FutureFuel Corp. Common shares (FF): Price and Financial Metrics

FF Price/Volume Stats

| Current price | $5.54 | 52-week high | $10.31 |

| Prev. close | $5.58 | 52-week low | $4.15 |

| Day low | $5.44 | Volume | 332,132 |

| Day high | $5.60 | Avg. volume | 510,784 |

| 50-day MA | $4.89 | Dividend yield | 4.34% |

| 200-day MA | $5.87 | Market Cap | 242.45M |

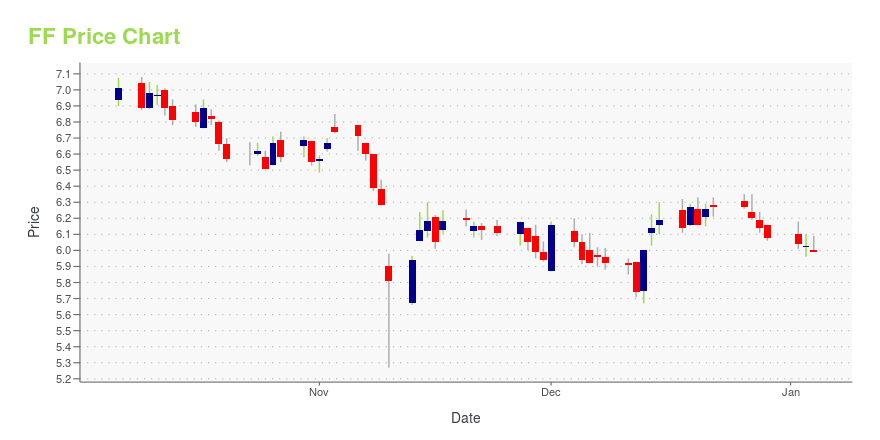

FF Stock Price Chart Interactive Chart >

FutureFuel Corp. Common shares (FF) Company Bio

FutureFuel Corporation manufactures and sells diversified chemical products, bio-based products, and bio-based specialty chemical products in the United States and internationally. It operates through two segments, Chemicals and Biofuels. The company was founded in 2005 and is based in Clayton, Missouri.

Latest FF News From Around the Web

Below are the latest news stories about FUTUREFUEL CORP that investors may wish to consider to help them evaluate FF as an investment opportunity.

Investors Could Be Concerned With FutureFuel's (NYSE:FF) Returns On CapitalWhat financial metrics can indicate to us that a company is maturing or even in decline? A business that's potentially... |

Calculating The Fair Value Of FutureFuel Corp. (NYSE:FF)Key Insights FutureFuel's estimated fair value is US$5.71 based on Dividend Discount Model With US$5.96 share price... |

FutureFuel (NYSE:FF) investors are sitting on a loss of 39% if they invested five years agoIn order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market... |

FutureFuel Releases Third Quarter 2023 ResultsReports Net Income of $2.8 Million or $0.06 per Diluted Share, and Adjusted EBITDA of $9.7 MillionCLAYTON, Mo., Nov. 09, 2023 (GLOBE NEWSWIRE) -- FutureFuel Corp. (NYSE: FF) (“FutureFuel”), a manufacturer of custom and performance chemicals and biofuels, today announced financial results for the third quarter ended September 30, 2023. Third quarter 2023 Financial Highlights (all comparisons are with the third quarter of 2022) Revenues were $116.8 million, compared to $118.1 million.Net income de |

With 43% ownership, FutureFuel Corp. (NYSE:FF) has piqued the interest of institutional investorsKey Insights Significantly high institutional ownership implies FutureFuel's stock price is sensitive to their trading... |

FF Price Returns

| 1-mo | 6.74% |

| 3-mo | 1.06% |

| 6-mo | 41.69% |

| 1-year | -14.57% |

| 3-year | 4.14% |

| 5-year | 20.73% |

| YTD | 34.23% |

| 2023 | -22.78% |

| 2022 | 9.86% |

| 2021 | -26.87% |

| 2020 | 37.61% |

| 2019 | -20.32% |

FF Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching FF

Want to see what other sources are saying about FutureFuel Corp's financials and stock price? Try the links below:FutureFuel Corp (FF) Stock Price | Nasdaq

FutureFuel Corp (FF) Stock Quote, History and News - Yahoo Finance

FutureFuel Corp (FF) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...