Evans Bancorp, Inc. (EVBN): Price and Financial Metrics

EVBN Price/Volume Stats

| Current price | $33.87 | 52-week high | $34.00 |

| Prev. close | $33.68 | 52-week low | $24.07 |

| Day low | $33.87 | Volume | 4,500 |

| Day high | $34.00 | Avg. volume | 27,266 |

| 50-day MA | $28.45 | Dividend yield | 3.98% |

| 200-day MA | $28.42 | Market Cap | 187.00M |

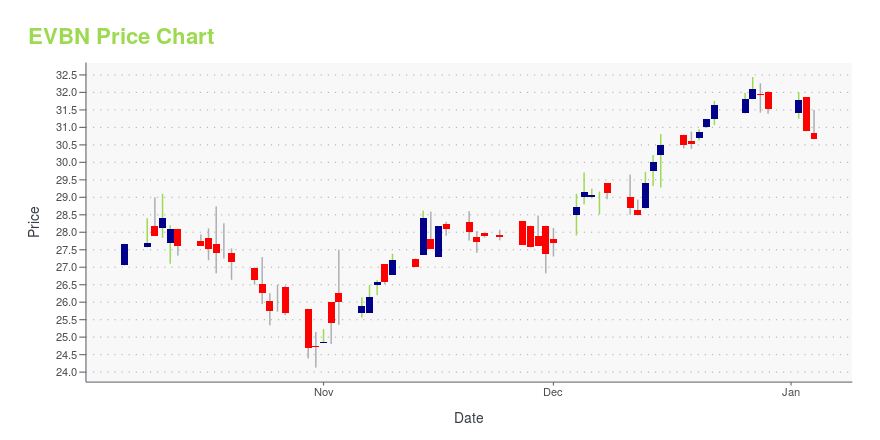

EVBN Stock Price Chart Interactive Chart >

Evans Bancorp, Inc. (EVBN) Company Bio

Evans Bancorp, Inc. provides a range of banking services to consumer and commercial customers in Western New York. The company was founded in 1920 and is based in Hamburg, New York.

Latest EVBN News From Around the Web

Below are the latest news stories about EVANS BANCORP INC that investors may wish to consider to help them evaluate EVBN as an investment opportunity.

Arthur J. Gallagher & Co. Completes Acquisition of The Evans Agency, LLCArthur J. Gallagher & Co. today announced it has completed the previously disclosed acquisition of Williamsville, New York-based The Evans Agency, LLC, a wholly-owned subsidiary of Evans Bancorp, Inc. (NYSE:EVBN). |

Citigroup (C) Closes Sale of Indonesia Consumer Banking to UOBThe sale of Citigroup's (C) Indonesia consumer businesses to UOB Indonesia marks the company's final full consumer divestiture in Asia. |

Director Lee Wortham's Strategic 4000 Share Purchase in Evans Bancorp Inc (EVBN)Recent insider trading activity has caught the attention of market analysts and investors alike, as Director Lee Wortham of Evans Bancorp Inc (EVBN) made a notable purchase of company shares. |

Evans Bancorp (EVBN) to Sell Insurance Operations of SubsidiaryEvans Bancorp (EVBN) agrees to divest the insurance operations of Evans Agency to Arthur J. Gallagher (AJG) for $40 million. |

Evans Bancorp, Inc. Announces Agreement to Sell the Insurance Operations of The Evans Agency, LLC to Arthur J. Gallagher & Co.WILLIAMSVILLE, N.Y., November 07, 2023--Evans Bancorp, Inc. (NYSE American: EVBN) Announces Agreement to Sell the Insurance Operations of The Evans Agency, LLC to Arthur J. Gallagher & Co. |

EVBN Price Returns

| 1-mo | 19.26% |

| 3-mo | 29.92% |

| 6-mo | 13.20% |

| 1-year | 20.10% |

| 3-year | -1.64% |

| 5-year | 14.30% |

| YTD | 9.86% |

| 2023 | -12.21% |

| 2022 | -4.13% |

| 2021 | 51.19% |

| 2020 | -28.18% |

| 2019 | 27.03% |

EVBN Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching EVBN

Want to see what other sources are saying about Evans Bancorp Inc's financials and stock price? Try the links below:Evans Bancorp Inc (EVBN) Stock Price | Nasdaq

Evans Bancorp Inc (EVBN) Stock Quote, History and News - Yahoo Finance

Evans Bancorp Inc (EVBN) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...