First Foundation Inc. (FFWM): Price and Financial Metrics

FFWM Price/Volume Stats

| Current price | $7.08 | 52-week high | $11.47 |

| Prev. close | $7.05 | 52-week low | $4.41 |

| Day low | $6.80 | Volume | 1,110,500 |

| Day high | $7.35 | Avg. volume | 631,312 |

| 50-day MA | $5.96 | Dividend yield | 0.58% |

| 200-day MA | $6.96 | Market Cap | 400.10M |

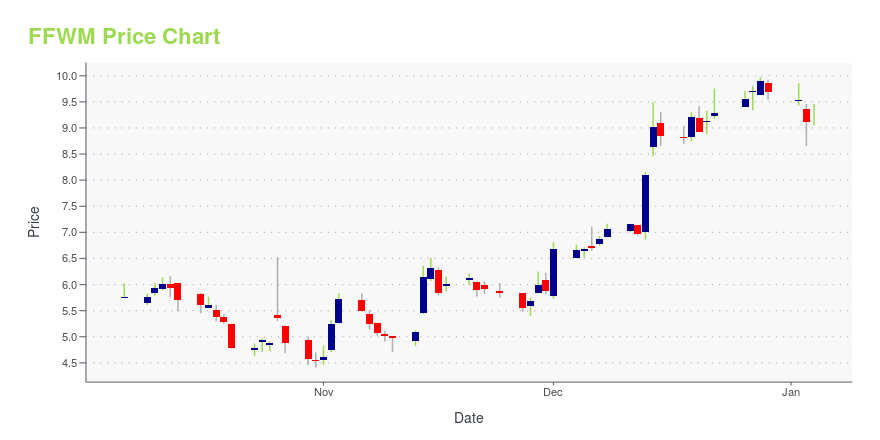

FFWM Stock Price Chart Interactive Chart >

First Foundation Inc. (FFWM) Company Bio

First Foundation Inc. provides various financial services to high net-worth individuals and their families, family businesses, and other affiliated organizations in the United States. It operates in two segments, Banking and Wealth Management. The company is based in Irvine, California.

Latest FFWM News From Around the Web

Below are the latest news stories about FIRST FOUNDATION INC that investors may wish to consider to help them evaluate FFWM as an investment opportunity.

First Foundation Inc. Reports Third Quarter 2023 Financial ResultsDALLAS, October 26, 2023--First Foundation Inc. (NYSE: FFWM), a financial services company with two wholly-owned operating subsidiaries, First Foundation Advisors ("FFA") and First Foundation Bank ("FFB"), today reported its financial results for the quarter ended September 30, 2023. Additionally, First Foundation Inc. announced today that its Board of Directors approved the payment of a quarterly cash dividend of $0.01 per common share payable on November 16, 2023, to common shareholders of rec |

First Foundation Inc. Announces Third Quarter 2023 Earnings Conference Call DetailsDALLAS, October 03, 2023--First Foundation Inc. (NYSE: FFWM) ("First Foundation"), a financial services company with two wholly owned operating subsidiaries, First Foundation Advisors and First Foundation Bank, announced today that it will release its third quarter 2023 earnings results before the market opens on Thursday, October 26. |

First Foundation Advisors Recognized as a Top Registered Investment Advisory Firm by Barron’sDALLAS, September 22, 2023--First Foundation Inc. (NYSE: FFWM) ("First Foundation" or the "Company"), a financial services company with two wholly-owned operating subsidiaries, First Foundation Advisors and First Foundation Bank, announced today its inclusion on the list of 2023 Top 100 RIA Firms by Barron's. The annual list recognizes the top-ranked RIAs in the country based on Barron’s proprietary ranking system that includes assets under management, revenue, and quality of practice. |

First Foundation Advisors Named as One of the Top Financial Advisory Firms on the CNBC FA100 ListDALLAS, September 13, 2023--First Foundation Inc. (NYSE: FFWM) ("First Foundation" or the "Company"), a financial services company with two wholly-owned operating subsidiaries, First Foundation Advisors and First Foundation Bank, announced today that First Foundation Advisors has been recognized as one of 2023’s top financial advisory firms for the second consecutive year. The CNBC FA100 is an annual list, issued on September 12, 2023, which recognizes firms that provide wealth management servic |

With 71% ownership of the shares, First Foundation Inc. (NASDAQ:FFWM) is heavily dominated by institutional ownersKey Insights Institutions' substantial holdings in First Foundation implies that they have significant influence over... |

FFWM Price Returns

| 1-mo | 26.65% |

| 3-mo | 16.66% |

| 6-mo | -31.46% |

| 1-year | 2.80% |

| 3-year | -66.86% |

| 5-year | -49.37% |

| YTD | -26.64% |

| 2023 | -31.35% |

| 2022 | -41.07% |

| 2021 | 26.19% |

| 2020 | 17.09% |

| 2019 | 37.16% |

FFWM Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching FFWM

Want to do more research on First Foundation Inc's stock and its price? Try the links below:First Foundation Inc (FFWM) Stock Price | Nasdaq

First Foundation Inc (FFWM) Stock Quote, History and News - Yahoo Finance

First Foundation Inc (FFWM) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...