Honeywell International Inc. (HON): Price and Financial Metrics

HON Price/Volume Stats

| Current price | $202.74 | 52-week high | $220.79 |

| Prev. close | $202.45 | 52-week low | $174.88 |

| Day low | $198.24 | Volume | 7,452,391 |

| Day high | $207.80 | Avg. volume | 2,909,416 |

| 50-day MA | $209.80 | Dividend yield | 1.99% |

| 200-day MA | $199.57 | Market Cap | 132.02B |

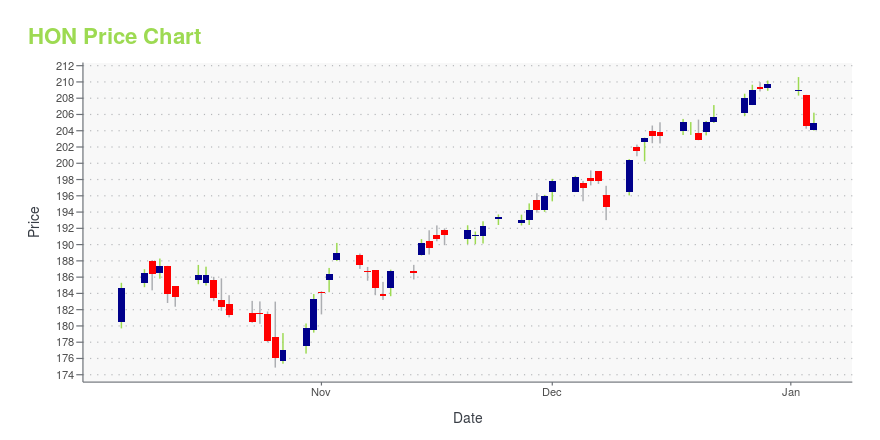

HON Stock Price Chart Interactive Chart >

Honeywell International Inc. (HON) Company Bio

Honeywell provides aerospace products and services, control, sensing and security technologies, turbochargers, automotive products, specialty chemicals, electronic and advanced materials, process technology for refining and petrochemicals, and energy efficient products and solutions. The company was founded in 1920 and is based in Morris Township, New Jersey.

Latest HON News From Around the Web

Below are the latest news stories about HONEYWELL INTERNATIONAL INC that investors may wish to consider to help them evaluate HON as an investment opportunity.

The 3 Best Industrial Stocks to Buy for 2024Industrial stocks present value despite short-term challenges. |

Honeywell International Inc. (HON) Stock Moves -0.83%: What You Should KnowHoneywell International Inc. (HON) concluded the recent trading session at $202.90, signifying a -0.83% move from its prior day's close. |

Innovative Solutions and Support Inc (ISSC) Reports Strong Q4 and Full Year Fiscal 2023 ResultsRevenue and Net Income Surge Following Honeywell Product Line Acquisition |

14 Most Profitable Industrial Stocks NowIn this piece, we will take a look at the 14 most profitable industrial stocks to buy now. If you want to skip our overview of the industrial sector and some recent developments, then take a look at 5 Most Profitable Industrial Stocks Now. The industrial sector plays a fundamental role in the U.S. economy, […] |

Honeywell: Steady EPS Growth Expected, Shares Modestly Undervalued Following Acquisition NewsThe industrials sector is mixed with winners and losers in 2023, and a recent M&A announcement put Honeywell in the spotlight |

HON Price Returns

| 1-mo | -5.01% |

| 3-mo | 5.36% |

| 6-mo | 1.55% |

| 1-year | 5.53% |

| 3-year | -5.96% |

| 5-year | 30.10% |

| YTD | -2.28% |

| 2023 | 0.02% |

| 2022 | 5.42% |

| 2021 | -0.29% |

| 2020 | 22.97% |

| 2019 | 36.70% |

HON Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching HON

Want to do more research on Honeywell International Inc's stock and its price? Try the links below:Honeywell International Inc (HON) Stock Price | Nasdaq

Honeywell International Inc (HON) Stock Quote, History and News - Yahoo Finance

Honeywell International Inc (HON) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...