Corning Inc. (GLW): Price and Financial Metrics

GLW Price/Volume Stats

| Current price | $42.85 | 52-week high | $46.39 |

| Prev. close | $42.81 | 52-week low | $25.26 |

| Day low | $42.62 | Volume | 7,690,340 |

| Day high | $43.25 | Avg. volume | 6,004,000 |

| 50-day MA | $39.66 | Dividend yield | 2.54% |

| 200-day MA | $32.94 | Market Cap | 36.71B |

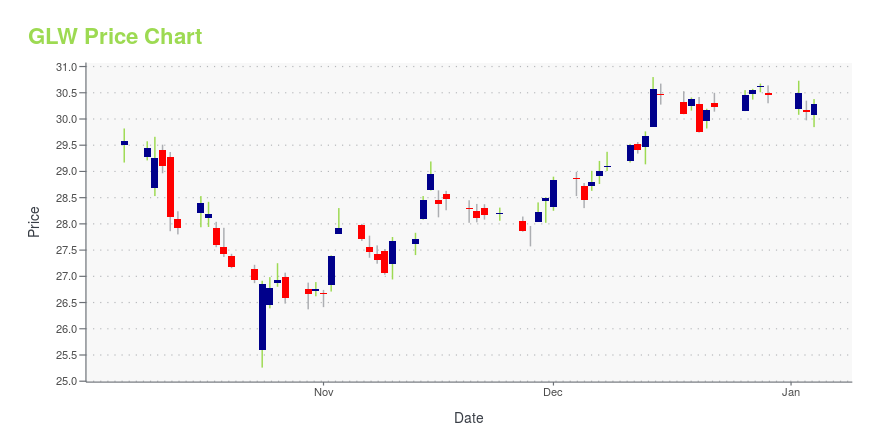

GLW Stock Price Chart Interactive Chart >

Corning Inc. (GLW) Company Bio

Corning Incorporated is an American multinational technology company that specializes in specialty glass, ceramics, and related materials and technologies including advanced optics, primarily for industrial and scientific applications. The company was named Corning Glass Works until 1989. Corning divested its consumer product lines (including CorningWare and Visions Pyroceram-based cookware, Corelle Vitrelle tableware, and Pyrex glass bakeware) in 1998 by selling the Corning Consumer Products Company subsidiary (now known as Corelle Brands) to Borden, but still holds an interest of about 8 percent. (Source:Wikipedia)

Latest GLW News From Around the Web

Below are the latest news stories about CORNING INC that investors may wish to consider to help them evaluate GLW as an investment opportunity.

Investors Interested In Corning Incorporated's (NYSE:GLW) EarningsCorning Incorporated's ( NYSE:GLW ) price-to-earnings (or "P/E") ratio of 44.4x might make it look like a strong sell... |

5G and Beyond: 3 Companies Innovating at the Edge of ConnectivityThe telecom industry had a bumpy year. |

3 Dividend-Paying Tech Stocks to Buy in DecemberDividend investors tend not to think about tech stocks when seeking income. Many emerging tech plays forgo dividend payments to invest in growth. Also, even when they pay dividends, they tend to have dividend yields below the S&P 500 average of 1.5%. |

Treat Yourself: These Cheap Stocks Are On Sale40% off select models. Up to 70% off clearance. Only one coupon code per customer. We’ve been bombarded with Black Friday deals for weeks; what used to be a one-day-only, in-store event has turned into a month-long celebration of “the best deals of the year,” and we’d feel pretty foolish for not jumping on that 70-inch television, AirPods Max headphones, or Ninja 14-piece knife set we’ve been eyeing since July. So, in the spirit of the week, I thought I’d revisit a couple of cheap stocks I’ve be |

With 69% institutional ownership, Corning Incorporated (NYSE:GLW) is a favorite amongst the big gunsKey Insights Significantly high institutional ownership implies Corning's stock price is sensitive to their trading... |

GLW Price Returns

| 1-mo | 11.94% |

| 3-mo | 37.86% |

| 6-mo | 41.17% |

| 1-year | 31.23% |

| 3-year | 16.24% |

| 5-year | 47.56% |

| YTD | 43.08% |

| 2023 | -1.23% |

| 2022 | -11.56% |

| 2021 | 5.92% |

| 2020 | 27.57% |

| 2019 | -1.02% |

GLW Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching GLW

Want to see what other sources are saying about Corning Inc's financials and stock price? Try the links below:Corning Inc (GLW) Stock Price | Nasdaq

Corning Inc (GLW) Stock Quote, History and News - Yahoo Finance

Corning Inc (GLW) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...