Garmin Ltd. (GRMN): Price and Financial Metrics

GRMN Price/Volume Stats

| Current price | $177.94 | 52-week high | $178.51 |

| Prev. close | $173.40 | 52-week low | $99.61 |

| Day low | $173.79 | Volume | 1,059,469 |

| Day high | $178.51 | Avg. volume | 847,458 |

| 50-day MA | $165.29 | Dividend yield | 1.74% |

| 200-day MA | $139.17 | Market Cap | 34.18B |

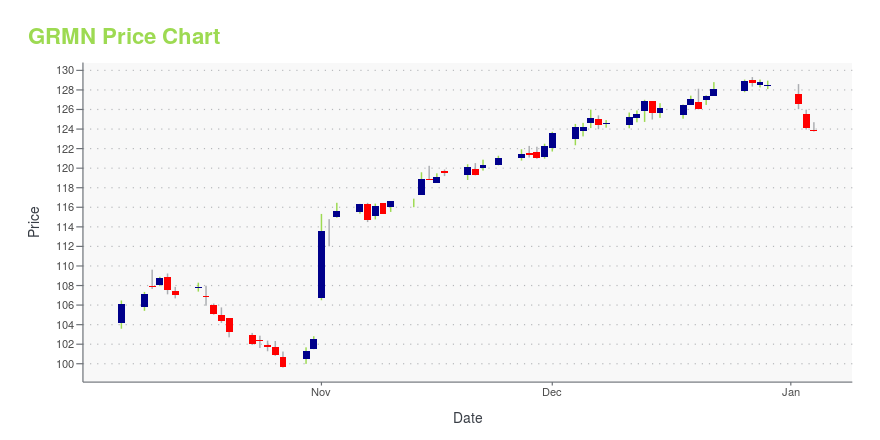

GRMN Stock Price Chart Interactive Chart >

Garmin Ltd. (GRMN) Company Bio

Garmin Ltd. (shortened to Garmin, stylized as GARMIN, and formerly known as ProNav) is an Swiss-domiciled multinational technology company founded in 1989 by Gary Burrell and Min Kao in Lenexa, Kansas, United States, with headquarters in Olathe, Kansas. Since 2010, the company is incorporated in Schaffhausen, Switzerland. (Source:Wikipedia)

Latest GRMN News From Around the Web

Below are the latest news stories about GARMIN LTD that investors may wish to consider to help them evaluate GRMN as an investment opportunity.

Burrell trust adopts Rule 10b5-1 stock disposition planGarmin Ltd. (NYSE: GRMN) today announced that a trust, of which Jonathan Burrell, son of the company's co-founder and a director of Garmin Ltd., is a co-trustee, has established a pre-arranged trading plan to sell a portion of the trust's shares in the company over a designated period. The plan was adopted in accordance with Rule 10b5-1 of the Securities Exchange Act of 1934 and the company's policy regarding stock transactions by insiders. |

Wearable Tech 2.0: 3 Companies Innovating Beyond the SmartwatchWhile the broader wearable technologies space has attracted legions of everyday consumers, smartwatch stocks deserve to be on your radar for one very simple reason: the massive total addressable market for innovations classified under wearable tech 2.0. |

Garmin unveils the Tacx NEO 3M: A powerful indoor smart trainer with multidirectional movementGarmin (NYSE: GRMN) today announced the Tacx® NEO 3M, its most accurate and powerful direct-drive trainer with multidirectional movement to take riding performance to the next level. The newest indoor smart trainer adds integrated motion plates to let cyclists enjoy a more comfortable and realistic ride. The Tacx NEO 3M also builds on its innovative electromagnetic motor braking system to deliver a virtual flywheel that allows cyclists to experience the feeling of riding on different road types |

The 3 Best Wearable Tech Stocks to Keep an Eye OnYou need to buy these wearable tech stocks now to allow your portfolio's value to skyrocket for the upcoming year. |

Garmin wins six CES 2024 Innovation AwardsGarmin (NYSE: GRMN) today announced that it received six CES® 2024 Innovation Awards, including a Best of Innovation honor, for outstanding design and engineering across a multitude of consumer technology product categories. The annual awards program, owned and produced by the Consumer Technology Associations (CTA)®, recognized the Venu® 3 advanced fitness and health smartwatch with three awards, along with the epix™ Pro, MARQ® Golfer—Carbon Edition and Garmin's Autoland Autonomous Aircraft Land |

GRMN Price Returns

| 1-mo | 10.41% |

| 3-mo | 24.63% |

| 6-mo | 44.03% |

| 1-year | 72.99% |

| 3-year | 26.18% |

| 5-year | 157.03% |

| YTD | 39.77% |

| 2023 | 43.12% |

| 2022 | -30.20% |

| 2021 | 15.90% |

| 2020 | 25.86% |

| 2019 | 58.13% |

GRMN Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching GRMN

Want to see what other sources are saying about Garmin Ltd's financials and stock price? Try the links below:Garmin Ltd (GRMN) Stock Price | Nasdaq

Garmin Ltd (GRMN) Stock Quote, History and News - Yahoo Finance

Garmin Ltd (GRMN) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...