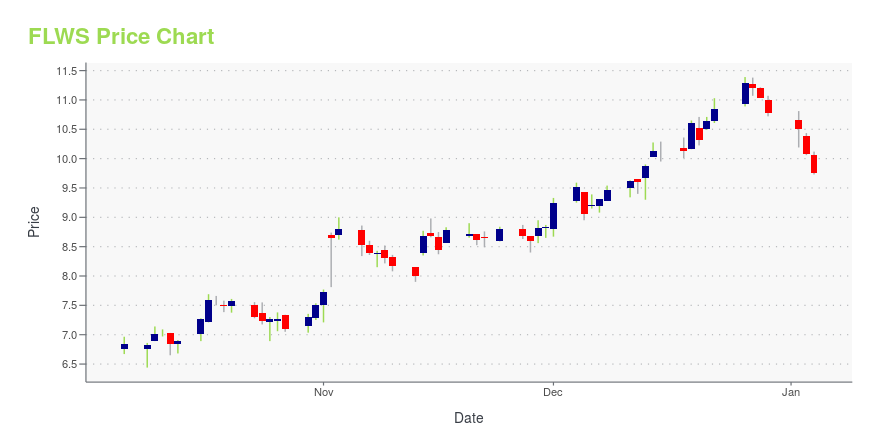

1-800 FLOWERS.COM, Inc. - (FLWS): Price and Financial Metrics

FLWS Price/Volume Stats

| Current price | $9.61 | 52-week high | $11.42 |

| Prev. close | $9.19 | 52-week low | $5.97 |

| Day low | $9.20 | Volume | 209,500 |

| Day high | $9.64 | Avg. volume | 332,544 |

| 50-day MA | $9.63 | Dividend yield | N/A |

| 200-day MA | $9.50 | Market Cap | 617.06M |

FLWS Stock Price Chart Interactive Chart >

1-800 FLOWERS.COM, Inc. - (FLWS) Company Bio

1-800-FLOWERS.COM, Inc. operates in three segments: Consumer Floral, Gourmet Food and Gift Baskets, and BloomNet Wire Service. It offers various products, such as fresh-cut flowers, floral and fruit arrangements and plants, gifts, popcorn, gourmet foods and gift baskets, cookies, chocolates, candies, wine, candles, balloons, and plush stuffed animals. The company was founded in 1976 and is based in Carle Place, New York.

Latest FLWS News From Around the Web

Below are the latest news stories about 1 800 FLOWERS COM INC that investors may wish to consider to help them evaluate FLWS as an investment opportunity.

1-800-FLOWERS.COM, Inc. (NASDAQ:FLWS) Q1 2024 Earnings Call Transcript1-800-FLOWERS.COM, Inc. (NASDAQ:FLWS) Q1 2024 Earnings Call Transcript November 5, 2023 Operator: Good morning, everyone, and welcome to the 1-800-FLOWERS.COM Incorporated 2024 First Quarter Results Conference Call. All participants will be in a listen-only mode. [Operator Instructions] After today’s presentation, there will be an opportunity to ask questions. [Operator Instructions] Please also note today’s event […] |

1-800-FLOWERS.COM (NASDAQ:FLWS) adds US$110m to market cap in the past 7 days, though investors from three years ago are still down 58%1-800-FLOWERS.COM, Inc. ( NASDAQ:FLWS ) shareholders should be happy to see the share price up 29% in the last month... |

1-800-flowers.com (FLWS) Q1 2024 Earnings Call TranscriptJoining us today are Jim McCann, chairman and CEO; Tom Hartnett, president; and Bill Shea, CFO. On our last call, we discussed our long-term historical trends and our expectation for our sales, gross profit margin, and adjusted EBITDA metrics to revert to the mean over time. |

Q1 2024 1-800-Flowers.Com Inc Earnings CallQ1 2024 1-800-Flowers.Com Inc Earnings Call |

1-800-Flowers.com Inc (FLWS) Reports Q1 2024 Earnings: Net Loss of $31.2 MillionCompany sees improvement in gross profit margin and adjusted EBITDA loss |

FLWS Price Returns

| 1-mo | 1.91% |

| 3-mo | 3.56% |

| 6-mo | -10.69% |

| 1-year | 16.77% |

| 3-year | -68.98% |

| 5-year | -51.17% |

| YTD | -10.85% |

| 2023 | 12.76% |

| 2022 | -59.09% |

| 2021 | -10.12% |

| 2020 | 79.31% |

| 2019 | 18.56% |

Continue Researching FLWS

Want to do more research on 1 800 Flowers Com Inc's stock and its price? Try the links below:1 800 Flowers Com Inc (FLWS) Stock Price | Nasdaq

1 800 Flowers Com Inc (FLWS) Stock Quote, History and News - Yahoo Finance

1 800 Flowers Com Inc (FLWS) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...