Genco Shipping & Trading Ltd. (GNK): Price and Financial Metrics

GNK Price/Volume Stats

| Current price | $19.56 | 52-week high | $23.43 |

| Prev. close | $19.67 | 52-week low | $12.65 |

| Day low | $19.38 | Volume | 374,481 |

| Day high | $19.80 | Avg. volume | 657,932 |

| 50-day MA | $21.39 | Dividend yield | 8.13% |

| 200-day MA | $18.54 | Market Cap | 836.35M |

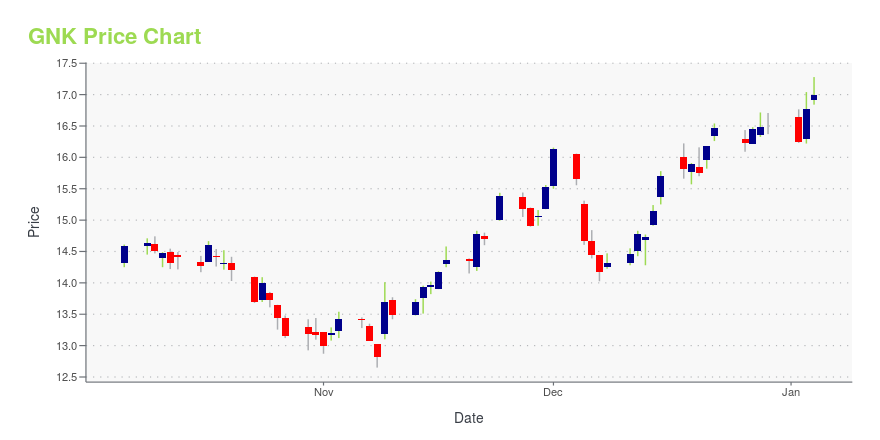

GNK Stock Price Chart Interactive Chart >

Genco Shipping & Trading Ltd. (GNK) Company Bio

Genco Shipping & Trading transports iron ore, coal, grain, steel products and other drybulk cargoes along worldwide shipping routes. The company was founded in 2004 and is based in New York, New York.

Latest GNK News From Around the Web

Below are the latest news stories about GENCO SHIPPING & TRADING LTD that investors may wish to consider to help them evaluate GNK as an investment opportunity.

Why Are Shipping Stocks ZIM, GNK, EGLE, SBLK Up Today?Shipping stocks are up on Monday after BP announced that it will no longer be using shipping routes that travel through the Red Sea. |

Genco Shipping & Trading Limited's (NYSE:GNK) Popularity With Investors Is Under Threat From OverpricingGenco Shipping & Trading Limited's ( NYSE:GNK ) price-to-sales (or "P/S") ratio of 1.7x may not look like an appealing... |

How to Boost Your Portfolio with Top Transportation Stocks Set to Beat EarningsFinding stocks expected to beat quarterly earnings estimates becomes an easier task with our Zacks Earnings ESP. |

Genco Shipping & Trading Limited Closes $500 Million Credit FacilityRevolving Credit Facility Significantly Increases Borrowing Capacity & Enhances Financial FlexibilityNEW YORK, Dec. 04, 2023 (GLOBE NEWSWIRE) -- Genco Shipping & Trading Limited (NYSE:GNK) (“Genco” or the “Company”), the largest U.S. headquartered drybulk shipowner focused on the global transportation of commodities, today announced that it has closed its previously announced $500 million revolving credit facility. Key terms of the $500 million revolving credit facility include: Borrowing capaci |

13 Best Shipping and Container Stocks To BuyIn this article, we will take a look at the 13 best shipping and container stocks to buy. To skip our recent market trends and activity analysis, you can go directly to see the 5 Best Shipping and Container Stocks to Buy. The usually inconspicuous realm of shipping stocks gained prominence during the COVID-19 pandemic, […] |

GNK Price Returns

| 1-mo | -9.11% |

| 3-mo | -7.57% |

| 6-mo | 14.17% |

| 1-year | 49.75% |

| 3-year | 44.06% |

| 5-year | 177.66% |

| YTD | 22.57% |

| 2023 | 14.44% |

| 2022 | 11.41% |

| 2021 | 121.79% |

| 2020 | -28.23% |

| 2019 | 41.18% |

GNK Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching GNK

Want to do more research on Genco Shipping & Trading Ltd's stock and its price? Try the links below:Genco Shipping & Trading Ltd (GNK) Stock Price | Nasdaq

Genco Shipping & Trading Ltd (GNK) Stock Quote, History and News - Yahoo Finance

Genco Shipping & Trading Ltd (GNK) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...