Golden Ocean Group Limited (GOGL): Price and Financial Metrics

GOGL Price/Volume Stats

| Current price | $12.48 | 52-week high | $15.77 |

| Prev. close | $12.54 | 52-week low | $6.89 |

| Day low | $12.35 | Volume | 1,357,600 |

| Day high | $12.61 | Avg. volume | 1,670,220 |

| 50-day MA | $13.72 | Dividend yield | 9.02% |

| 200-day MA | $11.51 | Market Cap | 2.49B |

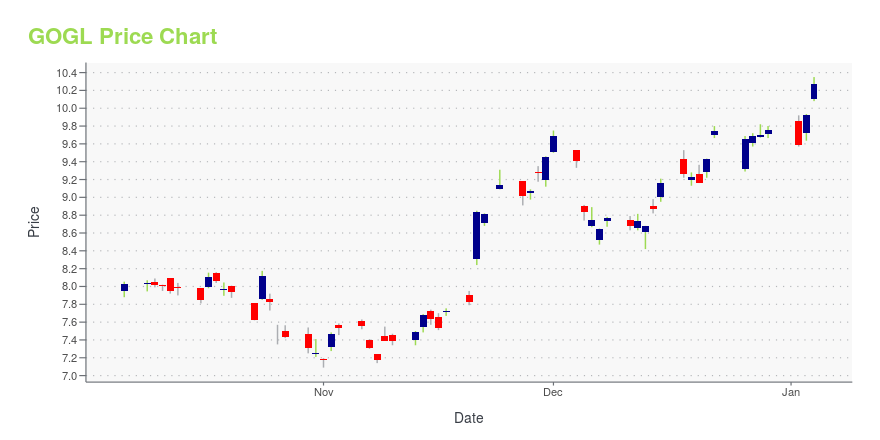

GOGL Stock Price Chart Interactive Chart >

Golden Ocean Group Limited (GOGL) Company Bio

Golden Ocean Group Limited engages in the transportation of dry bulk cargoes in the Capesize and Panamax markets. The company transports ores, coal, grains, and fertilizers along worldwide shipping routes. The company was founded in 2004 and is based in Hamilton, Bermuda.

Latest GOGL News From Around the Web

Below are the latest news stories about GOLDEN OCEAN GROUP LTD that investors may wish to consider to help them evaluate GOGL as an investment opportunity.

Should You Buy Golden Ocean Group (GOGL) After Golden Cross?Good things could be on the horizon when a stock experiences a golden cross event. How should investors react? |

Golden Ocean Group (GOGL) Forms 'Hammer Chart Pattern': Time for Bottom Fishing?Golden Ocean Group (GOGL) appears to have found support after losing some value lately, as indicated by the formation of a hammer chart. In addition to this technical chart pattern, strong agreement among Wall Street analysts in revising earnings estimates higher enhances the stock's potential for a turnaround in the near term. |

Wall Street Analysts Believe Golden Ocean Group (GOGL) Could Rally 25.2%: Here's is How to TradeThe consensus price target hints at a 25.2% upside potential for Golden Ocean Group (GOGL). While empirical research shows that this sought-after metric is hardly effective, an upward trend in earnings estimate revisions could mean that the stock will witness an upside in the near term. |

Is FedEx (FDX) Stock Outpacing Its Transportation Peers This Year?Here is how FedEx (FDX) and Golden Ocean Group (GOGL) have performed compared to their sector so far this year. |

13 Best Shipping and Container Stocks To BuyIn this article, we will take a look at the 13 best shipping and container stocks to buy. To skip our recent market trends and activity analysis, you can go directly to see the 5 Best Shipping and Container Stocks to Buy. The usually inconspicuous realm of shipping stocks gained prominence during the COVID-19 pandemic, […] |

GOGL Price Returns

| 1-mo | -9.04% |

| 3-mo | -9.20% |

| 6-mo | 21.49% |

| 1-year | 78.23% |

| 3-year | 107.70% |

| 5-year | 226.29% |

| YTD | 33.69% |

| 2023 | 18.86% |

| 2022 | 15.44% |

| 2021 | 135.47% |

| 2020 | -19.32% |

| 2019 | -0.15% |

GOGL Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching GOGL

Here are a few links from around the web to help you further your research on Golden Ocean Group Ltd's stock as an investment opportunity:Golden Ocean Group Ltd (GOGL) Stock Price | Nasdaq

Golden Ocean Group Ltd (GOGL) Stock Quote, History and News - Yahoo Finance

Golden Ocean Group Ltd (GOGL) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...