ImmuCell Corporation (ICCC): Price and Financial Metrics

ICCC Price/Volume Stats

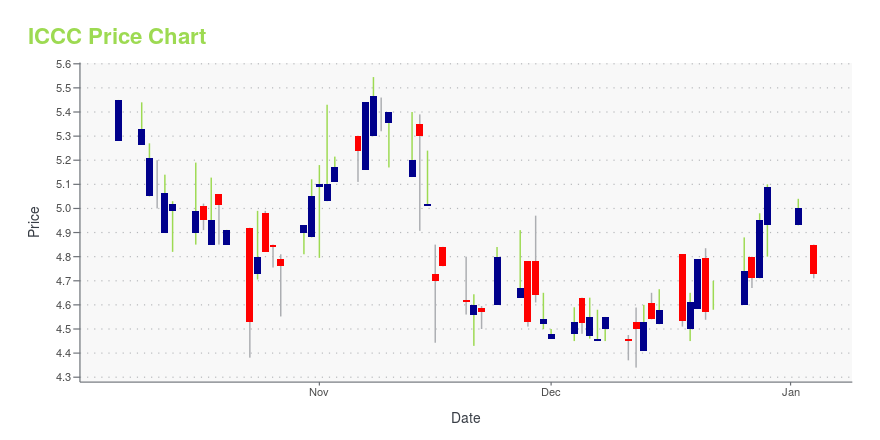

| Current price | $5.14 | 52-week high | $6.05 |

| Prev. close | $5.10 | 52-week low | $4.26 |

| Day low | $5.10 | Volume | 1,700 |

| Day high | $5.14 | Avg. volume | 7,570 |

| 50-day MA | $5.15 | Dividend yield | N/A |

| 200-day MA | $5.04 | Market Cap | 39.84M |

ICCC Stock Price Chart Interactive Chart >

ImmuCell Corporation (ICCC) Company Bio

ImmuCell Corporation, an animal health company, acquires, develops, manufactures, and sells products that enhance the health and productivity of dairy and beef cattle in the United States and internationally. It offers First Defense, an orally delivered scours preventive product for calves; and Tri-Shield First Defense, a passive antibody product for the treatment of E. coli, coronavirus, and rotavirus. The company also provides California Mastitis Test that is used to detect somatic cell counts in milk, as well as to determine, which quarter of the udder is mastitic; and Dual-Force First Defense, including a whey protein concentrate for the nutritional and feed supplement markets. In addition, it is involved in developing Re-Tain, a Nisin-based intramammary treatment of subclinical mastitis in lactating dairy cows. The company sells its products through animal health distributors. ImmuCell Corporation was founded in 1982 and is headquartered in Portland, Maine.

Latest ICCC News From Around the Web

Below are the latest news stories about IMMUCELL CORP that investors may wish to consider to help them evaluate ICCC as an investment opportunity.

ImmuCell Corporation (NASDAQ:ICCC) Q3 2023 Earnings Call TranscriptImmuCell Corporation (NASDAQ:ICCC) Q3 2023 Earnings Call Transcript November 14, 2023 Operator: Good day, everyone, and welcome to the ImmuCell Corporation’s Third Quarter 2023 Financial Results Conference Call. [Operator Instructions] Please note this event is being recorded. And now I would like to turn the conference over to Joe Diaz. Please go ahead. Joe Diaz: […] |

ImmuCell Announces Unaudited Financial Results for the Quarter Ended September 30, 2023PORTLAND, Maine, Nov. 13, 2023 (GLOBE NEWSWIRE) -- ImmuCell Corporation (Nasdaq: ICCC) (“ImmuCell” or the “Company”), a growing animal health company that develops, manufactures and markets scientifically proven and practical products that improve the health and productivity of dairy and beef cattle, today announced its unaudited financial results for the quarter ended September 30, 2023. Management’s Discussion: “Our unaudited, preliminary product sales for the third quarter of 2023 were first |

ImmuCell to Announce Unaudited Financial Results for the Quarter Ended September 30, 2023Conference Call Scheduled for Tuesday, November 14, 2023 at 9:00 AM ETPORTLAND, Maine, Nov. 07, 2023 (GLOBE NEWSWIRE) -- ImmuCell Corporation (Nasdaq: ICCC) (“ImmuCell” or the “Company”), a growing animal health company that develops, manufactures and markets scientifically proven and practical products that improve the health and productivity of dairy and beef cattle, expects to report unaudited financial results for the quarter ended September 30, 2023 after the market closes on Monday, Novemb |

ImmuCell Announces Preliminary, Unaudited Sales Results for Q3 2023PORTLAND, Maine, Oct. 05, 2023 (GLOBE NEWSWIRE) -- ImmuCell Corporation (Nasdaq: ICCC) (“ImmuCell” or the “Company”), a growing animal health company that develops, manufactures and markets scientifically proven and practical products that improve the health and productivity of dairy and beef cattle, today announced preliminary, unaudited sales results for the third quarter of 2023, which ended September 30, 2023. Preliminary, Unaudited Total Sales Results: 20232022$ Increase ($ Decrease) % Incr |

ImmuCell Announces Submission of CMC Technical Section to the FDAPORTLAND, Maine, Aug. 29, 2023 (GLOBE NEWSWIRE) -- ImmuCell Corporation (Nasdaq: ICCC) (“ImmuCell” or the “Company”), a growing animal health company that develops, manufactures and markets scientifically proven and practical products that improve the health and productivity of dairy and beef cattle, announced today that it recently submitted the Chemistry, Manufacturing and Controls (CMC) Technical Section for Re-Tain® to the FDA. On August 10, 2023, the Company issued a disclosure stating that |

ICCC Price Returns

| 1-mo | -3.02% |

| 3-mo | -4.46% |

| 6-mo | 4.26% |

| 1-year | 4.47% |

| 3-year | -51.51% |

| 5-year | -17.76% |

| YTD | 0.98% |

| 2023 | -16.56% |

| 2022 | -23.75% |

| 2021 | 34.46% |

| 2020 | 15.53% |

| 2019 | -26.95% |

Continue Researching ICCC

Want to see what other sources are saying about Immucell Corp's financials and stock price? Try the links below:Immucell Corp (ICCC) Stock Price | Nasdaq

Immucell Corp (ICCC) Stock Quote, History and News - Yahoo Finance

Immucell Corp (ICCC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...