Helmerich & Payne, Inc. (HP): Price and Financial Metrics

HP Price/Volume Stats

| Current price | $40.09 | 52-week high | $46.55 |

| Prev. close | $41.06 | 52-week low | $32.17 |

| Day low | $39.22 | Volume | 3,217,300 |

| Day high | $41.88 | Avg. volume | 1,281,224 |

| 50-day MA | $36.66 | Dividend yield | 2.65% |

| 200-day MA | $38.24 | Market Cap | 3.96B |

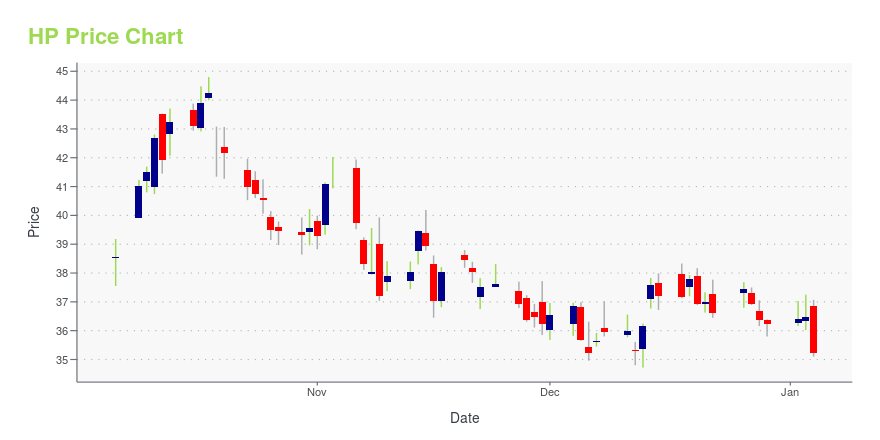

HP Stock Price Chart Interactive Chart >

Helmerich & Payne, Inc. (HP) Company Bio

Helmerich & Payne operates as a contract drilling company in South America, the Middle East, and Africa. It provides drilling rigs, equipment, personnel, and camps on a contract basis to explore for and develop oil and gas from onshore areas and fixed platforms, tension-leg platforms, and spars in offshore areas. The company was founded in 1920 and is based in Tulsa, Oklahoma.

Latest HP News From Around the Web

Below are the latest news stories about HELMERICH & PAYNE INC that investors may wish to consider to help them evaluate HP as an investment opportunity.

Helmerich & Payne (HP) Benefitted from Higher Oil PricesHarding Loevner, an asset management company, released its “Global Small Companies Equity Strategy” third-quarter 2023 investor letter. A copy of the same can be downloaded here. Global small caps fell sharply in the third quarter. Japan was the weakest region, although returns in healthcare were good and industrials detracted. The strategy returned -5.36% (net) compared to […] |

Pinning Down Helmerich & Payne, Inc.'s (NYSE:HP) P/S Is Difficult Right NowThere wouldn't be many who think Helmerich & Payne, Inc.'s ( NYSE:HP ) price-to-sales (or "P/S") ratio of 1.3x is worth... |

Helmerich & Payne, Inc. Announces Release of its 2023 Sustainability ReportTULSA, Okla., December 13, 2023--Helmerich & Payne, Inc. (NYSE:HP) (H&P or the Company) today announced that it has released its 2023 Sustainability Report outlining the Company’s sustainability efforts and performance for its fiscal year ended September 30, 2023. |

Buying Devon on the Dip? Here's a Better High-Yield Oil Stock to Buy First.Sometimes you can win with the producers, but the pick-and-shovel companies often make for much better investments. |

Beyond Occidental Petroleum: 3 Energy Stocks Taking the World by StormOccidental Petroleum (NYSE: OXY) has become one of the more popular stocks in the energy sector. Warren Buffett has a lot to do with its popularity. Helmerich & Payne (NYSE: HP), Brookfield Renewable (NYSE: BEPC)(NYSE: BEP), and EnLink (NYSE: ENLC) currently stand out to a few Fool.com contributors as even better investment opportunities. |

HP Price Returns

| 1-mo | 13.89% |

| 3-mo | 0.35% |

| 6-mo | 13.78% |

| 1-year | -6.03% |

| 3-year | 53.70% |

| 5-year | 8.22% |

| YTD | 13.15% |

| 2023 | -23.21% |

| 2022 | 115.23% |

| 2021 | 6.19% |

| 2020 | -44.28% |

| 2019 | 0.49% |

HP Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching HP

Here are a few links from around the web to help you further your research on Helmerich & Payne Inc's stock as an investment opportunity:Helmerich & Payne Inc (HP) Stock Price | Nasdaq

Helmerich & Payne Inc (HP) Stock Quote, History and News - Yahoo Finance

Helmerich & Payne Inc (HP) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...