Greenhill & Co., Inc. (GHL): Price and Financial Metrics

GHL Price/Volume Stats

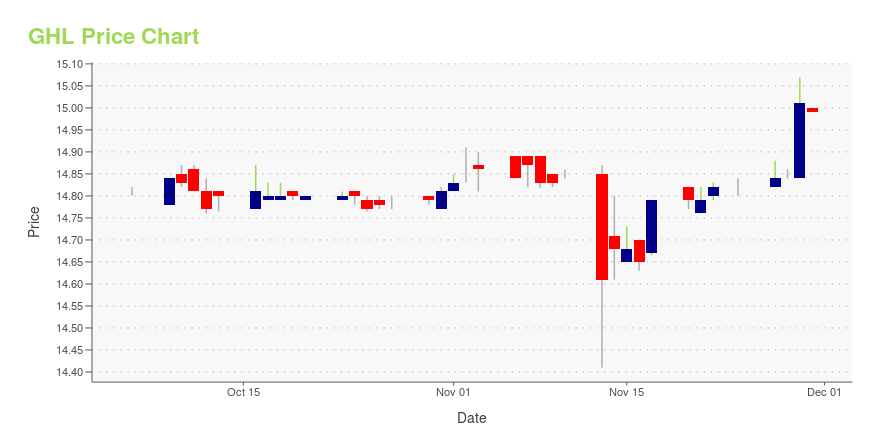

| Current price | $14.99 | 52-week high | $15.07 |

| Prev. close | $15.01 | 52-week low | $6.14 |

| Day low | $14.99 | Volume | 865,800 |

| Day high | $15.00 | Avg. volume | 183,278 |

| 50-day MA | $14.81 | Dividend yield | 2.67% |

| 200-day MA | $12.72 | Market Cap | 282.04M |

GHL Stock Price Chart Interactive Chart >

Greenhill & Co., Inc. (GHL) Company Bio

Greenhill & Company is an investment bank focused on providing financial advice on significant mergers, acquisitions, restructurings, financings and capital raisings to corporations, partnerships, institutions and governments. The company was founded in 1996 and is based in New York, New York.

Latest GHL News From Around the Web

Below are the latest news stories about GREENHILL & CO INC that investors may wish to consider to help them evaluate GHL as an investment opportunity.

Greenhill & Co Inc's Dividend Performance: A Comprehensive AnalysisGreenhill & Co Inc(NYSE:GHL) recently announced a dividend of $0.1 per share, payable on 2023-09-27, with the ex-dividend date set for 2023-09-12. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's deep dive into Greenhill & Co Inc's dividend performance and assess its sustainability. |

Greenhill & Co. Reports Second Quarter 2023 ResultsNEW YORK, August 09, 2023--Greenhill & Co., Inc. (NYSE: GHL) today reported revenues of $71.4 million, net income of $4.4 million and diluted earnings per share of $0.21 for the quarter ended June 30, 2023. |

RPT-Japan's top lenders in fresh drive to win US investment banking dealsJapan's top lenders aim to carve out a larger presence in U.S investment banking as they look to make better use of their massive balance sheets by winning a bigger slice of deals, executives say. For years Japan's megabanks have been notable players in U.S. corporate lending, armed with huge assets backed by household deposits at home. Mizuho's $550 million acquisition of U.S. boutique firm Greenhill announced in May will help it fill in "missing pieces" in advisory services and other areas, said Yoshiro Hamamoto, CEO of Mizuho Securities, the brokerage arm of Japan's third-largest bank. |

Japan's top lenders in fresh drive to win US investment banking dealsJapan's top lenders aim to carve out a larger presence in U.S investment banking as they look to make better use of their massive balance sheets by winning a bigger slice of deals, executives say. For years Japan's megabanks have been notable players in U.S. corporate lending, armed with huge assets backed by household deposits at home. Mizuho's $550 million acquisition of U.S. boutique firm Greenhill announced in May will help it fill in "missing pieces" in advisory services and other areas, said Yoshiro Hamamoto, CEO of Mizuho Securities, the brokerage arm of Japan's third-largest bank. |

Mizuho (MFG) to Buy Greenhill for $550M, Expand IB BusinessMizuho (MFG) signs an agreement to acquire Greenhill for $550 million. The deal will hasten the company's IB expansion efforts. |

GHL Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | 2.67% |

| 3-year | -0.51% |

| 5-year | 4.69% |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | -40.69% |

| 2021 | 49.52% |

| 2020 | -27.71% |

| 2019 | -29.16% |

GHL Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching GHL

Want to do more research on Greenhill & Co Inc's stock and its price? Try the links below:Greenhill & Co Inc (GHL) Stock Price | Nasdaq

Greenhill & Co Inc (GHL) Stock Quote, History and News - Yahoo Finance

Greenhill & Co Inc (GHL) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...