Fair Isaac Corp. (FICO): Price and Financial Metrics

FICO Price/Volume Stats

| Current price | $1,605.94 | 52-week high | $1,658.03 |

| Prev. close | $1,576.93 | 52-week low | $810.26 |

| Day low | $1,579.42 | Volume | 131,697 |

| Day high | $1,612.57 | Avg. volume | 179,685 |

| 50-day MA | $1,454.03 | Dividend yield | N/A |

| 200-day MA | $1,229.13 | Market Cap | 39.68B |

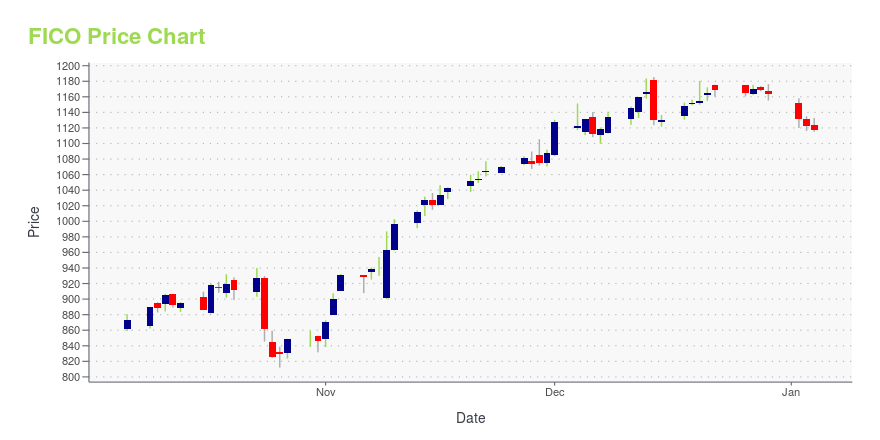

FICO Stock Price Chart Interactive Chart >

Fair Isaac Corp. (FICO) Company Bio

FICO (legal name: Fair Isaac Corporation), originally Fair, Isaac and Company, is a data analytics company based in Bozeman, Montana, focused on credit scoring services. It was founded by Bill Fair and Earl Isaac in 1956. Its FICO score, a measure of consumer credit risk, has become a fixture of consumer lending in the United States. (Source:Wikipedia)

Latest FICO News From Around the Web

Below are the latest news stories about FAIR ISAAC CORP that investors may wish to consider to help them evaluate FICO as an investment opportunity.

Ranking The Top S&P 500 Stocks By 5-Year ReturnsDespite economic challenges, S&P 500 stocks have demonstrated resilience, delivering significant gains over time. |

Fair Isaac (FICO) Rides on Robust Portfolio & Strong ClienteleFair Isaac (FICO) is benefiting from an innovative portfolio and an expanding clientele, which will include credit unions, thanks to the Preferred Partner status by NAFCU. |

Prediction: The Biggest (and Most Anticipated) Stock Splits for 2024Three stocks worth watching. |

FICO Granted 10 New Patents to Improve Decision-Making for EnterprisesBOZEMAN, Mont., December 20, 2023--FICO (NYSE: FICO): |

NAFCU Announces FICO as Preferred Partner for Credit Risk Score ServicesARLINGTON, Va., December 20, 2023--NAFCU Services announced today that FICO, a global analytics software leader, is the newest Preferred Partner to join its program serving credit unions. |

FICO Price Returns

| 1-mo | 9.25% |

| 3-mo | 44.57% |

| 6-mo | 34.24% |

| 1-year | 95.77% |

| 3-year | 203.13% |

| 5-year | 355.37% |

| YTD | 37.97% |

| 2023 | 94.46% |

| 2022 | 38.03% |

| 2021 | -15.14% |

| 2020 | 36.39% |

| 2019 | 100.36% |

Continue Researching FICO

Here are a few links from around the web to help you further your research on Fair Isaac Corp's stock as an investment opportunity:Fair Isaac Corp (FICO) Stock Price | Nasdaq

Fair Isaac Corp (FICO) Stock Quote, History and News - Yahoo Finance

Fair Isaac Corp (FICO) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...