GSK PLC ADR (GSK): Price and Financial Metrics

GSK Price/Volume Stats

| Current price | $39.86 | 52-week high | $45.92 |

| Prev. close | $39.07 | 52-week low | $33.67 |

| Day low | $39.58 | Volume | 3,064,130 |

| Day high | $40.12 | Avg. volume | 3,514,581 |

| 50-day MA | $41.01 | Dividend yield | 3.88% |

| 200-day MA | $39.75 | Market Cap | 82.61B |

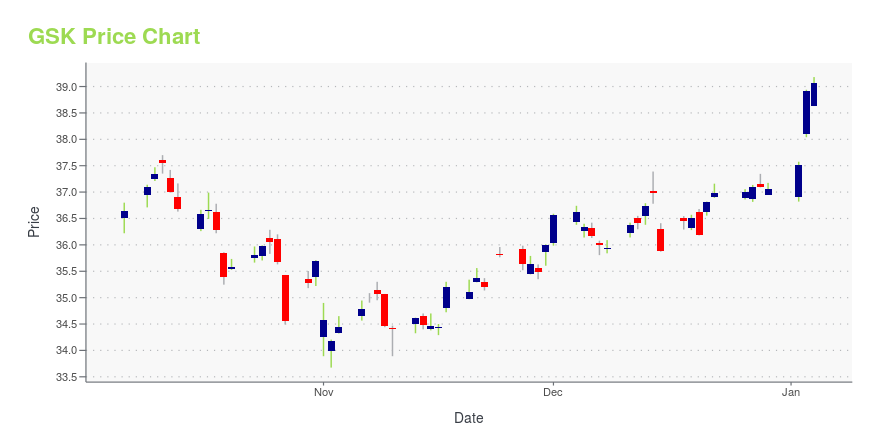

GSK Stock Price Chart Interactive Chart >

GSK PLC ADR (GSK) Company Bio

GSK plc, formerly GlaxoSmithKline plc, is a British multinational pharmaceutical and biotechnology company with global headquarters in London, England. Established in 2000 by a merger of Glaxo Wellcome and SmithKline Beecham. GSK is the tenth largest pharmaceutical company and #294 on the 2022 Fortune Global 500, ranked behind other pharmaceutical companies China Resources, Sinopharm, Johnson & Johnson, Pfizer, Roche, AbbVie, Novartis, Bayer, and Merck. (Source:Wikipedia)

Latest GSK News From Around the Web

Below are the latest news stories about GSK PLC that investors may wish to consider to help them evaluate GSK as an investment opportunity.

15 Undervalued Defensive Stocks For 2024In this article, we discuss the 15 undervalued defensive stocks for 2024. To skip the detailed overview of the market and defensive stocks, go directly to the 5 Undervalued Defensive Stocks For 2024. Defensive stocks are shares of companies that remain relatively stable during economic downturns as opposed to cyclical stocks. Defensive stocks usually outperform […] |

3 Growth at a Reasonable Price (GARP) Stocks for Balanced GrowthGARP stocks are less likely to plunge than growth stocks with high valuations and more likely to generate strong growth than value stocks. |

GSK to cut US prices for Advair, Valtrex and LamictalThe price cuts come after several companies have already announced price decreases for insulins earlier this year as they worked to avoid potential penalties under 2021's American Rescue Plan Act if they had kept prices high. Under the law, drug companies are required to rebate the Medicaid program if price increases on medicines outpace inflation - and beginning in January 2024 those rebates could even be larger than the actual net cost of the drug. According to a GSK spokesman, the company plans to cut list prices by up to 70% on Advair, up to 48% on Lamictal and 10% for Valtrex. |

Sunak hosts bosses for Business Council gatheringThe group agreed there could be more economic growth and dynamism next year, Downing Street said. |

3 Machine Learning Stocks to Turn $10,000 Into $1 Million: December 2023Machine learning stocks are ones to watch to unlock value from your portfolio. |

GSK Price Returns

| 1-mo | 2.55% |

| 3-mo | -2.23% |

| 6-mo | 3.85% |

| 1-year | 15.38% |

| 3-year | 14.29% |

| 5-year | 19.34% |

| YTD | 9.49% |

| 2023 | 9.66% |

| 2022 | -16.73% |

| 2021 | 26.64% |

| 2020 | -17.79% |

| 2019 | 29.12% |

GSK Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching GSK

Here are a few links from around the web to help you further your research on Glaxosmithkline Plc's stock as an investment opportunity:Glaxosmithkline Plc (GSK) Stock Price | Nasdaq

Glaxosmithkline Plc (GSK) Stock Quote, History and News - Yahoo Finance

Glaxosmithkline Plc (GSK) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...