FuelCell Energy, Inc. (FCEL): Price and Financial Metrics

FCEL Price/Volume Stats

| Current price | $0.53 | 52-week high | $2.26 |

| Prev. close | $0.54 | 52-week low | $0.49 |

| Day low | $0.51 | Volume | 64,861,410 |

| Day high | $0.55 | Avg. volume | 32,819,223 |

| 50-day MA | $0.74 | Dividend yield | N/A |

| 200-day MA | $1.08 | Market Cap | 264.53M |

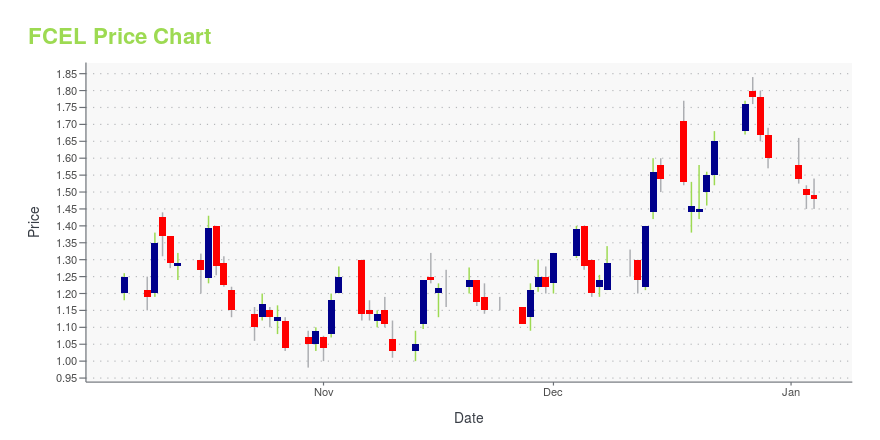

FCEL Stock Price Chart Interactive Chart >

FuelCell Energy, Inc. (FCEL) Company Bio

FuelCell Energy, Inc. manufactures, sells, installs, operates, and services stationary fuel cell power plants for distributed power generation. The company was founded in 1969 and is based in Danbury, Connecticut.

Latest FCEL News From Around the Web

Below are the latest news stories about FUELCELL ENERGY INC that investors may wish to consider to help them evaluate FCEL as an investment opportunity.

11 Most Promising Hydrogen and Fuel Cell Stocks According to AnalystsIn this piece, we will take a look at the 11 most promising hydrogen and fuel cell stocks according to analysts. If you want to skip our overview of this particular sub segment of the clean energy industry, then you can take a look at the 5 Most Promising Hydrogen and Fuel Cell Stocks to […] |

3 Stocks to Benefit from the Green Hydrogen RevolutionDive into the booming world of green hydrogen stocks to buy, where potential meets planet-friendly innovation in an evolving market. |

FuelCell Energy, Inc. (NASDAQ:FCEL) Q4 2023 Earnings Call TranscriptFuelCell Energy, Inc. (NASDAQ:FCEL) Q4 2023 Earnings Call Transcript December 19, 2023 FuelCell Energy, Inc. beats earnings expectations. Reported EPS is $-0.07, expectations were $-0.08. FCEL isn’t one of the 30 most popular stocks among hedge funds at the end of the third quarter (see the details here). Operator: Hello, and welcome to FuelCell Energy […] |

FuelCell Energy Full Year 2023 Earnings: EPS Beats Expectations, Revenues LagFuelCell Energy ( NASDAQ:FCEL ) Full Year 2023 Results Key Financial Results Revenue: US$123.4m (down 5.4% from FY... |

Q4 2023 Fuelcell Energy Inc Earnings CallQ4 2023 Fuelcell Energy Inc Earnings Call |

FCEL Price Returns

| 1-mo | -18.77% |

| 3-mo | -39.12% |

| 6-mo | -56.56% |

| 1-year | -74.64% |

| 3-year | -91.64% |

| 5-year | 40.66% |

| YTD | -66.88% |

| 2023 | -42.45% |

| 2022 | -46.54% |

| 2021 | -53.45% |

| 2020 | 345.02% |

| 2019 | -61.97% |

Continue Researching FCEL

Here are a few links from around the web to help you further your research on Fuelcell Energy Inc's stock as an investment opportunity:Fuelcell Energy Inc (FCEL) Stock Price | Nasdaq

Fuelcell Energy Inc (FCEL) Stock Quote, History and News - Yahoo Finance

Fuelcell Energy Inc (FCEL) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...