Equinor ASA ADR (EQNR): Price and Financial Metrics

EQNR Price/Volume Stats

| Current price | $26.01 | 52-week high | $34.73 |

| Prev. close | $25.99 | 52-week low | $24.44 |

| Day low | $25.81 | Volume | 2,478,300 |

| Day high | $26.17 | Avg. volume | 3,276,429 |

| 50-day MA | $27.74 | Dividend yield | 4.39% |

| 200-day MA | $28.97 | Market Cap | 76.59B |

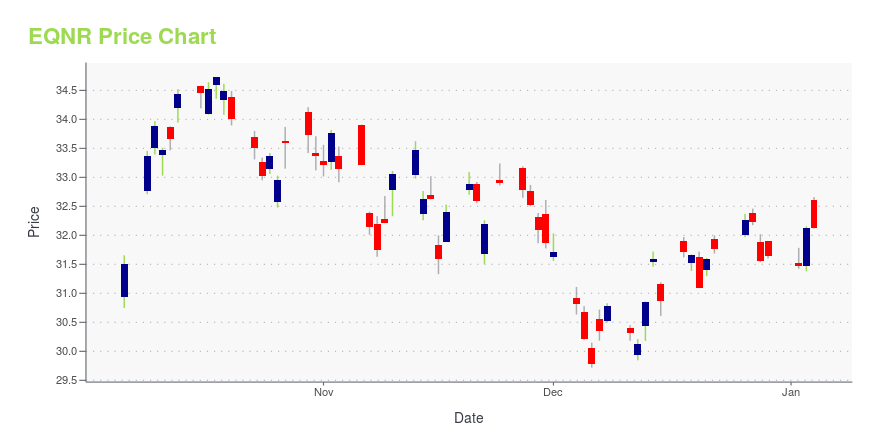

EQNR Stock Price Chart Interactive Chart >

Equinor ASA ADR (EQNR) Company Bio

Equinor ASA (formerlyStatoil and StatoilHydro) is a Norwegian state-owned multinational energy company headquartered in Stavanger. It is primarily a petroleum company, operating in 36 countries with additional investments in renewable energy. In the 2020 Forbes Global 2000, Equinor was ranked as the 169th-largest public company in the world. As of 2021, the company has 21,126 employees. (Source:Wikipedia)

Latest EQNR News From Around the Web

Below are the latest news stories about EQUINOR ASA that investors may wish to consider to help them evaluate EQNR as an investment opportunity.

Equinor ASA: Share buy-backPlease see below information about transactions made under the fourth tranche of the 2023 share buy-back programme for Equinor ASA (OSE:EQNR, NYSE:EQNR). Date on which the fourth tranche of the 2023 programme was announced: 27 October 2023. The duration of the fourth tranche of the 2023 programme: 30 October 2023 to no later than 29 January 2024. From 18 December to 22 December 2023, Equinor ASA has purchased a total of 1,765,000 own shares at the Oslo Stock Exchange at an average price of NOK 3 |

Equinor (EQNR) Barred From Repeating Green Claims in the UKEquinor's (EQNR) advertisements have been scrutinized by the ASA for potentially conveying a misleading impression to the public. |

Oil & Gas Stock Roundup: Exxon's Hebron Approval & Shell's Sparta FID Stand OutXOM, SHEL, EQNR, CVE and IMO emerge as the energy headline makers during the week. |

Equinor (EQNR) Divests Azerbaijan Assets to State-Owned SocarEquinor (EQNR) offloads Azerbaijan assets to state-owned Socar, marking a pivotal moment in the company's strategy for international growth. |

German property prices plummet as housing bubble burstsHouse prices in Germany dropped by a record 10.2pc in the third quarter in a further sign of the struggles faced by Europe’s largest economy since the pandemic. |

EQNR Price Returns

| 1-mo | -6.27% |

| 3-mo | -4.11% |

| 6-mo | -6.25% |

| 1-year | -4.53% |

| 3-year | 59.73% |

| 5-year | 84.52% |

| YTD | -13.54% |

| 2023 | -2.49% |

| 2022 | 41.39% |

| 2021 | 63.34% |

| 2020 | -14.69% |

| 2019 | -2.36% |

EQNR Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching EQNR

Want to see what other sources are saying about Equinor Asa's financials and stock price? Try the links below:Equinor Asa (EQNR) Stock Price | Nasdaq

Equinor Asa (EQNR) Stock Quote, History and News - Yahoo Finance

Equinor Asa (EQNR) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...