Guangshen Railway Company Limited (GSH): Price and Financial Metrics

GSH Price/Volume Stats

| Current price | $9.19 | 52-week high | $17.25 |

| Prev. close | $9.17 | 52-week low | $8.07 |

| Day low | $9.12 | Volume | 23,300 |

| Day high | $9.23 | Avg. volume | 29,752 |

| 50-day MA | $8.76 | Dividend yield | 3.93% |

| 200-day MA | $9.99 | Market Cap | 1.30B |

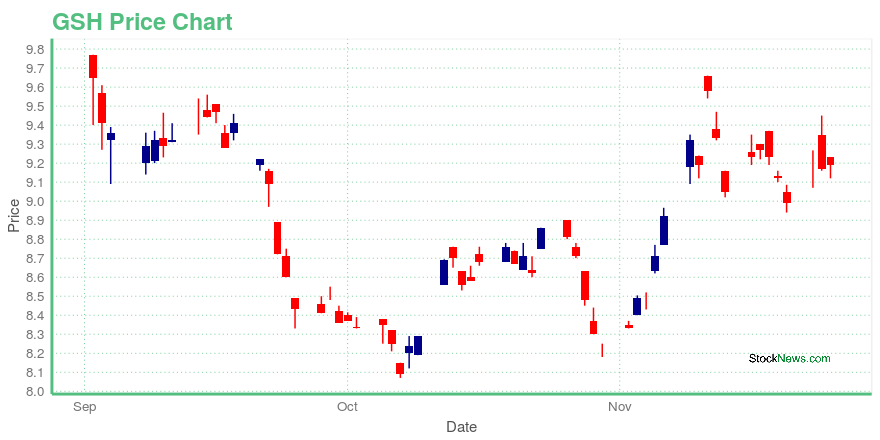

GSH Stock Price Chart Interactive Chart >

Guangshen Railway Company Limited (GSH) Company Bio

Guangshen Railway Company Limited engages in the railroad passenger and freight transportation business in the Peoples Republic of China. The company was founded in 1996 and is based in Shenzhen, China.

Latest GSH News From Around the Web

Below are the latest news stories about Guangshen Railway Co Ltd that investors may wish to consider to help them evaluate GSH as an investment opportunity.

Guangshen Railway Company goes ex-dividend tomorrowGuangshen Railway Company (GSH) had declared $0.361/share quarterly dividend.Payable Aug. 21; for shareholders of record June 29; ex-div June 26.See GSH Dividend Scorecard, Yield Chart, & Dividend Growth.... |

Here is What Hedge Funds Think About Guangshen Railway Co. Ltd (GSH)Concerns over rising interest rates and expected further rate increases have hit several stocks hard during the fourth quarter of 2018. Trends reversed 180 degrees in 2019 amid Powell's pivot and optimistic expectations towards a trade deal with China. Hedge funds and institutional investors tracked by Insider Monkey usually invest a disproportionate amount of their […] |

GSH Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | N/A |

| 3-year | N/A |

| 5-year | -43.53% |

| YTD | N/A |

| 2023 | N/A |

| 2022 | N/A |

| 2021 | N/A |

| 2020 | 0.00% |

| 2019 | -9.17% |

GSH Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching GSH

Want to see what other sources are saying about Guangshen Railway Co Ltd's financials and stock price? Try the links below:Guangshen Railway Co Ltd (GSH) Stock Price | Nasdaq

Guangshen Railway Co Ltd (GSH) Stock Quote, History and News - Yahoo Finance

Guangshen Railway Co Ltd (GSH) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...