Dyadic International, Inc. (DYAI): Price and Financial Metrics

DYAI Price/Volume Stats

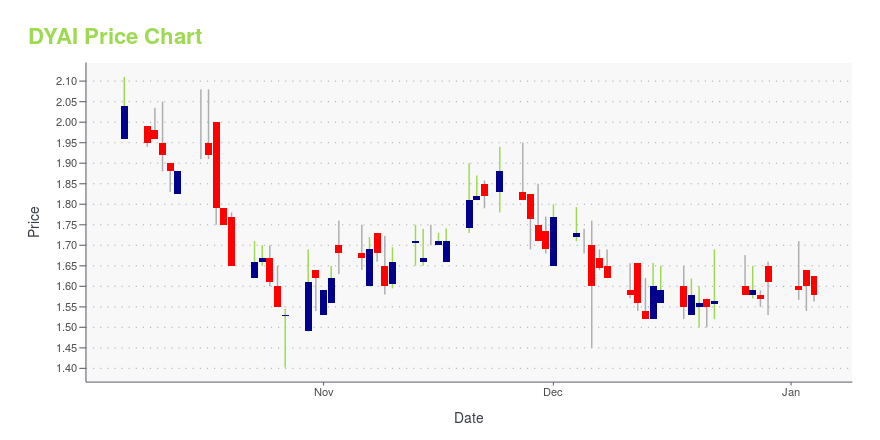

| Current price | $1.49 | 52-week high | $2.40 |

| Prev. close | $1.49 | 52-week low | $1.19 |

| Day low | $1.43 | Volume | 12,700 |

| Day high | $1.60 | Avg. volume | 21,504 |

| 50-day MA | $1.57 | Dividend yield | N/A |

| 200-day MA | $1.68 | Market Cap | 43.17M |

DYAI Stock Price Chart Interactive Chart >

Dyadic International, Inc. (DYAI) Company Bio

Dyadic International, Inc., a biotechnology platform company, develops, produces, and sells enzymes and other proteins in the United States. The company utilizes its patented and proprietary C1 technology and other technologies to conduct research, development, and commercial activities for the development and manufacturing of human and animal vaccines and drugs, such as virus like particles and antigens, monoclonal antibodies, fab antibody fragments, Fc-fusion proteins, biosimilars and/or biobetters, and other therapeutic proteins. It has a research and development agreement with VTT Technical Research Centre of Finland, Ltd., as well as with the Israel Institute for Biological Research; strategic research services agreement with Biotechnology Developments for Industry in Pharmaceuticals, S.L.U.; research collaboration with Sanofi-Aventis Deutschland GmbH; research and commercialization collaboration with Serum Institute of India Pvt.; and nonexclusive research collaboration with WuXi Biologics. Dyadic International, Inc. was founded in 1979 and is headquartered in Jupiter, Florida.

Latest DYAI News From Around the Web

Below are the latest news stories about DYADIC INTERNATIONAL INC that investors may wish to consider to help them evaluate DYAI as an investment opportunity.

Dyadic Attends Investor Events in DecemberJUPITER, Fla., Nov. 30, 2023 (GLOBE NEWSWIRE) -- Dyadic International, Inc. (“Dyadic”, or the “Company”) (NASDAQ: DYAI), a global biotechnology company focused on building innovative microbial platforms to address the growing demand for global protein bioproduction and unmet clinical needs for effective, affordable and accessible biopharmaceutical products for human and animal health, and alternative proteins for food, nutrition and wellness, today announced that its management will be attending |

Dyadic Announces Top-Line Results from its Successful Phase 1 Clinical Trial for a First-in-Human Filamentous Fungal-Based Vaccine CandidatePrimary endpoint met Demonstrated safety and reactogenicity of DYAI-100 recombinant proteinC1-cell produced antigen was both safe and well-toleratedNo Serious Adverse Events reportedFinal Clinical Study Report available in the coming weeks JUPITER, Fla., Nov. 29, 2023 (GLOBE NEWSWIRE) -- Dyadic International, Inc. ("Dyadic", "we", "us", "our", or the "Company") (NASDAQ: DYAI), a global biotechnology company focused on building innovative microbial protein production platforms to address the grow |

Shareholders in Dyadic International (NASDAQ:DYAI) are in the red if they invested three years agoIf you are building a properly diversified stock portfolio, the chances are some of your picks will perform badly. But... |

Dyadic’s C1 Platform to be Used to Produce Vaccines for Humans and Animals in AfricaJUPITER, Fla., Nov. 20, 2023 (GLOBE NEWSWIRE) -- Dyadic International, Inc. ("Dyadic", "we", "us", "our", or the "Company") (NASDAQ: DYAI), a global biotechnology company focused on building innovative microbial protein production platforms to address the growing demand for global protein bioproduction and unmet clinical needs for effective, affordable and accessible biopharmaceutical products for human and animal health, today applauds the signing of an agreement between Dyadic’s African licens |

Dyadic International, Inc. (NASDAQ:DYAI) Q3 2023 Earnings Call TranscriptDyadic International, Inc. (NASDAQ:DYAI) Q3 2023 Earnings Call Transcript November 8, 2023 Dyadic International, Inc. reports earnings inline with expectations. Reported EPS is $-0.06 EPS, expectations were $-0.06. Operator: Good evening, and welcome to the Dyadic International’s Third Quarter 2023 Financial Results Conference Call. Currently all participants are in a listen-only mode. Following management’s prepared […] |

DYAI Price Returns

| 1-mo | -8.59% |

| 3-mo | 7.97% |

| 6-mo | -2.61% |

| 1-year | -28.37% |

| 3-year | -68.43% |

| 5-year | -58.61% |

| YTD | -7.45% |

| 2023 | 30.89% |

| 2022 | -72.79% |

| 2021 | -15.99% |

| 2020 | 3.86% |

| 2019 | 174.07% |

Loading social stream, please wait...