Esperion Therapeutics, Inc. (ESPR): Price and Financial Metrics

ESPR Price/Volume Stats

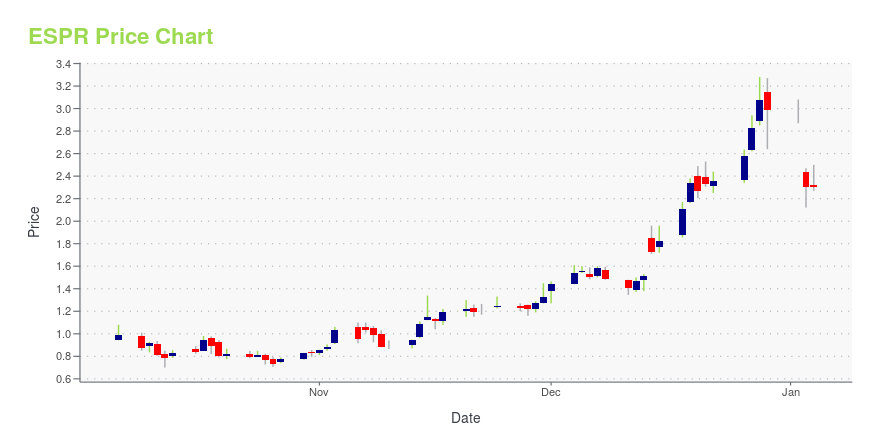

| Current price | $2.43 | 52-week high | $3.40 |

| Prev. close | $2.43 | 52-week low | $0.70 |

| Day low | $2.37 | Volume | 2,910,100 |

| Day high | $2.50 | Avg. volume | 7,400,989 |

| 50-day MA | $2.43 | Dividend yield | N/A |

| 200-day MA | $2.09 | Market Cap | 460.39M |

ESPR Stock Price Chart Interactive Chart >

Esperion Therapeutics, Inc. (ESPR) Company Bio

Esperion Therapeutics is focused on developing and commercializing first-in-class, oral, LDL-cholesterol-lowering therapies for the treatment of patients with hypercholesterolemia and other cardiometabolic risk markers. The company was founded in 1998 and is based in Ann Arbor, Michigan.

Latest ESPR News From Around the Web

Below are the latest news stories about ESPERION THERAPEUTICS INC that investors may wish to consider to help them evaluate ESPR as an investment opportunity.

Esperion to Participate in 42nd Annual J.P. Morgan Healthcare ConferenceANN ARBOR, Mich., Dec. 18, 2023 (GLOBE NEWSWIRE) -- Esperion (NASDAQ: ESPR) today announced its participation in the 42nd Annual J.P. Morgan Healthcare Conference. Sheldon Koenig, President and CEO, will deliver a corporate presentation on Wednesday, January 10, 2024, at 2:15 PM PT (5:15 PM ET). The Esperion management team will also be hosting investor meetings during the conference. To register for the live webcast, follow this link. A live audio webcast can be accessed on the investor and med |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on ThursdayIt's time to start the day off right with a look at the biggest pre-market stock movers to watch for Thursday morning! |

U.S. FDA Updates LDL-C Lowering Indication for Esperion’s NEXLETOL® (bempedoic acid) Tablet and NEXLIZET® (bempedoic acid and ezetimibe) Tablet– Updated Label Adds Primary Hyperlipidemia, Removes Maximally Tolerated Statin Requirement, Removes Limitation of Use – – Cardiovascular (CV) Risk Reduction Labels Remain on Track: in U.S. with PDUFA Date of March 31; in Europe with Anticipated Approval in 1H 2024 – ANN ARBOR, Mich., Dec. 13, 2023 (GLOBE NEWSWIRE) -- Esperion (NASDAQ: ESPR) announced today that the U.S. Food and Drug Administration (FDA) has approved an updated LDL-cholesterol lowering indication for NEXLETOL and NEXLIZET to in |

Why Is Catalyst (CPRX) Up 16.2% Since Last Earnings Report?Catalyst (CPRX) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues. |

Why Is Esperion Therapeutics (ESPR) Up 51.4% Since Last Earnings Report?Esperion Therapeutics (ESPR) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues. |

ESPR Price Returns

| 1-mo | 11.47% |

| 3-mo | 27.89% |

| 6-mo | 14.08% |

| 1-year | 74.82% |

| 3-year | -84.01% |

| 5-year | -94.18% |

| YTD | -18.73% |

| 2023 | -52.01% |

| 2022 | 24.60% |

| 2021 | -80.77% |

| 2020 | -56.40% |

| 2019 | 29.63% |

Continue Researching ESPR

Want to do more research on Esperion Therapeutics Inc's stock and its price? Try the links below:Esperion Therapeutics Inc (ESPR) Stock Price | Nasdaq

Esperion Therapeutics Inc (ESPR) Stock Quote, History and News - Yahoo Finance

Esperion Therapeutics Inc (ESPR) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...