Elbit Systems Ltd. (ESLT): Price and Financial Metrics

ESLT Price/Volume Stats

| Current price | $187.08 | 52-week high | $225.64 |

| Prev. close | $186.65 | 52-week low | $175.30 |

| Day low | $186.74 | Volume | 14,685 |

| Day high | $188.41 | Avg. volume | 22,855 |

| 50-day MA | $187.42 | Dividend yield | 0.89% |

| 200-day MA | $200.06 | Market Cap | 8.32B |

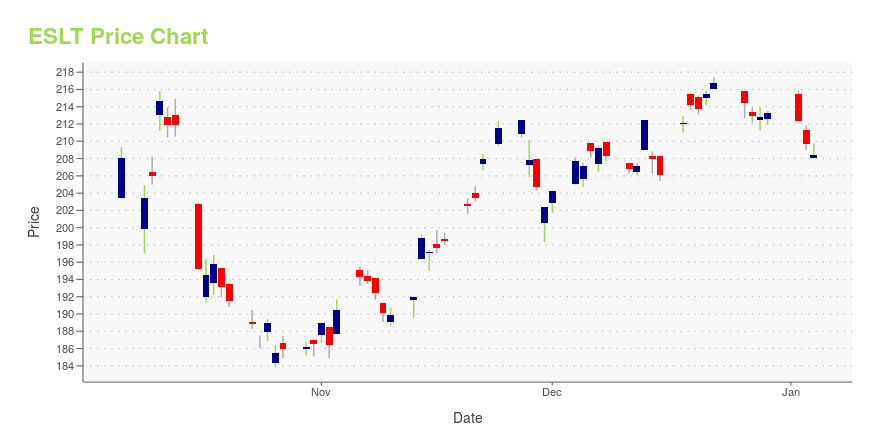

ESLT Stock Price Chart Interactive Chart >

Elbit Systems Ltd. (ESLT) Company Bio

Elbit Systems operates in the areas of aerospace, land and naval systems, command, control, communications, computers, intelligence surveillance and reconnaissance ("C4ISR"), unmanned aircraft systems, advanced electro-optics, electro-optic space systems, EW suites, signal intelligence systems, data links and communications systems, radios and cyber-based systems. The Company also focuses on the upgrading of existing platforms, developing new technologies for defense, homeland security and commercial applications and providing a range of support services, including training and simulation systems. Elbit Systems Ltd. was founded in 1966 and is based in Haifa, Israel.

Latest ESLT News From Around the Web

Below are the latest news stories about ELBIT SYSTEMS LTD that investors may wish to consider to help them evaluate ESLT as an investment opportunity.

Taking Off? 3 Top Drone Maker Stock Picks for 2024With drones so ubiquitous in the military, the sector is becoming quite lucrative. |

Elbit Systems Awarded Contracts from the Israel Ministry Of Defense in an Aggregate Material AmountElbit Systems Ltd. (NASDAQ: ESLT) (TASE: ESLT) ("Elbit Systems" or the "Company") announced today, in furtherance of the Company's report from November 28, 2023, that since the beginning of the Swords of Iron War, it has been awarded a series of contracts by the Israel Ministry of Defense (IMOD) in an aggregate amount that is material to the Company. |

Elbit Systems Ltd. (NASDAQ:ESLT) Q3 2023 Earnings Call TranscriptElbit Systems Ltd. (NASDAQ:ESLT) Q3 2023 Earnings Call Transcript November 28, 2023 Elbit Systems Ltd. misses on earnings expectations. Reported EPS is $1.65 EPS, expectations were $1.7. Operator: Ladies and gentlemen, thank you for standing by. Welcome to Elbit Systems Third Quarter 2020 Results Conference Call. All participants are present in listen-only mode. Following management’s […] |

Company News for Nov 29, 2023Companies in The News Are: ESLT,RNA,ZS,SDRL |

Elbit Systems of America Awarded an ID/IQ Contract With a Ceiling of $500 Million for the Supply of Squad Binocular Night Vision Goggles to the U.S. Marine CorpsElbit Systems Ltd. (NASDAQ: ESLT) (TASE: ESLT) ("Elbit Systems" or the "Company") announced today that according to the announcement of the U.S. Department of Defense (DOD), Elbit Systems' U.S. subsidiary, Elbit Systems of America – Night Vision LLC, ("Elbit Systems of America"), was awarded an indefinite delivery/ indefinite quantity (ID/IQ) contract with a maximum ceiling of $500 million, for the supply of Squad Binocular Night Vision Goggle (SBNVG) systems; spare and repair parts; contractor |

ESLT Price Returns

| 1-mo | 4.88% |

| 3-mo | -6.60% |

| 6-mo | -8.31% |

| 1-year | -7.02% |

| 3-year | 44.67% |

| 5-year | 22.10% |

| YTD | -11.89% |

| 2023 | 31.08% |

| 2022 | -4.98% |

| 2021 | 34.45% |

| 2020 | -15.35% |

| 2019 | 35.99% |

ESLT Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching ESLT

Here are a few links from around the web to help you further your research on Elbit Systems Ltd's stock as an investment opportunity:Elbit Systems Ltd (ESLT) Stock Price | Nasdaq

Elbit Systems Ltd (ESLT) Stock Quote, History and News - Yahoo Finance

Elbit Systems Ltd (ESLT) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...