Ellington Financial Inc. (EFC): Price and Financial Metrics

EFC Price/Volume Stats

| Current price | $12.89 | 52-week high | $14.05 |

| Prev. close | $12.71 | 52-week low | $10.88 |

| Day low | $12.72 | Volume | 997,100 |

| Day high | $12.91 | Avg. volume | 1,019,032 |

| 50-day MA | $12.30 | Dividend yield | 11.89% |

| 200-day MA | $12.21 | Market Cap | 1.10B |

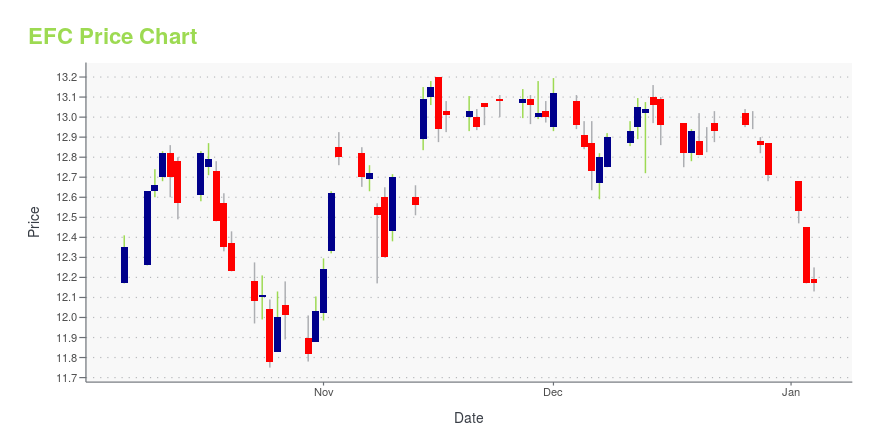

EFC Stock Price Chart Interactive Chart >

Ellington Financial Inc. (EFC) Company Bio

Ellington Financial is a specialty finance company that primarily acquires and manages mortgage-related assets, including residential mortgage-backed securities, residential mortgage loans, commercial mortgage-backed securities, commercial mortgage loans and other commercial real estate debt, real property, and mortgage-related derivatives. The company was founded in 2007 and is based in Old Greenwich, Connecticut.

Latest EFC News From Around the Web

Below are the latest news stories about ELLINGTON FINANCIAL INC that investors may wish to consider to help them evaluate EFC as an investment opportunity.

Hidden High-Yielders: 3 Lesser-Known Stocks With Attractive DividendsOne of the best ways for investors to generate income and protect their portfolios in 2024 is with high-yield dividend stocks. |

Ellington Financial Announces Estimated Book Value Per Common Share as of November 30, 2023OLD GREENWICH, Conn., December 26, 2023--Ellington Financial Inc. (NYSE: EFC) (the "Company") today announced its estimated book value per share of common stock of $14.06 as of November 30, 2023. This estimate includes the effects of both the previously announced monthly dividend of $0.15 per share of common stock, payable on December 26, 2023 to holders of record on November 30, 2023, with an ex-dividend date of November 29, 2023; as well as the previously announced interim monthly dividend of |

7 Growth Stocks That Also Pay Monthly Dividends: December 2023While it’s obvious there are great reasons to buy and hold stocks, it’s also easy to overlook a regular income gained by owning monthly dividend-paying growth stocks. |

With 55% institutional ownership, Ellington Financial Inc. (NYSE:EFC) is a favorite amongst the big gunsKey Insights Given the large stake in the stock by institutions, Ellington Financial's stock price might be vulnerable... |

Ellington Financial Declares Common and Preferred DividendsOLD GREENWICH, Conn., December 15, 2023--Ellington Financial Inc. (NYSE: EFC) (the "Company") today announced that its Board of Directors has declared a monthly dividend of $0.09 per share of common stock, payable on January 25, 2024 to common stockholders of record as of December 29, 2023. This monthly dividend of $0.09 per share of common stock is in addition to the Company's previously announced interim monthly dividend of $0.06 per share, paid on December 13, 2023 to shareholders of record a |

EFC Price Returns

| 1-mo | 6.98% |

| 3-mo | 13.76% |

| 6-mo | 7.08% |

| 1-year | 8.32% |

| 3-year | 3.38% |

| 5-year | 27.58% |

| YTD | 8.68% |

| 2023 | 18.16% |

| 2022 | -18.32% |

| 2021 | 26.33% |

| 2020 | -10.16% |

| 2019 | 32.43% |

EFC Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching EFC

Want to do more research on Ellington Financial Inc's stock and its price? Try the links below:Ellington Financial Inc (EFC) Stock Price | Nasdaq

Ellington Financial Inc (EFC) Stock Quote, History and News - Yahoo Finance

Ellington Financial Inc (EFC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...