Edgewell Personal Care Company (EPC): Price and Financial Metrics

EPC Price/Volume Stats

| Current price | $40.16 | 52-week high | $42.15 |

| Prev. close | $39.86 | 52-week low | $33.71 |

| Day low | $40.02 | Volume | 479,632 |

| Day high | $40.55 | Avg. volume | 376,404 |

| 50-day MA | $39.54 | Dividend yield | 1.52% |

| 200-day MA | $37.45 | Market Cap | 1.99B |

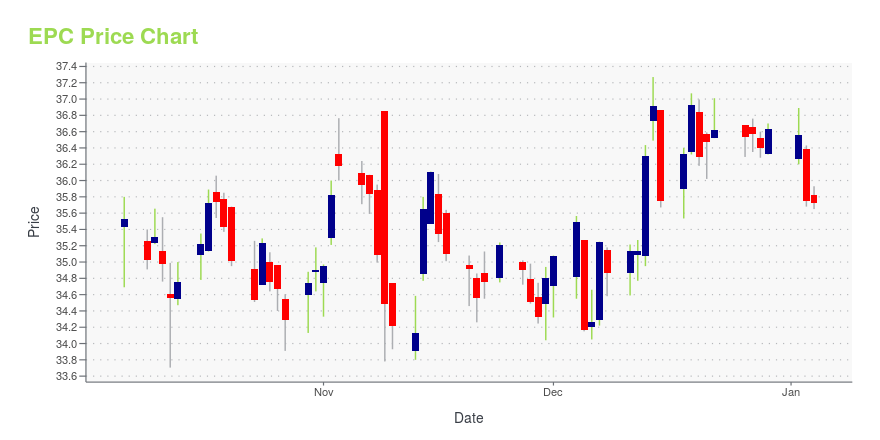

EPC Stock Price Chart Interactive Chart >

Edgewell Personal Care Company (EPC) Company Bio

Edgewell Personal Care Company manufactures and markets a diversified range of personal care products in the wet shave, skin care, feminine care and infant care categories. The company was founded in 1999 and is based in Chesterfield, Missouri.

Latest EPC News From Around the Web

Below are the latest news stories about EDGEWELL PERSONAL CARE CO that investors may wish to consider to help them evaluate EPC as an investment opportunity.

Edgewell Personal Care Named by Newsweek as one of America's Most Responsible Companies in 2024Edgewell Personal Care Company (NYSE: EPC) has been named one of Newsweek's Most Responsible Companies for the fifth year in a row. The annual list presented by Statista Inc. revealed the company's highest ranking yet, at 19 out of 500 total ranked organizations. Amongst the Consumer Goods organizations listed, Edgewell ranked 3rd out of 48 total companies. |

Edgewell Personal Care (NYSE:EPC) Has Affirmed Its Dividend Of $0.15Edgewell Personal Care Company's ( NYSE:EPC ) investors are due to receive a payment of $0.15 per share on 4th of... |

Edgewell Personal Care Company (NYSE:EPC) Looks Interesting, And It's About To Pay A DividendEdgewell Personal Care Company ( NYSE:EPC ) is about to trade ex-dividend in the next 4 days. Typically, the... |

Edgewell Personal Care Company (NYSE:EPC) Stock's Been Sliding But Fundamentals Look Decent: Will The Market Correct The Share Price In The Future?It is hard to get excited after looking at Edgewell Personal Care's (NYSE:EPC) recent performance, when its stock has... |

Edgewell Personal Care Recognized for Contribution to the American Red Cross Ready 365 Giving CircleEdgewell Personal Care Company (NYSE: EPC), based in Shelton, CT, is partnering with the American Red Cross to support Red Cross Disaster Relief and International Services as part of the Ready 365 Giving Circle, and in pursuit of Edgewell's core purpose, values and behaviors. |

EPC Price Returns

| 1-mo | -0.54% |

| 3-mo | 7.71% |

| 6-mo | 7.28% |

| 1-year | 4.82% |

| 3-year | 1.78% |

| 5-year | 44.25% |

| YTD | 10.50% |

| 2023 | -3.48% |

| 2022 | -14.34% |

| 2021 | 34.26% |

| 2020 | 12.17% |

| 2019 | -17.11% |

EPC Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching EPC

Want to see what other sources are saying about EDGEWELL PERSONAL CARE Co's financials and stock price? Try the links below:EDGEWELL PERSONAL CARE Co (EPC) Stock Price | Nasdaq

EDGEWELL PERSONAL CARE Co (EPC) Stock Quote, History and News - Yahoo Finance

EDGEWELL PERSONAL CARE Co (EPC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...