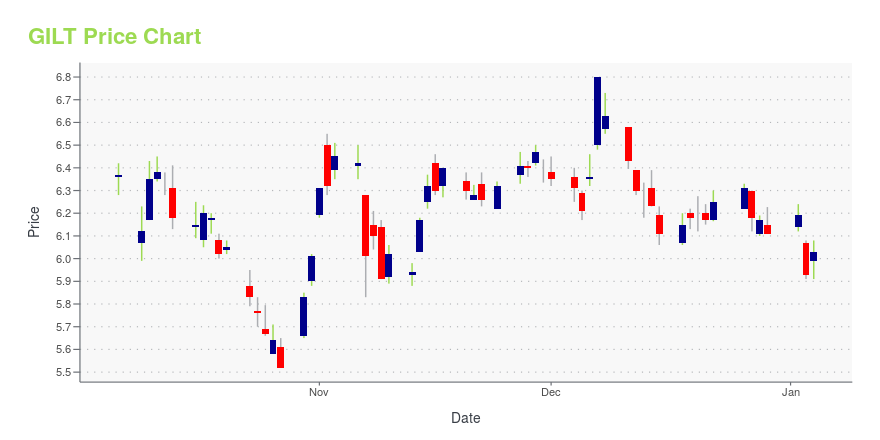

Gilat Satellite Networks Ltd. (GILT): Price and Financial Metrics

GILT Price/Volume Stats

| Current price | $4.70 | 52-week high | $7.16 |

| Prev. close | $4.69 | 52-week low | $4.31 |

| Day low | $4.65 | Volume | 136,400 |

| Day high | $4.74 | Avg. volume | 204,320 |

| 50-day MA | $4.92 | Dividend yield | N/A |

| 200-day MA | $5.70 | Market Cap | 267.98M |

GILT Stock Price Chart Interactive Chart >

Gilat Satellite Networks Ltd. (GILT) Company Bio

Gilat Satellite Networks Ltd. provides broadband satellite communication and networking solutions and services worldwide. The company operates through three divisions: Commercial, Mobility, and Services. The company was founded in 1987 and is based in Petah Tikva, Israel.

Latest GILT News From Around the Web

Below are the latest news stories about GILAT SATELLITE NETWORKS LTD that investors may wish to consider to help them evaluate GILT as an investment opportunity.

3 Stocks Capitalizing on the Space Internet RevolutionThese space stocks are pioneering new internet technologies with their satellite constellations. |

US Army Awards Nearly $20 Million Contract Extension to Gilat to Sustain Anytime, Anywhere Satellite ConnectivityGilat to provide additional 50W Ka-band BUCs for long-term sustainment of thousands of mobile Satellite Transportable Terminals (STTs)PETAH TIKVA, Israel, Dec. 04, 2023 (GLOBE NEWSWIRE) -- Gilat Satellite Networks Ltd. (Nasdaq: GILT, TASE: GILT), a worldwide leader in satellite networking technology, solutions, and services, announced today that the United States Army awarded a nearly $20 million contract to the company’s US-based subsidiary, Wavestream, for the continuation of a program to sust |

With 61% ownership of the shares, Gilat Satellite Networks Ltd. (NASDAQ:GILT) is heavily dominated by institutional ownersKey Insights Institutions' substantial holdings in Gilat Satellite Networks implies that they have significant... |

Gilat Completes Acquisition of DataPath, Inc.The acquisition represents a strong step forward in Gilat’s strategy to increase its presence in the growing defense communications marketPETAH TIKVA, Israel, Nov. 16, 2023 (GLOBE NEWSWIRE) -- Gilat Satellite Networks Ltd. (Nasdaq: GILT, TASE: GILT), a worldwide leader in satellite networking technology, solutions, and services, announced today that it has completed the acquisition of DataPath, Inc., a market leader in trusted communications for the US DoD Military and Government sectors. The tr |

Gilat Satellite Networks Ltd. (NASDAQ:GILT) Q3 2023 Earnings Call TranscriptGilat Satellite Networks Ltd. (NASDAQ:GILT) Q3 2023 Earnings Call Transcript November 7, 2023 Operator: Ladies and gentlemen, thank you for standing by. Welcome to Gilat’s Third Quarter 2023 Results Conference Call. All participants are present in listen-only mode. Following management’s formal presentation, instructions will be given for the question-and-answer session. [Operator Instructions] As a reminder, […] |

GILT Price Returns

| 1-mo | 5.86% |

| 3-mo | -8.56% |

| 6-mo | -29.22% |

| 1-year | -22.31% |

| 3-year | -52.67% |

| 5-year | -37.95% |

| YTD | -23.08% |

| 2023 | 5.34% |

| 2022 | -17.96% |

| 2021 | 15.55% |

| 2020 | -13.38% |

| 2019 | -9.43% |

Continue Researching GILT

Want to do more research on Gilat Satellite Networks Ltd's stock and its price? Try the links below:Gilat Satellite Networks Ltd (GILT) Stock Price | Nasdaq

Gilat Satellite Networks Ltd (GILT) Stock Quote, History and News - Yahoo Finance

Gilat Satellite Networks Ltd (GILT) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...