First Hawaiian, Inc. (FHB): Price and Financial Metrics

FHB Price/Volume Stats

| Current price | $26.10 | 52-week high | $26.18 |

| Prev. close | $25.12 | 52-week low | $17.18 |

| Day low | $24.62 | Volume | 1,146,500 |

| Day high | $26.18 | Avg. volume | 698,855 |

| 50-day MA | $21.41 | Dividend yield | 4.18% |

| 200-day MA | $20.97 | Market Cap | 3.34B |

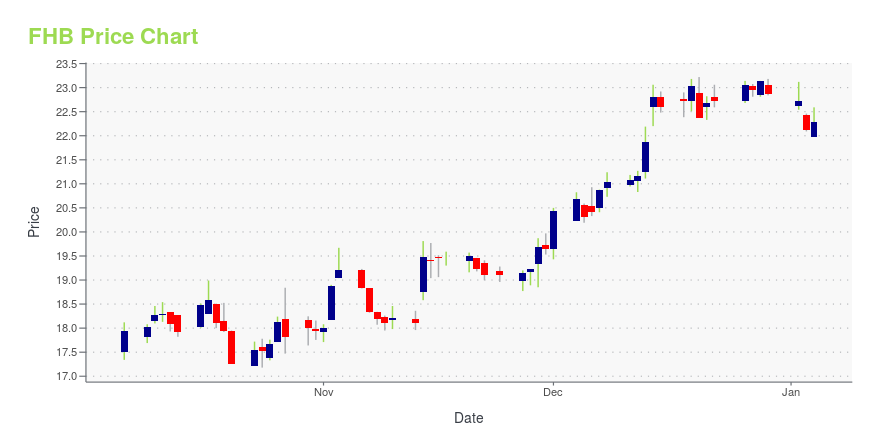

FHB Stock Price Chart Interactive Chart >

First Hawaiian, Inc. (FHB) Company Bio

First Hawaiian, Inc., a holding company, through its subsidiaries, provides banking products and services to individuals and businesses in Hawaii. The company was founded in 1973 and is based in San Francisco, California.

Latest FHB News From Around the Web

Below are the latest news stories about FIRST HAWAIIAN INC that investors may wish to consider to help them evaluate FHB as an investment opportunity.

First Hawaiian (NASDAQ:FHB) shareholders have endured a 13% loss from investing in the stock a year agoFirst Hawaiian, Inc. ( NASDAQ:FHB ) shareholders should be happy to see the share price up 18% in the last quarter. But... |

First Hawaiian Inc's Dividend AnalysisFirst Hawaiian Inc (NASDAQ:FHB) recently announced a dividend of $0.26 per share, payable on 2023-12-01, with the ex-dividend date set for 2023-11-17. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's look into First Hawaiian Inc's dividend performance and assess its sustainability. |

As Maui reopens, Hawaii's leading banks brace for post-fire challengesThe island state's biggest banks — which reported lower profits in the third quarter — say it is too soon to fully assess the economic fallout from the deadly August wildfires. The rebuilding effort could boost near-term deposit growth and long-term loan demand, they said. |

News Flash: Analysts Just Made A Huge Upgrade To Their First Hawaiian, Inc. (NASDAQ:FHB) ForecastsCelebrations may be in order for First Hawaiian, Inc. ( NASDAQ:FHB ) shareholders, with the analysts delivering a... |

First Hawaiian, Inc. (NASDAQ:FHB) Q3 2023 Earnings Call TranscriptFirst Hawaiian, Inc. (NASDAQ:FHB) Q3 2023 Earnings Call Transcript October 27, 2023 Operator: Good day and thank you for standing by. Welcome to the First Hawaiian, Inc. Q3 Earnings Conference Call. At this time, all participants are in a listen-only mode. After the speakers’ presentation, there’ll be a question-and-answer session. [Operator Instructions] Please be advised, […] |

FHB Price Returns

| 1-mo | 28.63% |

| 3-mo | 20.66% |

| 6-mo | 19.95% |

| 1-year | 25.30% |

| 3-year | 7.03% |

| 5-year | 20.38% |

| YTD | 16.96% |

| 2023 | -7.56% |

| 2022 | -0.92% |

| 2021 | 20.39% |

| 2020 | -13.84% |

| 2019 | 33.26% |

FHB Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching FHB

Want to do more research on First Hawaiian Inc's stock and its price? Try the links below:First Hawaiian Inc (FHB) Stock Price | Nasdaq

First Hawaiian Inc (FHB) Stock Quote, History and News - Yahoo Finance

First Hawaiian Inc (FHB) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...