Hollysys Automation Technologies, Ltd. (HOLI): Price and Financial Metrics

HOLI Price/Volume Stats

| Current price | $26.42 | 52-week high | $27.25 |

| Prev. close | $26.41 | 52-week low | $16.25 |

| Day low | $26.40 | Volume | 3,281,400 |

| Day high | $26.44 | Avg. volume | 642,693 |

| 50-day MA | $23.24 | Dividend yield | N/A |

| 200-day MA | $24.01 | Market Cap | 1.64B |

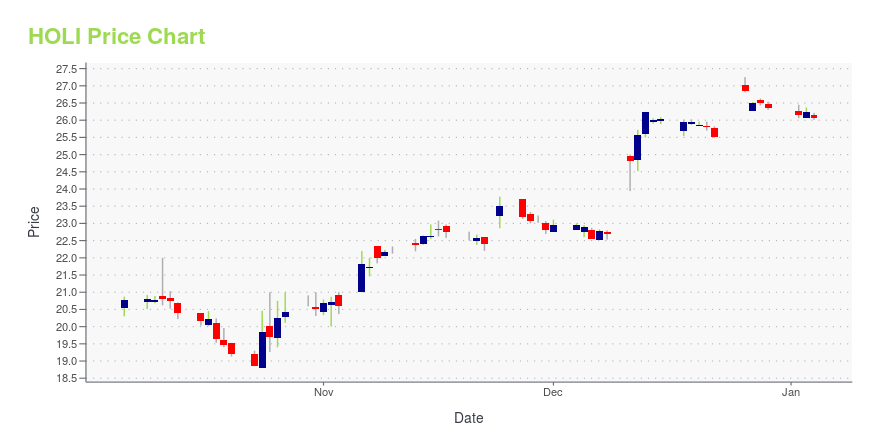

HOLI Stock Price Chart Interactive Chart >

Hollysys Automation Technologies, Ltd. (HOLI) Company Bio

HollySys Automation Technologies Ltd. provides automation and control technologies and products to customers in industrial, railway, subway, nuclear power, building retrofit, and mechanical and electronic industries primarily in China, Hong Kong, Southeast Asia, and the Middle East. The company was founded in 1993 and is based in Beijing, China.

Latest HOLI News From Around the Web

Below are the latest news stories about HOLLYSYS AUTOMATION TECHNOLOGIES LTD that investors may wish to consider to help them evaluate HOLI as an investment opportunity.

Hollysys Announces End of "Go-Shop" Period under Merger Agreement with Ascendent Capital PartnersHollysys Automation Technologies Ltd. (NASDAQ: HOLI) ("Hollysys" or the "Company") today announced the end of the "go-shop" period as provided for in the merger agreement with funds managed by Ascendent Capital Partners ("Ascendent"). The "go-shop" period followed an extensive, competitive process by the Company that led to the signing of the merger agreement with Ascendent. |

UPDATE 1-Dazheng Group consortium announces bid to buy Hollysys Automation for $1.8 billionA consortium led by China's Dazheng Group Acquisition has announced a bid to acquire automation and control technology provider Hollysys Automation Technologies in an all-cash transaction valued at $1.8 billion, according to a statement on Sunday. The consortium, which includes TFI Asset Management and GA Technologies, said it would acquire all outstanding shares of Hollysys it does not already own for $29 per share in cash. In August, a consortium led by Recco Control Technology and Dazheng Group made an all-cash offer of $25 per share to buy the company. |

Dazheng Group consortium announces bid to buy Hollysys Automation for $1.8 billionThe consortium, which includes TFI Asset Management and GA Technologies, said it would acquire all outstanding shares of Hollysys it does not already own for $29 per share in cash. In August, a consortium led by Recco Control Technology and Dazheng Group made an all-cash offer of $25 per share to buy the company. |

M&A Opportunities: 3 Automation Stocks Set for Big MovesThe ongoing growth in artificial intelligence use should see automation stocks get their fair share of M&A attention in 2024. |

Hollysys to be Acquired by Ascendent Capital Partners for US$26.50 in Cash Per ShareHollysys Automation Technologies Ltd. (NASDAQ: HOLI) ("Hollysys" or the "Company") today announced that it has reached an agreement to be acquired by Ascendent Capital Partners ("Ascendent"), an international private investment firm headquartered in Hong Kong. The acquisition, which concludes a months-long sale process, will be completed through an all-cash transaction valued at approximately US$1.66bn. |

HOLI Price Returns

| 1-mo | 23.17% |

| 3-mo | 7.62% |

| 6-mo | 4.06% |

| 1-year | 54.23% |

| 3-year | 82.29% |

| 5-year | 55.11% |

| YTD | 0.27% |

| 2023 | 60.38% |

| 2022 | 19.08% |

| 2021 | -4.15% |

| 2020 | -8.99% |

| 2019 | -4.91% |

Continue Researching HOLI

Want to see what other sources are saying about Hollysys Automation Technologies Ltd's financials and stock price? Try the links below:Hollysys Automation Technologies Ltd (HOLI) Stock Price | Nasdaq

Hollysys Automation Technologies Ltd (HOLI) Stock Quote, History and News - Yahoo Finance

Hollysys Automation Technologies Ltd (HOLI) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...