Hope Bancorp, Inc. (HOPE): Price and Financial Metrics

HOPE Price/Volume Stats

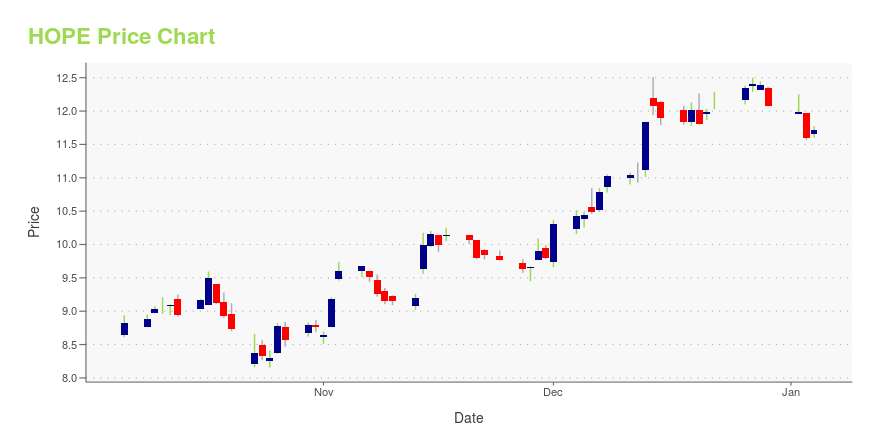

| Current price | $13.52 | 52-week high | $13.55 |

| Prev. close | $13.23 | 52-week low | $8.15 |

| Day low | $13.22 | Volume | 994,900 |

| Day high | $13.55 | Avg. volume | 722,434 |

| 50-day MA | $10.91 | Dividend yield | 4.26% |

| 200-day MA | $10.74 | Market Cap | 1.63B |

HOPE Stock Price Chart Interactive Chart >

Hope Bancorp, Inc. (HOPE) Company Bio

Hope Bancorp, Inc. operates as the bank holding company for Bank of Hope that provides commercial banking services primarily to small- to medium-sized businesses and individuals in the United States. The company was formerly known as BBCN Bancorp, Inc. and changed its name to Hope Bancorp, Inc. in August 2016. Hope Bancorp, Inc. is based in Los Angeles, California.

Latest HOPE News From Around the Web

Below are the latest news stories about HOPE BANCORP INC that investors may wish to consider to help them evaluate HOPE as an investment opportunity.

Is Hope Bancorp (HOPE) Stock Undervalued Right Now?Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks. |

Those who invested in Hope Bancorp (NASDAQ:HOPE) three years ago are up 28%Buying a low-cost index fund will get you the average market return. But across the board there are plenty of stocks... |

Is It Smart To Buy Hope Bancorp, Inc. (NASDAQ:HOPE) Before It Goes Ex-Dividend?Readers hoping to buy Hope Bancorp, Inc. ( NASDAQ:HOPE ) for its dividend will need to make their move shortly, as the... |

Hope Bancorp (NASDAQ:HOPE) Is Paying Out A Dividend Of $0.14The board of Hope Bancorp, Inc. ( NASDAQ:HOPE ) has announced that it will pay a dividend of $0.14 per share on the... |

Hope Bancorp, Inc. (NASDAQ:HOPE) Q3 2023 Earnings Call TranscriptHope Bancorp, Inc. (NASDAQ:HOPE) Q3 2023 Earnings Call Transcript October 23, 2023 Hope Bancorp, Inc. misses on earnings expectations. Reported EPS is $0.25 EPS, expectations were $0.26. Operator: Good day, and welcome to the Hope Bancorp’s 2023 Third Quarter Earnings Conference Call. All participants will be in listen-only mode. [Operator Instructions] After today’s presentation, there […] |

HOPE Price Returns

| 1-mo | 30.63% |

| 3-mo | 24.99% |

| 6-mo | 17.34% |

| 1-year | 34.34% |

| 3-year | 17.22% |

| 5-year | 16.56% |

| YTD | 14.91% |

| 2023 | -0.10% |

| 2022 | -9.57% |

| 2021 | 40.48% |

| 2020 | -22.02% |

| 2019 | 30.29% |

HOPE Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching HOPE

Want to do more research on Hope Bancorp Inc's stock and its price? Try the links below:Hope Bancorp Inc (HOPE) Stock Price | Nasdaq

Hope Bancorp Inc (HOPE) Stock Quote, History and News - Yahoo Finance

Hope Bancorp Inc (HOPE) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...