First Commonwealth Financial Corporation (FCF): Price and Financial Metrics

FCF Price/Volume Stats

| Current price | $18.58 | 52-week high | $19.01 |

| Prev. close | $18.60 | 52-week low | $11.16 |

| Day low | $18.30 | Volume | 832,713 |

| Day high | $18.85 | Avg. volume | 508,071 |

| 50-day MA | $14.24 | Dividend yield | 3.1% |

| 200-day MA | $13.75 | Market Cap | 1.90B |

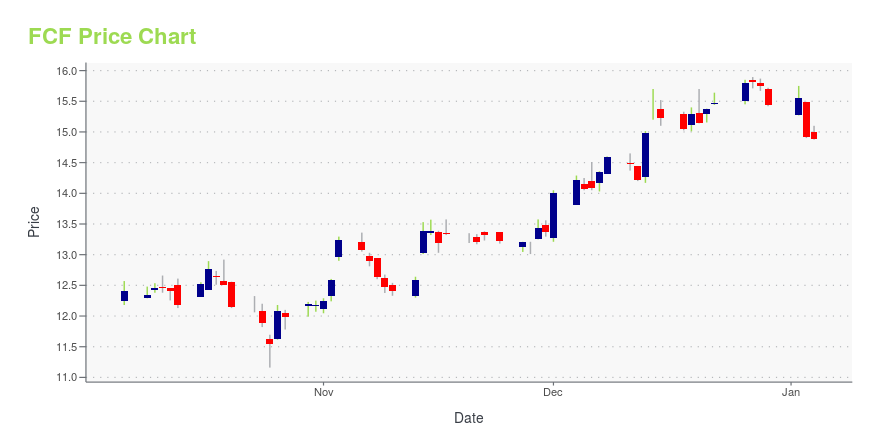

FCF Stock Price Chart Interactive Chart >

First Commonwealth Financial Corporation (FCF) Company Bio

First Commonwealth Financial provides various consumer and commercial banking services to individuals, and small and mid-sized businesses in Pennsylvania. The company was founded in 1982 and is based in Indiana, Pennsylvania.

Latest FCF News From Around the Web

Below are the latest news stories about FIRST COMMONWEALTH FINANCIAL CORP that investors may wish to consider to help them evaluate FCF as an investment opportunity.

Strength Seen in First Commonwealth Financial (FCF): Can Its 5.5% Jump Turn into More Strength?First Commonwealth Financial (FCF) was a big mover last session on higher-than-average trading volume. The latest trend in earnings estimate revisions might not help the stock continue moving higher in the near term. |

First Commonwealth Financial's (NYSE:FCF) three-year earnings growth trails the 14% YoY shareholder returnsOne simple way to benefit from the stock market is to buy an index fund. But if you choose individual stocks with... |

First Commonwealth Financial's (NYSE:FCF) Dividend Will Be $0.125The board of First Commonwealth Financial Corporation ( NYSE:FCF ) has announced that it will pay a dividend of $0.125... |

First Commonwealth Financial Corporation (NYSE:FCF) Q3 2023 Earnings Call TranscriptFirst Commonwealth Financial Corporation (NYSE:FCF) Q3 2023 Earnings Call Transcript October 25, 2023 Operator: Ladies and gentlemen thank you for standing by. My name is Brent and I would like to welcome everyone to the First Commonwealth Financial Corporation Third Quarter 2023 Earnings Results Release Conference Call. At this time, all lines have been placed […] |

Q3 2023 First Commonwealth Financial Corp Earnings CallQ3 2023 First Commonwealth Financial Corp Earnings Call |

FCF Price Returns

| 1-mo | 38.97% |

| 3-mo | 38.46% |

| 6-mo | 28.15% |

| 1-year | 32.77% |

| 3-year | 54.04% |

| 5-year | 63.64% |

| YTD | 22.67% |

| 2023 | 14.76% |

| 2022 | -10.33% |

| 2021 | 52.00% |

| 2020 | -20.84% |

| 2019 | 23.64% |

FCF Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching FCF

Want to see what other sources are saying about First Commonwealth Financial Corp's financials and stock price? Try the links below:First Commonwealth Financial Corp (FCF) Stock Price | Nasdaq

First Commonwealth Financial Corp (FCF) Stock Quote, History and News - Yahoo Finance

First Commonwealth Financial Corp (FCF) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...