Diamondback Energy Inc. (FANG): Price and Financial Metrics

FANG Price/Volume Stats

| Current price | $200.76 | 52-week high | $214.50 |

| Prev. close | $199.80 | 52-week low | $142.71 |

| Day low | $197.73 | Volume | 775,693 |

| Day high | $201.32 | Avg. volume | 1,573,757 |

| 50-day MA | $197.97 | Dividend yield | 1.81% |

| 200-day MA | $178.63 | Market Cap | 35.80B |

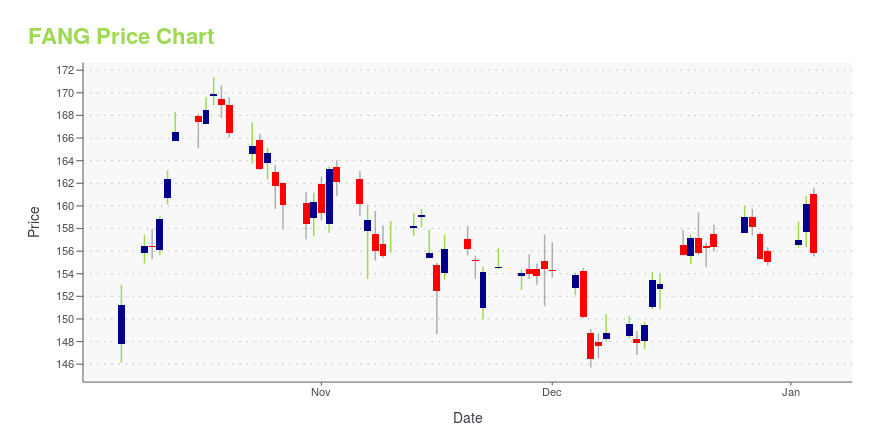

FANG Stock Price Chart Interactive Chart >

Diamondback Energy Inc. (FANG) Company Bio

Diamondback Energy is a company engaged in hydrocarbon exploration headquartered in Midland, Texas. (Source:Wikipedia)

Latest FANG News From Around the Web

Below are the latest news stories about DIAMONDBACK ENERGY INC that investors may wish to consider to help them evaluate FANG as an investment opportunity.

3 Stocks to Buy as the Nasdaq 100 Hits New All-Time HighAs the markets finish 2023 positively, these Nasdaq 100 stocks are worth investor consideration due to their value. |

13 Most Profitable Oil Stocks in the WorldIn this article, we discuss the 13 most profitable oil stocks in the world. To skip our detailed analysis of the oil and gas sector, go directly to the 5 Most Profitable Oil Stocks in the World. Oil stocks experienced a remarkable performance in 2022, but their fortunes took a downturn in 2023. Despite the […] |

EIA Expects Record Oil & Liquid Exports in '24: 3 Stocks to GainIt is an opportune moment for investors to monitor upstream companies like EOG, MTDR and FANG that will contribute to oil production in the United States. |

Should You Buy the 3 Highest-Paying Dividend Stocks in the Nasdaq-100?Even income investors can find stocks to like in the tech-heavy Nasdaq-100. |

Death Cross Isn't A Death Sentence For Energy StocksDespite its ominous name, the death cross does not necessarily portend that the skies are about to fall; rather, it frequently precedes a near-term rebound with above-average returns |

FANG Price Returns

| 1-mo | 1.93% |

| 3-mo | -2.41% |

| 6-mo | 31.96% |

| 1-year | 46.75% |

| 3-year | 198.62% |

| 5-year | 141.90% |

| YTD | 32.95% |

| 2023 | 19.66% |

| 2022 | 35.34% |

| 2021 | 127.51% |

| 2020 | -46.00% |

| 2019 | 0.92% |

FANG Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching FANG

Want to do more research on Diamondback Energy Inc's stock and its price? Try the links below:Diamondback Energy Inc (FANG) Stock Price | Nasdaq

Diamondback Energy Inc (FANG) Stock Quote, History and News - Yahoo Finance

Diamondback Energy Inc (FANG) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...