Franco-Nevada Corporation (FNV): Price and Financial Metrics

FNV Price/Volume Stats

| Current price | $124.64 | 52-week high | $147.35 |

| Prev. close | $124.21 | 52-week low | $102.29 |

| Day low | $124.27 | Volume | 434,973 |

| Day high | $126.00 | Avg. volume | 667,535 |

| 50-day MA | $122.54 | Dividend yield | 1.15% |

| 200-day MA | $118.09 | Market Cap | 23.98B |

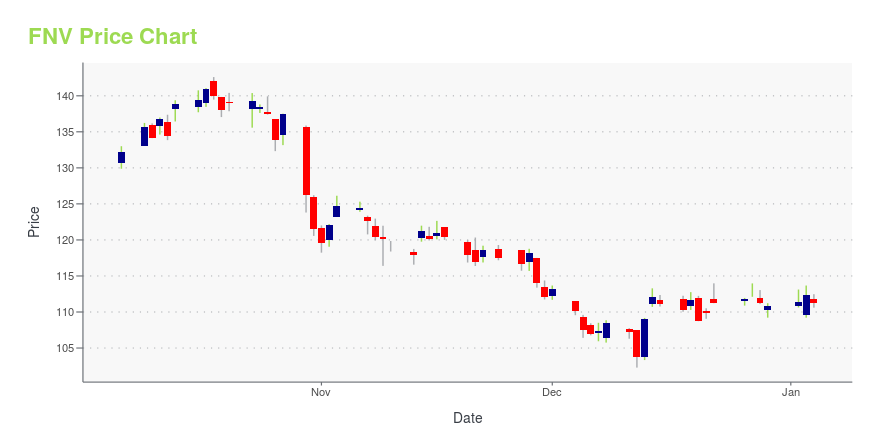

FNV Stock Price Chart Interactive Chart >

Franco-Nevada Corporation (FNV) Company Bio

Franco-Nevada Corporation operates as a gold-focused royalty and stream company in the United States, Canada, Latin America, and internationally. The company was founded in 2007 and is based in Toronto, Canada.

Latest FNV News From Around the Web

Below are the latest news stories about FRANCO NEVADA CORP that investors may wish to consider to help them evaluate FNV as an investment opportunity.

7 Growth Stocks Poised to Thrive in a Post-Fed Pivot WorldWith the Federal Reserve previously engaged in a bitter – and seemingly, at times desperate – struggle against blisteringly hot inflation, the narrative for growth stocks to buy now frankly didn’t resonate very well with many investors. |

Is This Unique Gold Investment the Perfect Inflation Hedge?Investors often see hard assets as a way to hedge against inflation. These precious metals stocks could be a nearly perfect option. |

Cobre Panama Environmental Stewardship UpdateFranco-Nevada Corporation ("Franco-Nevada") (TSX: FNV) (NYSE: FNV) notes that its partner, First Quantum Minerals Ltd. ("First Quantum"), has provided an update in respect of its position regarding the next steps required for the responsible environmental stewardship of the Cobre Panama mine site and First Quantum's intention to pursue all appropriate legal avenues to protect its investment and rights. |

Franco-Nevada Stock (NYSE:FNV): A Gamma Squeeze Could be in PlayOn the surface, gold royalties and streaming specialist Franco-Nevada (NYSE:FNV) appears to be an incredibly risky idea. Due to a critical issue at one of its key mines, FNV has heavily underperformed its rivals in the broader precious metals industry. Nevertheless, an unexpected reversal of fortune could create a positive feedback loop from gamma squeeze conditions. It’s an extremely speculative idea. Nevertheless, I’m bullish on FNV stock because the backdrop seems favorable for a recovery. FN |

Oil Prices and 1 Customer Are Taking a Toll on This Dividend Stock. Is It a Buy?Franco-Nevada is badly lagging its largest streaming peers. Here's why that's happening and why it could be worth buying anyway. |

FNV Price Returns

| 1-mo | 5.06% |

| 3-mo | 2.01% |

| 6-mo | 15.91% |

| 1-year | -11.82% |

| 3-year | -14.27% |

| 5-year | 46.05% |

| YTD | 13.17% |

| 2023 | -17.96% |

| 2022 | -0.16% |

| 2021 | 10.82% |

| 2020 | 22.31% |

| 2019 | 48.92% |

FNV Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching FNV

Here are a few links from around the web to help you further your research on FRANCO NEVADA Corp's stock as an investment opportunity:FRANCO NEVADA Corp (FNV) Stock Price | Nasdaq

FRANCO NEVADA Corp (FNV) Stock Quote, History and News - Yahoo Finance

FRANCO NEVADA Corp (FNV) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...