Hurco Companies, Inc. (HURC): Price and Financial Metrics

HURC Price/Volume Stats

| Current price | $18.14 | 52-week high | $28.20 |

| Prev. close | $17.44 | 52-week low | $14.82 |

| Day low | $17.44 | Volume | 8,406 |

| Day high | $18.14 | Avg. volume | 26,483 |

| 50-day MA | $16.87 | Dividend yield | 3.67% |

| 200-day MA | $20.31 | Market Cap | 118.33M |

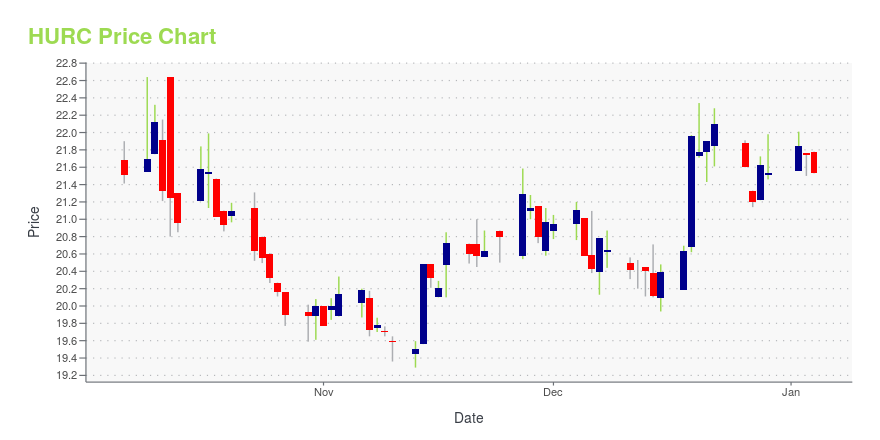

HURC Stock Price Chart Interactive Chart >

Hurco Companies, Inc. (HURC) Company Bio

Hurco Cos., Inc. is an international industrial technology company, which engages in the designing, manufacturing and selling of computerized machine tools. It also offers machine tool components, software options, control upgrades, and accessories and replacement parts for its products, as well as customer service and training and applications support. The company was founded by Edward Humston and Gerald V. Roch in 1968 and is headquartered in Indianapolis, IN.

Latest HURC News From Around the Web

Below are the latest news stories about HURCO COMPANIES INC that investors may wish to consider to help them evaluate HURC as an investment opportunity.

With 58% ownership of the shares, Hurco Companies, Inc. (NASDAQ:HURC) is heavily dominated by institutional ownersKey Insights Institutions' substantial holdings in Hurco Companies implies that they have significant influence over... |

Hurco Companies, Inc. Announces Quarterly Cash DividendINDIANAPOLIS, Nov. 10, 2023 (GLOBE NEWSWIRE) -- Hurco Companies, Inc. (Nasdaq Global Select Market: HURC), an international industrial technology company, announced today that its Board of Directors approved the payment of a cash dividend of $0.16 per share on its issued and outstanding common stock. The dividend will be paid on January 16, 2024, to shareholders of record as of the close of business on January 2, 2024. Future declarations of dividends are subject to approval of the Board of Dire |

Hurco Companies (NASDAQ:HURC) investors are sitting on a loss of 44% if they invested five years agoThe main aim of stock picking is to find the market-beating stocks. But in any portfolio, there will be mixed results... |

Unveiling the Dividend Profile of Hurco Companies IncHurco Companies Inc(NASDAQ:HURC) recently announced a dividend of $0.16 per share, payable on 2023-10-16, with the ex-dividend date set for 2023-09-29. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's deep dive into Hurco Companies Incs dividend performance and assess its sustainability. |

Michael Doar Bought 5.3% More Shares In Hurco CompaniesPotential Hurco Companies, Inc. ( NASDAQ:HURC ) shareholders may wish to note that the Executive Chairman, Michael... |

HURC Price Returns

| 1-mo | 16.28% |

| 3-mo | -1.79% |

| 6-mo | -23.48% |

| 1-year | -17.50% |

| 3-year | -42.97% |

| 5-year | -42.08% |

| YTD | -15.06% |

| 2023 | -15.21% |

| 2022 | -9.98% |

| 2021 | 1.20% |

| 2020 | -20.69% |

| 2019 | 9.22% |

HURC Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching HURC

Want to see what other sources are saying about Hurco Companies Inc's financials and stock price? Try the links below:Hurco Companies Inc (HURC) Stock Price | Nasdaq

Hurco Companies Inc (HURC) Stock Quote, History and News - Yahoo Finance

Hurco Companies Inc (HURC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...