DXC Technology Co. (DXC): Price and Financial Metrics

DXC Price/Volume Stats

| Current price | $20.06 | 52-week high | $28.83 |

| Prev. close | $19.77 | 52-week low | $14.78 |

| Day low | $19.76 | Volume | 827,800 |

| Day high | $20.15 | Avg. volume | 2,563,342 |

| 50-day MA | $18.01 | Dividend yield | N/A |

| 200-day MA | $20.76 | Market Cap | 3.62B |

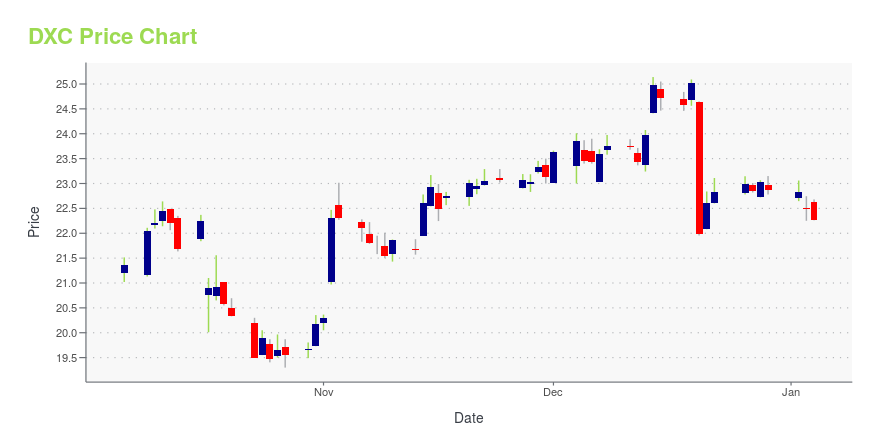

DXC Stock Price Chart Interactive Chart >

DXC Technology Co. (DXC) Company Bio

DXC Technology is an American multinational information technology (IT) services and consulting company headquartered in Ashburn, Virginia. (Source:Wikipedia)

Latest DXC News From Around the Web

Below are the latest news stories about DXC TECHNOLOGY CO that investors may wish to consider to help them evaluate DXC as an investment opportunity.

13 Cash-Rich Small Cap Stocks To Invest InIn this piece, we will take a look at the 13 cash rich small cap stocks to invest in. If you want to skip our introduction to small cap investing and the latest stock market news, then you can take a look at the 5 Cash-Rich Small Cap Stocks To Invest In. Small cap stocks […] |

Here’s Why DXC Technology Company (DXC) Fell in Q3Chartwell Investment Partners, LLC, an affiliate of Carillon Tower Advisers, Inc., released the “Carillon Chartwell Mid Cap Value Fund” third quarter 2023 investor letter. A copy of the same can be downloaded here. Equities rose early in the quarter on the back of a broader appetite for risk, however, they eventually fell when interest rates crossed 4%. […] |

Stocks Flat Despite Improving Consumer SentimentStocks are muted this afternoon, with both the Dow Jones Industrial Average and S&P 500 Index trading near breakeven. |

DXC Technology Appoints Raul Fernandez as Interim President and CEODXC Technology (NYSE: DXC), a leading Fortune 500 global technology services company, today announced that the Company's Board of Directors has named Board member Raul Fernandez Interim President and Chief Executive Officer, effective immediately. Fernandez brings a wealth of executive and operational experience in the technology and investment sectors to the position. He has served as CEO of several companies including Proxicom, which he founded, Dimension Data North America and ObjectVideo. |

DXC Technology Company. (DXC) Up 3.7% Since Last Earnings Report: Can It Continue?DXC Technology Company. (DXC) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues. |

DXC Price Returns

| 1-mo | 7.27% |

| 3-mo | -0.10% |

| 6-mo | -13.65% |

| 1-year | -28.38% |

| 3-year | -49.07% |

| 5-year | -63.44% |

| YTD | -12.29% |

| 2023 | -13.70% |

| 2022 | -17.68% |

| 2021 | 25.01% |

| 2020 | -30.14% |

| 2019 | -27.90% |

Continue Researching DXC

Want to see what other sources are saying about DXC Technology Co's financials and stock price? Try the links below:DXC Technology Co (DXC) Stock Price | Nasdaq

DXC Technology Co (DXC) Stock Quote, History and News - Yahoo Finance

DXC Technology Co (DXC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...