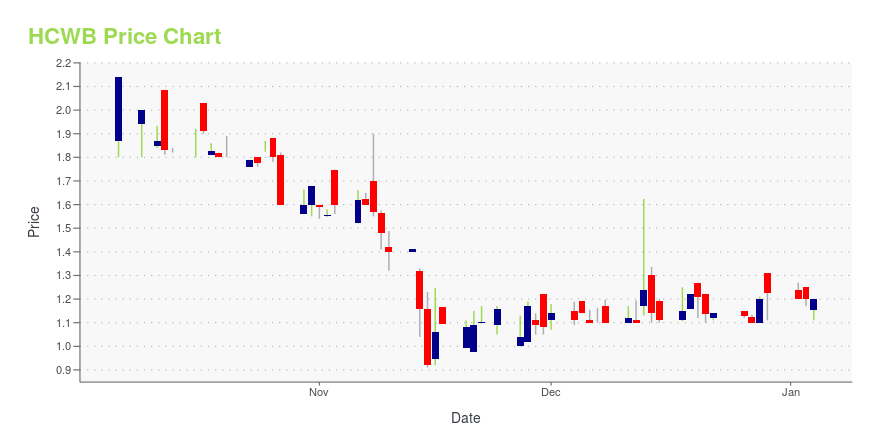

HCW Biologics Inc. (HCWB): Price and Financial Metrics

HCWB Price/Volume Stats

| Current price | $1.46 | 52-week high | $2.32 |

| Prev. close | $1.50 | 52-week low | $0.91 |

| Day low | $1.45 | Volume | 2,700 |

| Day high | $1.53 | Avg. volume | 15,010 |

| 50-day MA | $1.52 | Dividend yield | N/A |

| 200-day MA | $1.60 | Market Cap | 55.22M |

HCWB Stock Price Chart Interactive Chart >

HCW Biologics Inc. (HCWB) Company Bio

HCW Biologics Inc., a clinical stage biopharmaceutical company, focuses on discovering and developing novel immunotherapies for chronic, low-grade inflammation and age-related diseases. The company is involved in developing HCW9201, a cell-based therapy that is in Phase II clinical trials for the treatment of patients with relapsed/refractory acute myeloid leukemia; and HCW9206 for the treatment of acute myeloid leukemia. It is also developing HCW9218 as an injectable immunotherapeutic for patients with pancreatic, breast, ovarian, colorectal, and prostate cancers, as well as pulmonary fibrosis; and HCW9302 for auto-immune diseases, such as alopecia areata. The company was incorporated in 2018 and is headquartered in Miramar, Florida.

Latest HCWB News From Around the Web

Below are the latest news stories about HCW BIOLOGICS INC that investors may wish to consider to help them evaluate HCWB as an investment opportunity.

HCW Biologics Reports Third Quarter 2023 Financial Results And Recent Business HighlightsMIRAMAR, Fla., Nov. 14, 2023 (GLOBE NEWSWIRE) -- HCW Biologics Inc. (the “Company” or “HCW Biologics”) (NASDAQ: HCWB), a clinical-stage biopharmaceutical company focused on discovering and developing novel immunotherapies to lengthen healthspan by disrupting the link between inflammation and age-related diseases, today reported financial results and recent business highlights for its third quarter ended September 30, 2023. A human data readout from the ongoing Phase 1 clinical trial to evaluate |

Investigator Sponsor of HCW Biologics’ Phase 1 Clinical Trial Presented Human Data Readout and Anti-Cancer Mechanism of Action of HCW9218 at 38th SITC Annual MeetingShowed HCW9218 clinical safety and tumor response endpointsfor 15 patients with heavily pretreated advanced solid tumors Results in ovarian cancer patients outpace other indications, with 66% stable disease MIRAMAR, Fla., Nov. 08, 2023 (GLOBE NEWSWIRE) -- HCW Biologics Inc. (the “Company” or “HCW Biologics”) (NASDAQ: HCWB), a clinical-stage biopharmaceutical company focused on discovering and developing novel immunotherapies to lengthen healthspan by disrupting the link between inflammation and |

Masonic Cancer Center, University of Minnesota to Present Data in Poster Presentation Human Data Readout for Phase 1 Study to Evaluate HCW9218 in Solid Tumors at SITC 38th Annual MeetingHCW9218 is the lead product candidate of HCW Biologics Inc.MIRAMAR, Fla., Nov. 01, 2023 (GLOBE NEWSWIRE) -- HCW Biologics Inc. (the “Company” or “HCW Biologics”) (NASDAQ: HCWB), a clinical-stage biopharmaceutical company focused on discovering and developing novel immunotherapies to lengthen healthspan by disrupting the link between inflammation and age-related diseases, will have a human data readout at the 38th Annual Meeting of the Society for Immunotherapy of Cancer (“SITC”) from an ongoing |

Insider Buying: CFO Rebecca Byam Acquires 5,000 Shares of HCW Biologics IncOn September 13, 2023, Rebecca Byam, the Chief Financial Officer (CFO) of HCW Biologics Inc (NASDAQ:HCWB), made a significant insider purchase of 5,000 shares of the company's stock. |

Insider Buying: CFO Rebecca Byam Acquires 10,000 Shares of HCW Biologics IncOn September 12, 2023, Rebecca Byam, the Chief Financial Officer (CFO) of HCW Biologics Inc (NASDAQ:HCWB), made a significant insider purchase of 10,000 shares of the company's stock. |

HCWB Price Returns

| 1-mo | -17.05% |

| 3-mo | 32.73% |

| 6-mo | -8.75% |

| 1-year | 4.51% |

| 3-year | N/A |

| 5-year | N/A |

| YTD | 19.18% |

| 2023 | -36.02% |

| 2022 | -17.47% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...