GeoVax Labs, Inc. (GOVX): Price and Financial Metrics

GOVX Price/Volume Stats

| Current price | $1.47 | 52-week high | $11.54 |

| Prev. close | $1.54 | 52-week low | $1.44 |

| Day low | $1.44 | Volume | 23,600 |

| Day high | $1.56 | Avg. volume | 37,169 |

| 50-day MA | $2.00 | Dividend yield | N/A |

| 200-day MA | $5.71 | Market Cap | 3.39M |

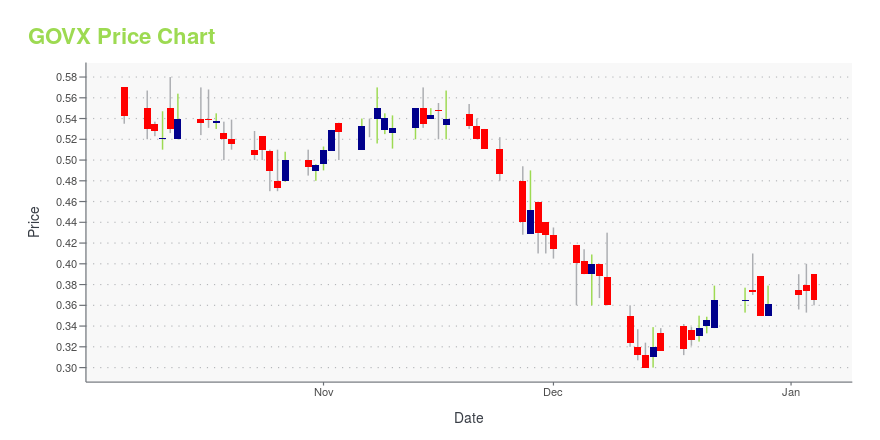

GOVX Stock Price Chart Interactive Chart >

GeoVax Labs, Inc. (GOVX) Company Bio

GeoVax Labs, Inc., a clinical-stage biotechnology company, develops human vaccines and immunotherapies against infectious diseases and cancers using modified vaccinia ankara virus-like particle vaccine platform in the United States and internationally. It is developing various preventive vaccines against coronavirus (COVID-19), human immunodeficiency virus (HIV); Zika virus; malaria; and hemorrhagic fever viruses, such as Ebola, Sudan, Marburg, and Lassa, as well as therapeutic vaccines for chronic Hepatitis B infections and cancers. The company has collaboration and partnership agreements with the National Institute of Allergy and Infectious Diseases of the National Institutes of Health; the HIV Vaccines Trial Network; Centers for Disease Control and Prevention; U.S. Department of Defense; U.S. Army Research Institute of Infectious Disease; U.S. Naval Research Laboratory; Emory University; University of Pittsburgh; Georgia State University Research Foundation; University of Texas Medical Branch; the Institute of Human Virology at the University of Maryland; the Scripps Research Institute; the Burnet Institute; American Gene Technologies International, Inc.; Viamune, Inc.; Vaxeal Holding SA; Virometix AG; Geneva Foundation; Enesi Pharma; UCSF; BravoVax; and Leidos, Inc. GeoVax Labs, Inc. was founded in 2001 and is based in Smyrna, Georgia.

Latest GOVX News From Around the Web

Below are the latest news stories about GEOVAX LABS INC that investors may wish to consider to help them evaluate GOVX as an investment opportunity.

GeoVax to Present at Biotech Showcase During J.P. Morgan Healthcare Week 2024ATLANTA, GA, Dec. 27, 2023 (GLOBE NEWSWIRE) -- via NewMediaWire - GeoVax Labs, Inc. (Nasdaq: GOVX), a biotechnology company developing immunotherapies and vaccines against cancers and infectious diseases, today announced that David Dodd, Chief Executive Officer, will present at the Biotech Showcase coinciding with the 42nd Annual J.P. Morgan Healthcare Conference in San Francisco, January 8-11, 2024. Presentation Details:Presenter: David Dodd, Chairman & CEODate/Time: January 8, 2023, 2:30 pm PS |

GeoVax Expands Rights Under NIH COVID-19 License to Include Mpox and SmallpoxATLANTA, GA, Dec. 19, 2023 (GLOBE NEWSWIRE) -- via NewMediaWire – GeoVax Labs, Inc. (Nasdaq: GOVX), a biotechnology company developing immunotherapies and vaccines against cancers and infectious diseases, today announced that it has amended a previously executed Patent and Biological Materials License Agreement (the “License Agreement”) with the National Institute of Allergy and Infectious Diseases (NIAID), part of the National Institutes of Health (NIH), in support of GeoVax’s development of a |

Presenting on the Emerging Growth Conference 65 Day 1 on December 6th Register NowMIAMI, Dec. 05, 2023 (GLOBE NEWSWIRE) -- EmergingGrowth.com a leading independent small cap media portal announces the schedule of the 65th Emerging Growth Conference on December 6th and 7th, 2023. The Emerging Growth Conference identifies companies in a wide range of growth sectors, with strong management teams, innovative products & services, focused strategy, execution, and the overall potential for long-term growth. Register for the Conference here. Submit Questions for any of the presenting |

GeoVax Hemorrhagic Fever Vaccine Data Presented at World Vaccine Congress80% Survival in Nonhuman Primates Observed in a Lethal Challenge Model ATLANTA, GA, Nov. 30, 2023 (GLOBE NEWSWIRE) -- via NewMediaWire – GeoVax Labs, Inc. (Nasdaq: GOVX), a biotechnology company developing immunotherapies and vaccines against cancers and infectious diseases, today announced the presentation of data from recent preclinical studies of its vaccine candidates against Marburg virus and Sudan virus. The data were presented during the World Vaccine Congress, West Coast conference, bein |

GeoVax to Participate in Upcoming December Investor EventsATLANTA, GA, Nov. 29, 2023 (GLOBE NEWSWIRE) -- via NewMediaWire – GeoVax Labs, Inc. (Nasdaq: GOVX), a biotechnology company developing immunotherapies and vaccines against cancers and infectious diseases, today announced that its senior management will participate in two upcoming investor events: NobleCon19, December 3-5, 2023, Boca Raton, FLDate/Time: December 4, 2023 at 10:00 a.m. ETPresentation Topic: Corporate Overview and UpdateSpeaker: David Dodd, Chairman & CEO Noble Capital Markets’ Nine |

GOVX Price Returns

| 1-mo | -20.54% |

| 3-mo | -65.43% |

| 6-mo | -80.40% |

| 1-year | -84.44% |

| 3-year | -98.02% |

| 5-year | -100.00% |

| YTD | -72.85% |

| 2023 | -42.72% |

| 2022 | -82.59% |

| 2021 | 7.10% |

| 2020 | -71.83% |

| 2019 | -100.00% |

Loading social stream, please wait...