Finch Therapeutics Group, Inc., (FNCH): Price and Financial Metrics

FNCH Price/Volume Stats

| Current price | $2.32 | 52-week high | $16.74 |

| Prev. close | $2.24 | 52-week low | $1.86 |

| Day low | $2.10 | Volume | 38,235 |

| Day high | $2.43 | Avg. volume | 38,084 |

| 50-day MA | $2.52 | Dividend yield | N/A |

| 200-day MA | $4.32 | Market Cap | 3.73M |

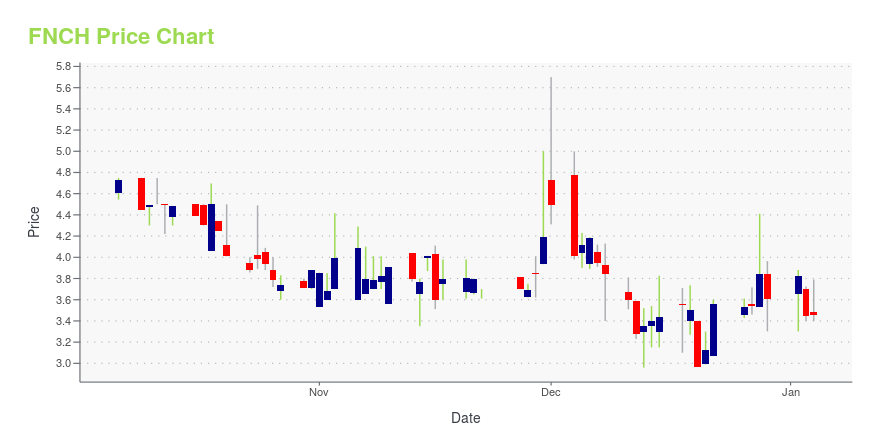

FNCH Stock Price Chart Interactive Chart >

Finch Therapeutics Group, Inc., (FNCH) Company Bio

Finch Therapeutics Group, Inc., a clinical-stage microbiome therapeutics company, develops a novel class of orally administered biological drugs in the United States. The company's lead candidate is CP101, an orally administered microbiome capsule that has completed Phase II clinical trial for the treatment of patients with recurrent Clostridioides difficile infection, as well as for the treatment of chronic hepatitis B virus. It is also developing FIN-211, an orally administered enriched consortia product candidate for use in the treatment of autism spectrum disorder; and FIN-524 and FIN-525, which are orally administered targeted consortia product candidates for the treatment of ulcerative colitis and crohn's disease. The company has collaboration and license agreements with Millennium Pharmaceuticals, Inc.; Skysong Innovations LLC; and University of Minnesota. Finch Therapeutics Group, Inc. was incorporated in 2014 and is based in Somerville, Massachusetts.

Latest FNCH News From Around the Web

Below are the latest news stories about FINCH THERAPEUTICS GROUP INC that investors may wish to consider to help them evaluate FNCH as an investment opportunity.

Billionaire Seth Klarman’s Biotech Stock PicksIn this article, we discuss billionaire Seth Klarman’s biotech stock picks. To skip the detailed analysis of the biotech industry, Seth Klarman’s investment philosophy, and Baupost Group’s performance and Q3 bets, go directly to Billionaire Seth Klarman’s Top 4 Biotech Stock Picks. Biotechnology is the technology segment that utilizes cellular and biomolecular processes for the […] |

Finch Announces Reverse Stock Split of Common StockBOSTON, June 09, 2023 (GLOBE NEWSWIRE) -- Finch Therapeutics Group, Inc. (“Finch”, “Finch Therapeutics” or the “Company”) (Nasdaq: FNCH), a microbiome technology company with a portfolio of intellectual property and microbiome assets, today announced it will effect a one-for-30 reverse stock split of its issued and outstanding common stock. Finch stockholders approved an amendment to its Amended and Restated Certificate of Incorporation to effect the reverse stock split at Finch’s Annual Meeting |

The Petri Dish: Laronde CEO exits after 6 months; Enanta seeks Covid pill partnerFinch Therapeutics forges a path forward, Insulet shakes up its C-suite, plus other biotech news in the Petri Dish. |

Finch Therapeutics Reports First Quarter 2023 Financial Results and Provides Business UpdatesSOMERVILLE, Mass., May 10, 2023 (GLOBE NEWSWIRE) -- Finch Therapeutics Group, Inc. (“Finch”, “Finch Therapeutics” or the “Company”) (Nasdaq: FNCH), a microbiome technology company with a portfolio of intellectual property and microbiome assets, today reported first quarter 2023 financial results and provided business updates. “Finch has continued to execute on its strategy to advance its novel microbiome technology through partnerships and collaborations, highlighted by the recent investigator-s |

Finch Therapeutics Announces Executive Leadership TransitionsMatthew P. Blischak, an experienced life sciences executive and intellectual property counsel, appointed as Chief Executive Officer effective May 16, 2023; Mark Smith, PhD, to complete his time as CEO effective May 15 Lance Thibault, Managing Director of Danforth Advisors, to serve as Chief Financial Officer effective May 16, 2023; Marc Blaustein to complete his time as Chief Operating Officer and principal financial officer effective May 15 SOMERVILLE, Mass., April 25, 2023 (GLOBE NEWSWIRE) -- |

FNCH Price Returns

| 1-mo | -19.84% |

| 3-mo | -20.00% |

| 6-mo | -37.97% |

| 1-year | -83.15% |

| 3-year | -99.43% |

| 5-year | N/A |

| YTD | -35.73% |

| 2023 | -74.93% |

| 2022 | -95.19% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...