eBay Inc. (EBAY): Price and Financial Metrics

EBAY Price/Volume Stats

| Current price | $54.18 | 52-week high | $55.69 |

| Prev. close | $53.12 | 52-week low | $37.17 |

| Day low | $53.64 | Volume | 4,130,100 |

| Day high | $54.83 | Avg. volume | 5,738,533 |

| 50-day MA | $53.33 | Dividend yield | 2.03% |

| 200-day MA | $47.11 | Market Cap | 27.20B |

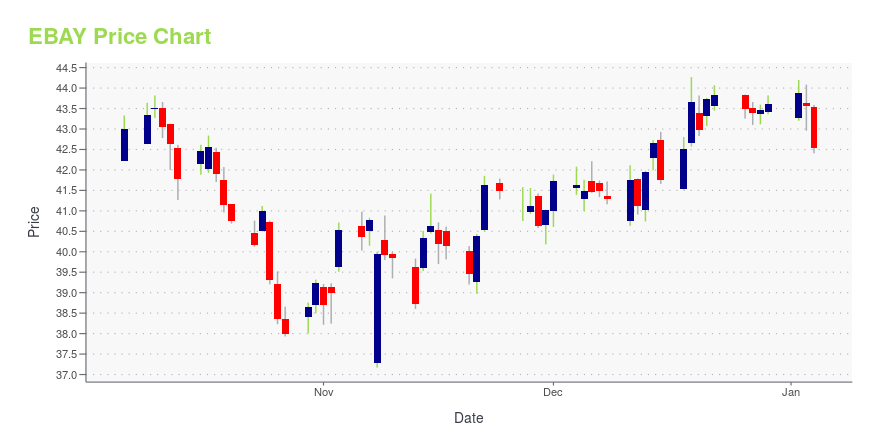

EBAY Stock Price Chart Interactive Chart >

eBay Inc. (EBAY) Company Bio

eBay Inc. (/ˈiːbeɪ/ EE-bay) is an American multinational e-commerce corporation based in San Jose, California, that facilitates consumer-to-consumer and business-to-consumer sales through its website. eBay was founded by Pierre Omidyar in 1995, and became a notable success story of the dot-com bubble. eBay is a multibillion-dollar business with operations in about 32 countries, as of 2019. The company manages the eBay website, an online auction and shopping website in which people and businesses buy and sell a wide variety of goods and services worldwide. The website is free to use for buyers, but sellers are charged fees for listing items after a limited number of free listings, and an additional or separate fee when those items are sold. (Source:Wikipedia)

Latest EBAY News From Around the Web

Below are the latest news stories about EBAY INC that investors may wish to consider to help them evaluate EBAY as an investment opportunity.

1 Spectacular Dividend Stock Down 47% for Passive Income Investors to Buy Hand Over Fist for 2024This dividend stock employs an asset-light business model that leaves plenty of cash to pay dividends. |

‘We’re lighting experts – can you tell from our own home makeover?’When Abby Fox and Louis Christie moved into their four-bedroom Edwardian terrace back in 2018, all the original features had been crudely ripped out. They quickly began work on restoring it to its former period glory. |

30 Trending Products to Sell Online in 2024In this article, we will take a look at the 30 trending products to sell online in 2024. If you want to skip our detailed analysis, you can go directly to 5 Trending Products to Sell Online in 2024. Technology & E-commerce: At a Glance According to a report by Forbes, artificial intelligence powered e-commerce […] |

eBay Inc's SVP, Chief People Officer Cornelius Boone Sells 4,930 ShareseBay Inc (NASDAQ:EBAY), a global commerce leader that connects millions of buyers and sellers around the world, has reported an insider sale according to a recent SEC filing. |

A bizarre (and expensive) technology just sold on eBayAn important piece of aviation history was finally sold on the online auction site for a rather hefty sum. |

EBAY Price Returns

| 1-mo | 0.91% |

| 3-mo | 4.69% |

| 6-mo | 28.26% |

| 1-year | 26.89% |

| 3-year | -20.64% |

| 5-year | 43.08% |

| YTD | 25.52% |

| 2023 | 7.65% |

| 2022 | -36.47% |

| 2021 | 33.81% |

| 2020 | 41.16% |

| 2019 | 30.59% |

EBAY Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching EBAY

Want to do more research on Ebay Inc's stock and its price? Try the links below:Ebay Inc (EBAY) Stock Price | Nasdaq

Ebay Inc (EBAY) Stock Quote, History and News - Yahoo Finance

Ebay Inc (EBAY) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...