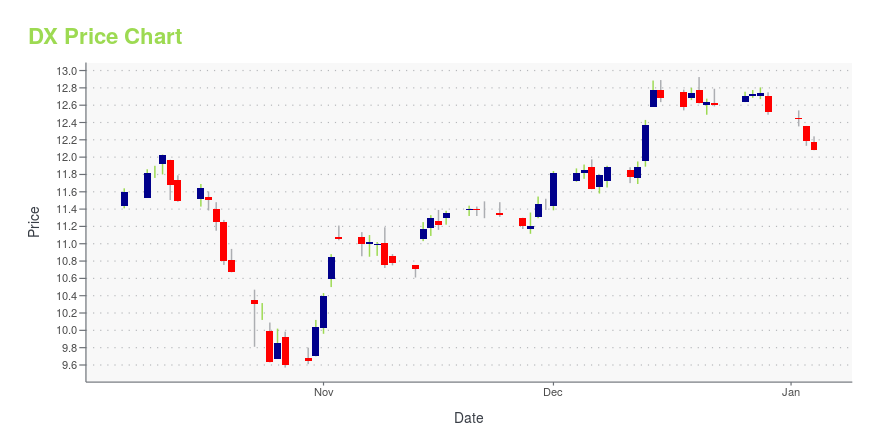

| Current price | $12.21 | 52-week high | $13.56 |

| Prev. close | $12.08 | 52-week low | $9.57 |

| Day low | $12.08 | Volume | 1,325,100 |

| Day high | $12.25 | Avg. volume | 1,393,166 |

| 50-day MA | $12.11 | Dividend yield | 12.53% |

| 200-day MA | $11.98 | Market Cap | 783.98M |

DX Stock Price Chart Interactive Chart >

Dynex Capital, Inc. (DX) Company Bio

Dynex Capital, Inc., a mortgage real estate investment trust, invests in mortgage securities on a leveraged basis in the United States. It invests in residential mortgage-backed securities and commercial mortgage-backed securities (CMBS), including CMBS interest-only securities guaranteed by an agency of the U.S. government or a U.S. government-sponsored entity; non-agency mortgage-backed securities; and securitized and unsecuritized mortgage loans. The company was founded in 1987 and is based in Glen Allen, Virginia.

Latest DX News From Around the Web

Below are the latest news stories about DYNEX CAPITAL INC that investors may wish to consider to help them evaluate DX as an investment opportunity.

Gold prices steady above $2,000 as Fed rate cut bets persistInvesting.com-- Gold prices steadied on Wednesday, sticking to a trading range established over the past week amid persistent bets that the Federal Reserve will trim interest rates earlier in 2024. |

Gold prices soar past $2,000 as Fed signals 2024 rate cutsInvesting.com-- Gold prices rose above key levels in Asian trade on Thursday, extending gains from the prior session after the Federal Reserve said it was done raising interest rates and projected lower borrowing costs in 2024. |

Gold prices pinned below $2,000 as Fed meeting looms, outlook uncertainInvesting.com-- Gold prices hovered below key levels on Wednesday as markets grew wary of non-yielding assets before the conclusion of the Federal Reserve’s final meeting for the year. |

Dynex Capital declares $0.13 dividendMore on Dynex Capital |

Dynex Capital, Inc. Declares Common and Preferred Stock DividendsGLEN ALLEN, Va., December 12, 2023--Dynex Capital, Inc. announced today that the Company’s Board of Directors has declared a cash dividend of $0.13 per share on its Common Stock (NYSE: DX) for December 2023 and the quarterly cash dividend of $0.43125 per share of its 6.900% Series C Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock (NYSE: DXPRC) for the fourth quarter of 2023. |

DX Price Returns

| 1-mo | 4.21% |

| 3-mo | 5.74% |

| 6-mo | 1.38% |

| 1-year | 4.61% |

| 3-year | -2.01% |

| 5-year | 24.45% |

| YTD | 5.06% |

| 2023 | 11.91% |

| 2022 | -15.39% |

| 2021 | 2.25% |

| 2020 | 17.09% |

| 2019 | 11.12% |

DX Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching DX

Here are a few links from around the web to help you further your research on Dynex Capital Inc's stock as an investment opportunity:Dynex Capital Inc (DX) Stock Price | Nasdaq

Dynex Capital Inc (DX) Stock Quote, History and News - Yahoo Finance

Dynex Capital Inc (DX) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...