The First Bancshares, Inc. (FBMS): Price and Financial Metrics

FBMS Price/Volume Stats

| Current price | $30.80 | 52-week high | $32.06 |

| Prev. close | $30.26 | 52-week low | $22.96 |

| Day low | $30.40 | Volume | 254,900 |

| Day high | $31.05 | Avg. volume | 161,966 |

| 50-day MA | $25.91 | Dividend yield | 3.33% |

| 200-day MA | $25.87 | Market Cap | 961.55M |

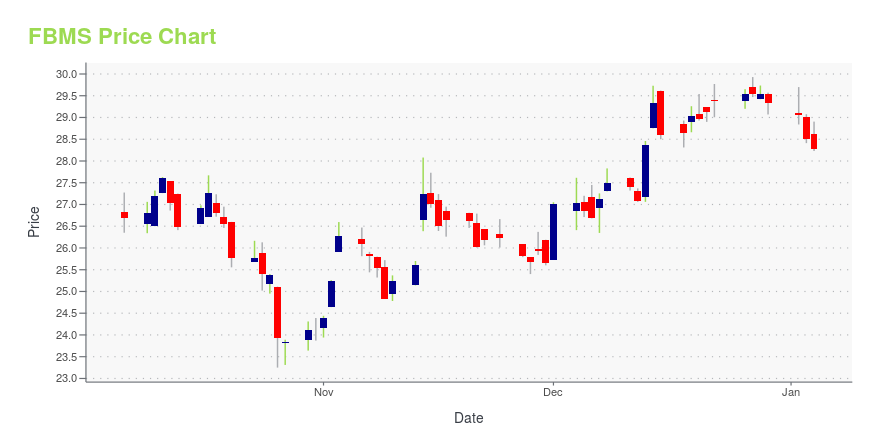

FBMS Stock Price Chart Interactive Chart >

The First Bancshares, Inc. (FBMS) Company Bio

The First Bancshares, Inc. operates as the bank holding company for The First, A National Banking Association that provides commercial and retail banking services to small to medium-sized businesses, professional concerns, and individuals in Mississippi, Alabama, and Louisiana. The company was founded in 1995 and is based in Hattiesburg, Mississippi.

Latest FBMS News From Around the Web

Below are the latest news stories about FIRST BANCSHARES INC that investors may wish to consider to help them evaluate FBMS as an investment opportunity.

First Bancshares' (NASDAQ:FBMS) Dividend Will Be Increased To $0.24The First Bancshares, Inc. ( NASDAQ:FBMS ) has announced that it will be increasing its dividend from last year's... |

The First Bancshares, Inc. (NASDAQ:FBMS) Q3 2023 Earnings Call TranscriptThe First Bancshares, Inc. (NASDAQ:FBMS) Q3 2023 Earnings Call Transcript October 26, 2023 Hoppy Cole: [Call Starts Abruptly] I’ll give a few high level highlights of the quarter and then turn it over to other members of our teams in their respective areas. This morning I’ve got Dee Dee Lowery, our CFO with us; George […] |

Q3 2023 First Bancshares Inc (Mississippi) Earnings CallQ3 2023 First Bancshares Inc (Mississippi) Earnings Call |

The First Bancshares (FBMS) Lags Q3 Earnings EstimatesThe First Bancshares (FBMS) delivered earnings and revenue surprises of -5% and 4.89%, respectively, for the quarter ended September 2023. Do the numbers hold clues to what lies ahead for the stock? |

The First Bancshares, Inc. Reports Results for Third Quarter ended September 30, 2023; Increases Quarterly Dividend 4%HATTIESBURG, Miss., October 25, 2023--The First Bancshares, Inc. ("FBMS" or "the Company") (NASDAQ: FBMS), holding company for The First Bank, (www.thefirstbank.com) reported today financial results for the quarter ended September 30, 2023. |

FBMS Price Returns

| 1-mo | 25.31% |

| 3-mo | 30.18% |

| 6-mo | 19.98% |

| 1-year | 5.50% |

| 3-year | -10.81% |

| 5-year | 6.02% |

| YTD | 7.17% |

| 2023 | -5.37% |

| 2022 | -15.21% |

| 2021 | 26.97% |

| 2020 | -11.48% |

| 2019 | 18.56% |

FBMS Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching FBMS

Want to do more research on First Bancshares Inc's stock and its price? Try the links below:First Bancshares Inc (FBMS) Stock Price | Nasdaq

First Bancshares Inc (FBMS) Stock Quote, History and News - Yahoo Finance

First Bancshares Inc (FBMS) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...