Home BancShares, Inc. - common stock (HOMB): Price and Financial Metrics

HOMB Price/Volume Stats

| Current price | $28.56 | 52-week high | $28.82 |

| Prev. close | $28.33 | 52-week low | $19.61 |

| Day low | $28.21 | Volume | 1,217,716 |

| Day high | $28.82 | Avg. volume | 1,000,685 |

| 50-day MA | $24.34 | Dividend yield | 2.57% |

| 200-day MA | $23.58 | Market Cap | 5.72B |

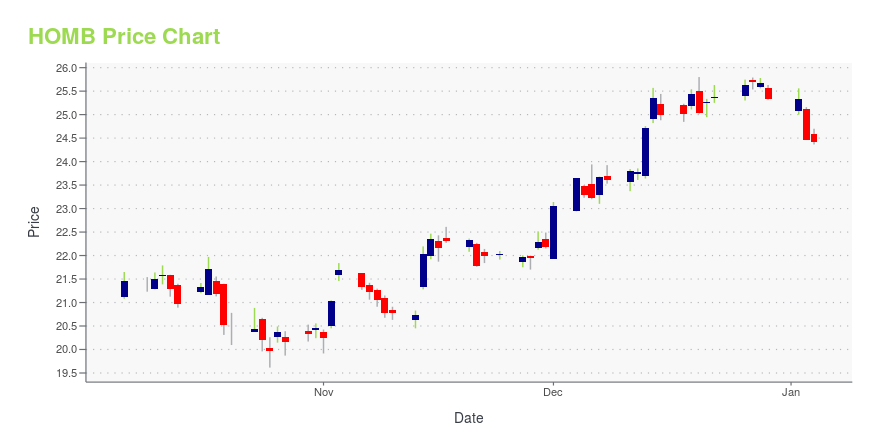

HOMB Stock Price Chart Interactive Chart >

Home BancShares, Inc. - common stock (HOMB) Company Bio

Home Bancshares provides commercial and retail banking, and related financial services to businesses, real estate developers and investors, individuals, and municipalities in Arkansas, Florida, and Alabama. The company was founded in 1998 and is based in Conway, Arkansas.

Latest HOMB News From Around the Web

Below are the latest news stories about HOME BANCSHARES INC that investors may wish to consider to help them evaluate HOMB as an investment opportunity.

Home BancShares, Inc. to Participate in Fireside Chat at Stephens Annual Investment ConferenceCONWAY, Ark., Nov. 07, 2023 (GLOBE NEWSWIRE) -- Home BancShares, Inc. (NYSE: HOMB) (“Home” or “the Company”), and its wholly-owned subsidiary, Centennial Bank (“Centennial”), announced that it would participate in a Fireside Chat during the Stephens Annual Investment Conference being held November 14, 2023. The Company will present at 9:00 a.m. CT (10:00 a.m. ET), on Tuesday, November 14, 2023. The Fireside Chat can be accessed live using the following link: https://wsw.com/webcast/stph34/homb/1 |

Home BancShares, Inc. Announces Fourth Quarter Cash DividendCONWAY, Ark., Oct. 25, 2023 (GLOBE NEWSWIRE) -- Home BancShares, Inc. (NYSE: HOMB), parent company of Centennial Bank, today announced that its Board of Directors has declared a regular $0.18 per share quarterly cash dividend payable December 6, 2023, to shareholders of record November 15, 2023. This cash dividend represents a $0.015 per share, or 9.1%, increase over the $0.165 cash dividend paid during the fourth quarter of 2022. Home BancShares, Inc. is a bank holding company, headquartered in |

HOMB on Track for $400 Million YearCONWAY, Ark., Oct. 19, 2023 (GLOBE NEWSWIRE) -- Home BancShares, Inc. (NYSE: HOMB) (“Home” or the “Company”), parent company of Centennial Bank, released quarterly earnings today. Highlights of the Third Quarter of 2023: MetricQ3 2023Q2 2023Q1 2023Q4 2022Q3 2022Net income$98.5 million$105.3 million$103.0 million$115.7 million$108.7 millionTotal revenue (net)$245.4 million$257.2 million$248.8 million$272.3 million$256.3 millionIncome before income taxes$129.3 million$136.9 million$132.9 million$1 |

Home BancShares, Inc. Announces Third Quarter Earnings Release Date and Conference CallCONWAY, Ark., Sept. 19, 2023 (GLOBE NEWSWIRE) -- Home BancShares, Inc. (NYSE: HOMB), parent company of Centennial Bank, today announced it expects to release Third Quarter 2023 earnings before the market opens on October 19, 2023. Following this release, management will conduct a conference call to review these earnings at 1:00 p.m. CT (2:00 p.m. ET) on Thursday, October 19, 2023. We strongly encourage all participants to pre-register for the conference call webcast or the live call using one of |

Home BancShares, Inc. Announces Third Quarter Cash DividendCONWAY, Ark., July 26, 2023 (GLOBE NEWSWIRE) -- Home BancShares, Inc. (NYSE: HOMB), parent company of Centennial Bank, today announced that its Board of Directors has declared a regular $0.18 per share quarterly cash dividend payable September 6, 2023, to shareholders of record August 16, 2023. This cash dividend represents a $0.015 per share, or 9.1%, increase over the $0.165 cash dividend paid during the third quarter of 2022. Home BancShares, Inc. is a bank holding company, headquartered in C |

HOMB Price Returns

| 1-mo | 22.26% |

| 3-mo | 17.81% |

| 6-mo | 17.64% |

| 1-year | 22.52% |

| 3-year | 46.26% |

| 5-year | 66.33% |

| YTD | 14.44% |

| 2023 | 14.82% |

| 2022 | -3.73% |

| 2021 | 27.89% |

| 2020 | 2.30% |

| 2019 | 23.70% |

HOMB Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching HOMB

Want to see what other sources are saying about Home Bancshares Inc's financials and stock price? Try the links below:Home Bancshares Inc (HOMB) Stock Price | Nasdaq

Home Bancshares Inc (HOMB) Stock Quote, History and News - Yahoo Finance

Home Bancshares Inc (HOMB) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...