G-III Apparel Group, LTD. (GIII): Price and Financial Metrics

GIII Price/Volume Stats

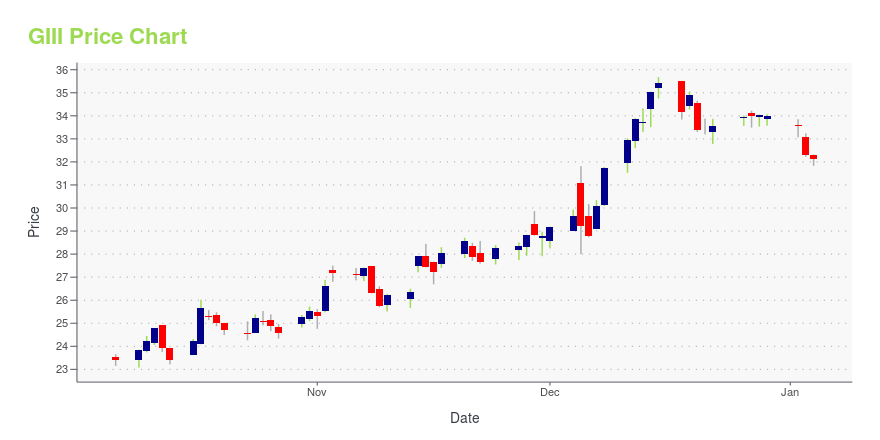

| Current price | $26.65 | 52-week high | $35.68 |

| Prev. close | $25.85 | 52-week low | $18.47 |

| Day low | $26.23 | Volume | 454,300 |

| Day high | $26.91 | Avg. volume | 623,313 |

| 50-day MA | $27.38 | Dividend yield | N/A |

| 200-day MA | $28.80 | Market Cap | 1.20B |

GIII Stock Price Chart Interactive Chart >

G-III Apparel Group, LTD. (GIII) Company Bio

G-III Apparel Group is a leading manufacturer and distributor of outerwear, dresses, sportswear, swimwear, women's suits, women's performance wear, footwear, luggage, women's handbags, small leather goods and cold weather accessories under licensed brands, owned brands and private label brands. The company was founded in 1879 and is based in New York, New York.

Latest GIII News From Around the Web

Below are the latest news stories about G III APPAREL GROUP LTD that investors may wish to consider to help them evaluate GIII as an investment opportunity.

The Zacks Analyst Blog Highlights Splunk, Workday, NVIDIA, G-III Apparel Group and Casey's General StoresSplunk, Workday, NVIDIA, G-III Apparel Group and Casey's General Stores are part of the Zacks top Analyst Blog. |

Zacks.com featured highlights include G-III Apparel, United States Cellular and FrontdoorG-III Apparel, United States Cellular and Frontdoor are part of the Zacks Screen of the Week article. |

Is GIII Apparel Group (GIII) Stock Outpacing Its Consumer Discretionary Peers This Year?Here is how G-III Apparel Group (GIII) and Royal Caribbean (RCL) have performed compared to their sector so far this year. |

3 Momentum Anomaly Stocks to Buy as Santa Claus Rally ContinuesG-III Apparel (GIII), U.S. Cellular (USM) and Frontdoor (FTDR) are currently witnessing a short-term pullback in price. So, make sure you take full advantage of it. |

Why Fast-paced Mover G-III Apparel (GIII) Is a Great Choice for Value InvestorsG-III Apparel (GIII) made it through our 'Fast-Paced Momentum at a Bargain' screen and could be a great choice for investors looking for stocks that have gained strong momentum recently but are still trading at reasonable prices. |

GIII Price Returns

| 1-mo | -1.84% |

| 3-mo | -6.23% |

| 6-mo | -13.78% |

| 1-year | 30.77% |

| 3-year | -10.42% |

| 5-year | -7.69% |

| YTD | -21.57% |

| 2023 | 147.85% |

| 2022 | -50.40% |

| 2021 | 16.43% |

| 2020 | -29.13% |

| 2019 | 20.11% |

Continue Researching GIII

Want to see what other sources are saying about G Iii Apparel Group Ltd's financials and stock price? Try the links below:G Iii Apparel Group Ltd (GIII) Stock Price | Nasdaq

G Iii Apparel Group Ltd (GIII) Stock Quote, History and News - Yahoo Finance

G Iii Apparel Group Ltd (GIII) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...