Telefon AB L.M. Ericsson ADR (ERIC): Price and Financial Metrics

ERIC Price/Volume Stats

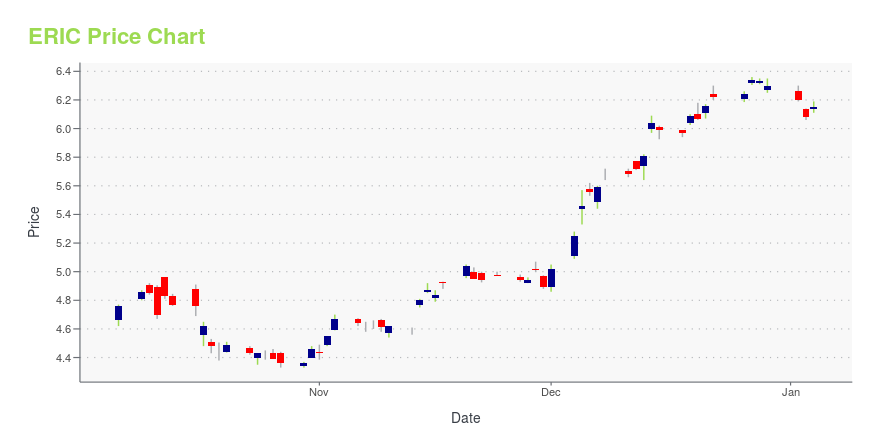

| Current price | $6.69 | 52-week high | $6.81 |

| Prev. close | $6.55 | 52-week low | $4.33 |

| Day low | $6.58 | Volume | 16,450,800 |

| Day high | $6.70 | Avg. volume | 16,628,805 |

| 50-day MA | $6.19 | Dividend yield | 2.53% |

| 200-day MA | $5.55 | Market Cap | 22.30B |

ERIC Stock Price Chart Interactive Chart >

Telefon AB L.M. Ericsson ADR (ERIC) Company Bio

Telefon AB L.M. Ericsson is a telecom services provider based in Sweden. Founded in 1876, the company provides wireless telecommunication solutions globally and has operations in the United State, Europe, Africa, the Middle East, Asia/Pacific, and Australia. Ericsson offers a wide variety of products and services, which include cloud managed services, networking solutions, managed and digital services, and enterprise and business solutions. Headquartered in Stockholm, Sweden, Ericsson has over 100,000 employees worldwide, of which just under half are located in Europe. Borje Ekholm is the company’s President and he has served as Chief Executive Officer since 2017.

Latest ERIC News From Around the Web

Below are the latest news stories about ERICSSON LM TELEPHONE CO that investors may wish to consider to help them evaluate ERIC as an investment opportunity.

3 Top Computer Networking Stocks to Buy for 2024Computer networking stocks are likely to get big boosts over the long term from the proliferation of AI and 5G technology. |

Telecom Titans: 3 Stocks Dialing Up Success in the 5G EraInvestors seeking exposure to telecom stocks should consider these companies that are actively involved in 5G infrastructure. |

Ericsson (ERIC) Deploys 5G SA in Ireland to Accelerate InnovationThree Ireland selects Ericsson's (ERIC) portfolio to implement 5G Standalone and develop advanced applications for various industries. |

Ericsson (ERIC) to Deploy Private 5G Networks Across SpainOrange Spain selects Ericsson's (ERIC) dual-mode 5G core and Local Packet Gateway solution to deploy private 5G networks for the B2B sector. |

Ericsson (ERIC) Stock Moves -0.33%: What You Should KnowIn the most recent trading session, Ericsson (ERIC) closed at $6.07, indicating a -0.33% shift from the previous trading day. |

ERIC Price Returns

| 1-mo | 11.13% |

| 3-mo | 29.15% |

| 6-mo | 17.55% |

| 1-year | 36.28% |

| 3-year | -36.92% |

| 5-year | -18.40% |

| YTD | 7.85% |

| 2023 | 11.42% |

| 2022 | -45.07% |

| 2021 | -7.89% |

| 2020 | 37.58% |

| 2019 | -0.31% |

ERIC Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching ERIC

Want to do more research on Ericsson Lm Telephone Co's stock and its price? Try the links below:Ericsson Lm Telephone Co (ERIC) Stock Price | Nasdaq

Ericsson Lm Telephone Co (ERIC) Stock Quote, History and News - Yahoo Finance

Ericsson Lm Telephone Co (ERIC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...