GeoPark Ltd. (GPRK): Price and Financial Metrics

GPRK Price/Volume Stats

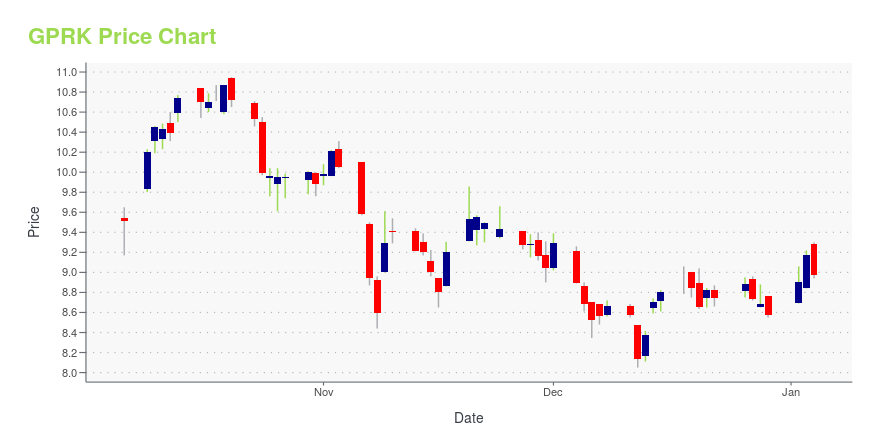

| Current price | $10.18 | 52-week high | $11.25 |

| Prev. close | $10.45 | 52-week low | $8.05 |

| Day low | $10.17 | Volume | 451,900 |

| Day high | $10.56 | Avg. volume | 424,662 |

| 50-day MA | $10.41 | Dividend yield | 5.94% |

| 200-day MA | $9.54 | Market Cap | 563.24M |

GPRK Stock Price Chart Interactive Chart >

GeoPark Ltd. (GPRK) Company Bio

GeoPark Limited engages in the exploration, development, and production of oil and gas reserves in Chile, Colombia, Brazil, and Argentina. The company was founded in 2002 and is based in Santiago, Chile.

Latest GPRK News From Around the Web

Below are the latest news stories about GEOPARK LTD that investors may wish to consider to help them evaluate GPRK as an investment opportunity.

New Chief Financial Officer AppointedBOGOTA, Colombia, December 20, 2023--GeoPark Limited ("GeoPark" or the "Company") (NYSE: GPRK), a leading independent Latin American oil and gas explorer, operator and consolidator, announces the appointment of a new Chief Financial Officer ("CFO") and provides an operating activity update in the Llanos 123 (GeoPark operated, 50% WI) and Llanos 87 (GeoPark operated, 50% WI) blocks in Colombia. |

GeoPark Limited (NYSE:GPRK) is largely controlled by institutional shareholders who own 52% of the companyKey Insights Significantly high institutional ownership implies GeoPark's stock price is sensitive to their trading... |

There's A Lot To Like About GeoPark's (NYSE:GPRK) Upcoming US$0.13 DividendGeoPark Limited ( NYSE:GPRK ) stock is about to trade ex-dividend in 4 days. Typically, the ex-dividend date is one... |

13 Cheap Energy Stocks To BuyIn this piece, we will take a look at the 13 cheap energy stocks to buy. If you want to skip our overview of the energy industry and some recent trends, then check out 5 Cheap Energy Stocks To Buy. Despite the global push towards renewable energy and emissions free vehicles, the global fossil fuel […] |

GeoPark's (NYSE:GPRK) Dividend Will Be Increased To $0.134GeoPark Limited's ( NYSE:GPRK ) dividend will be increasing from last year's payment of the same period to $0.134 on... |

GPRK Price Returns

| 1-mo | -8.21% |

| 3-mo | 6.57% |

| 6-mo | 12.06% |

| 1-year | 8.10% |

| 3-year | -2.82% |

| 5-year | -35.79% |

| YTD | 22.26% |

| 2023 | -41.47% |

| 2022 | 38.97% |

| 2021 | -10.98% |

| 2020 | -40.56% |

| 2019 | 60.27% |

GPRK Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching GPRK

Want to see what other sources are saying about GeoPark Ltd's financials and stock price? Try the links below:GeoPark Ltd (GPRK) Stock Price | Nasdaq

GeoPark Ltd (GPRK) Stock Quote, History and News - Yahoo Finance

GeoPark Ltd (GPRK) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...