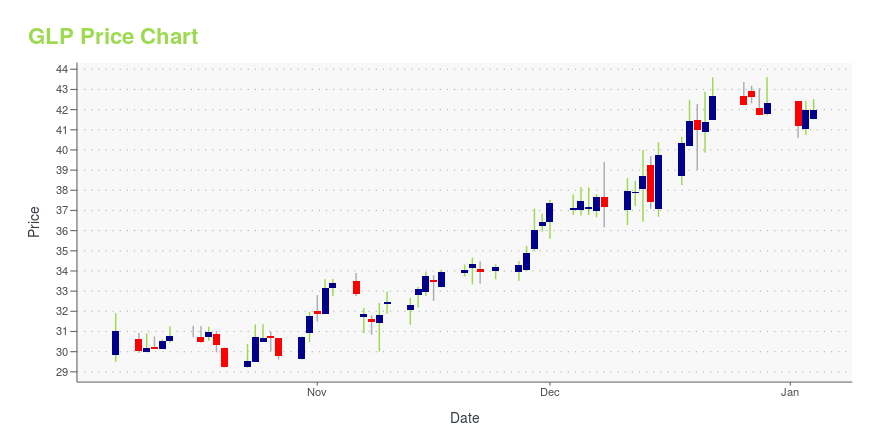

Global Partners LP (GLP): Price and Financial Metrics

GLP Price/Volume Stats

| Current price | $40.51 | 52-week high | $50.85 |

| Prev. close | $39.82 | 52-week low | $27.07 |

| Day low | $39.81 | Volume | 45,200 |

| Day high | $40.99 | Avg. volume | 115,537 |

| 50-day MA | $44.94 | Dividend yield | 6.95% |

| 200-day MA | $42.40 | Market Cap | 1.37B |

GLP Stock Price Chart Interactive Chart >

Global Partners LP (GLP) Company Bio

Global Partners LP distributes gasoline, distillates, residual oil, and renewable fuels to wholesalers, retailers, and commercial customers in the New England states and New York. It operates in three segments: Wholesale, Gasoline Distribution and Station Operations, and Commercial. The company was founded in 2005 and is based in Waltham, Massachusetts.

Latest GLP News From Around the Web

Below are the latest news stories about GLOBAL PARTNERS LP that investors may wish to consider to help them evaluate GLP as an investment opportunity.

Global Partners LP Completes Acquisition of 25 Liquid Energy Terminals from Motiva Enterprises LLCWALTHAM, Mass., December 21, 2023--Global Partners LP (NYSE: GLP) ("Global" or the "Partnership") today announced the completion of its previously announced acquisition of 25 liquid energy terminals from Motiva Enterprises LLC ("Motiva"). The transaction is underpinned by a 25-year take-or-pay throughput agreement with Motiva, the anchor tenant at the terminals, that includes minimum annual revenue commitments. |

Insider Spends AU$358k Buying More Shares In Associate Global PartnersPotential Associate Global Partners Limited ( ASX:APL ) shareholders may wish to note that the CEO, MD & Executive... |

Global Partners LP (NYSE:GLP) Q3 2023 Earnings Call TranscriptGlobal Partners LP (NYSE:GLP) Q3 2023 Earnings Call Transcript November 9, 2023 Global Partners LP misses on earnings expectations. Reported EPS is $0.6 EPS, expectations were $0.69. Operator: Good day, everyone, and welcome to the Global Partners Third Quarter 2023 Financial Results Conference Call. Today’s call is being recorded. [Operator Instructions]. With us from Global […] |

Q3 2023 Global Partners LP Earnings CallQ3 2023 Global Partners LP Earnings Call |

Global Partners LP (GLP) Reports Decline in Q3 2023 Earnings Amid Market NormalizationStrategic Acquisitions and Asset Optimization in Focus as Earnings Dip Compared to 2022 |

GLP Price Returns

| 1-mo | -11.49% |

| 3-mo | -12.93% |

| 6-mo | -9.97% |

| 1-year | 31.31% |

| 3-year | 104.79% |

| 5-year | 240.44% |

| YTD | -1.35% |

| 2023 | 35.29% |

| 2022 | 61.23% |

| 2021 | 55.37% |

| 2020 | -3.25% |

| 2019 | 37.24% |

GLP Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching GLP

Want to see what other sources are saying about Global Partners Lp's financials and stock price? Try the links below:Global Partners Lp (GLP) Stock Price | Nasdaq

Global Partners Lp (GLP) Stock Quote, History and News - Yahoo Finance

Global Partners Lp (GLP) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...