GoDaddy Inc. Cl A (GDDY): Price and Financial Metrics

GDDY Price/Volume Stats

| Current price | $125.01 | 52-week high | $127.15 |

| Prev. close | $124.14 | 52-week low | $67.43 |

| Day low | $123.73 | Volume | 995,700 |

| Day high | $126.68 | Avg. volume | 1,451,321 |

| 50-day MA | $118.62 | Dividend yield | N/A |

| 200-day MA | $95.03 | Market Cap | 17.81B |

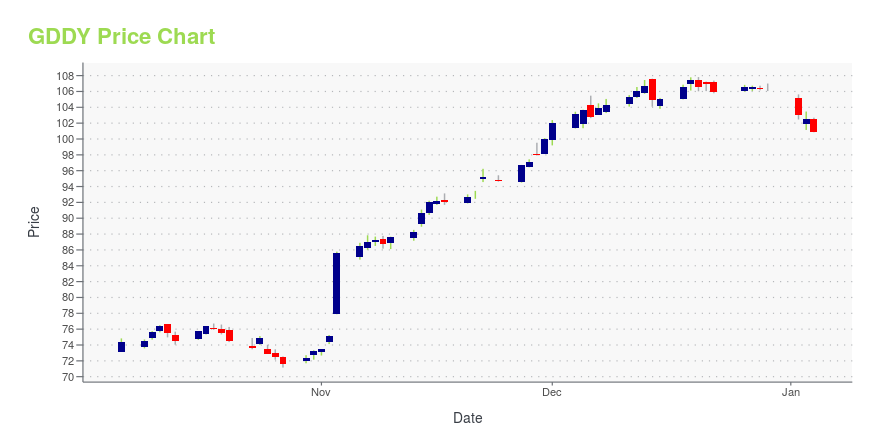

GDDY Stock Price Chart Interactive Chart >

GoDaddy Inc. Cl A (GDDY) Company Bio

GoDaddy Inc. is an American publicly traded Internet domain registrar and web hosting company headquartered in Tempe, Arizona, and incorporated in Delaware. (Source:Wikipedia)

Latest GDDY News From Around the Web

Below are the latest news stories about GODADDY INC that investors may wish to consider to help them evaluate GDDY as an investment opportunity.

Understand Microbusinesses Better With Five Insights From GoDaddy Venture ForwardNORTHAMPTON, MA / ACCESSWIRE / December 27, 2023 / GoDaddy As originally published by GoDaddy's Venture Forward Research Initiative Life is better as an entrepreneur - a trend revealed via our research of more than 6,000 entrepreneurs. This year, ... |

Own Your Career Podcast - Give More Space: Meet Sanjana BadamNORTHAMPTON, MA / ACCESSWIRE / December 26, 2023 / GoDaddy Originally published on GoDaddy Resource Library Listen to the Podcast, here!Transcription provided, below. Janelle (Host): Hello and welcome to the Own Your Career podcast. My name is Janelle ... |

The Mission Driven Business Podcast Episode 67: Empowering Inclusive Entrepreneurship with Ebony JanelleNORTHAMPTON, MA / ACCESSWIRE / December 21, 2023 / GoDaddy Originally published on Brian Thompson Financial Listen to the podcast, here! Brian chats with inclusive entrepreneurship expert Ebony Janelle. As an Empower by GoDaddy manager, Ebony drives ... |

Own Your Career Podcast - Find Something That Can Become an Obsession: Meet Nick KoenigNORTHAMPTON, MA / ACCESSWIRE / December 19, 2023 / GoDaddy Originally published on GoDaddy Resource Library Listen to the Podcast, here!Transcription provided, below. Janelle (Host): Hello and welcome to the Own Your Career Podcast. My name is Janelle ... |

Unlocking Success: Tips for Entrepreneurs in Peak Seasons [Video]NORTHAMPTON, MA / ACCESSWIRE / December 15, 2023 / GoDaddyEntrepreneurs should leverage generative AI, mobile payments, social media and networking to accelerate their growth during the busy season and beyond, according to GoDaddy marketing experts.Watch ... |

GDDY Price Returns

| 1-mo | 5.33% |

| 3-mo | 16.02% |

| 6-mo | 72.71% |

| 1-year | 65.18% |

| 3-year | 42.14% |

| 5-year | 53.99% |

| YTD | 17.76% |

| 2023 | 41.89% |

| 2022 | -11.83% |

| 2021 | 2.30% |

| 2020 | 22.13% |

| 2019 | 3.51% |

Continue Researching GDDY

Want to see what other sources are saying about GoDaddy Inc's financials and stock price? Try the links below:GoDaddy Inc (GDDY) Stock Price | Nasdaq

GoDaddy Inc (GDDY) Stock Quote, History and News - Yahoo Finance

GoDaddy Inc (GDDY) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...