IDACORP, Inc. (IDA): Price and Financial Metrics

IDA Price/Volume Stats

| Current price | $97.50 | 52-week high | $104.79 |

| Prev. close | $97.25 | 52-week low | $86.43 |

| Day low | $96.87 | Volume | 251,935 |

| Day high | $97.96 | Avg. volume | 364,058 |

| 50-day MA | $93.98 | Dividend yield | 3.5% |

| 200-day MA | $94.15 | Market Cap | 5.19B |

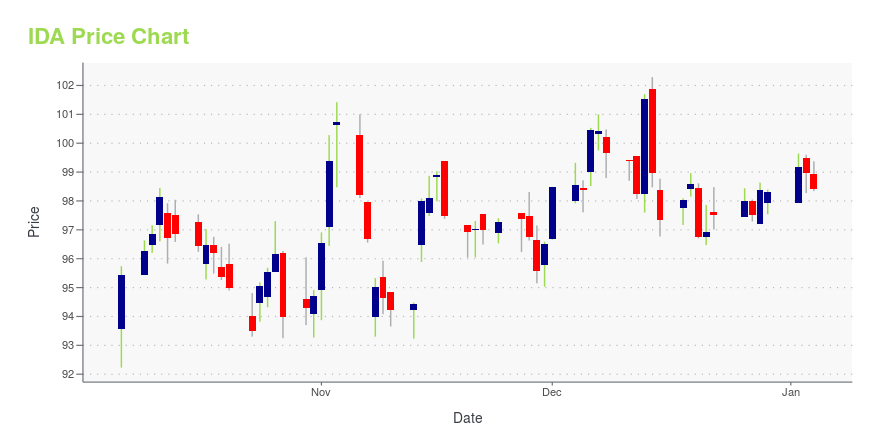

IDA Stock Price Chart Interactive Chart >

IDACORP, Inc. (IDA) Company Bio

IdaCorp Inc. engages in the generation, transmission, distribution, purchase, and sale of electric energy in the United States. The company was founded in 1915 and is based in Boise, Idaho.

Latest IDA News From Around the Web

Below are the latest news stories about IDACORP INC that investors may wish to consider to help them evaluate IDA as an investment opportunity.

VST or IDA: Which is a Better Utility Electric Power Stock?Both Vistra (VST) and IDACORP (IDA) work efficiently and continue to provide reliable service to their customers. |

What IDACORP, Inc.'s (NYSE:IDA) P/E Is Not Telling YouWith a median price-to-earnings (or "P/E") ratio of close to 17x in the United States, you could be forgiven for... |

IDACORP and Idaho Power Announce New Vice PresidentBOISE, Idaho, December 15, 2023--IDACORP, Inc. (NYSE:IDA): IDACORP, Inc. and Idaho Power announced today that Amy Shaw has been named Vice President of Finance, Compliance, and Risk, effective January 1. Shaw currently serves as the Director of Investor Relations, Compliance, and Risk for IDACORP and Idaho Power. |

Reasons to Add IDACORP (IDA) to Your Portfolio Right NowIDACORP (IDA) makes a strong case for investment, given its earnings growth prospects, strong ROE and ability to increase shareholders' value. |

IDACORP, Inc. Prices Public Offering of 2,801,724 Shares of Common StockBOISE, Idaho, November 08, 2023--IDACORP, Inc. (NYSE: IDA) announced today that it has priced an underwritten public offering of 2,801,724 shares of its common stock at a public offering price of $92.80 per share. Subject to certain conditions, all shares are expected to be borrowed by the forward counterparty (as defined below) (or its affiliates) and sold to the underwriters in the offering in connection with the forward sale agreement described below. In conjunction with the offering, IDACORP |

IDA Price Returns

| 1-mo | 5.89% |

| 3-mo | 3.97% |

| 6-mo | 7.19% |

| 1-year | -0.60% |

| 3-year | 1.32% |

| 5-year | 10.42% |

| YTD | 0.92% |

| 2023 | -5.97% |

| 2022 | -2.07% |

| 2021 | 21.45% |

| 2020 | -7.47% |

| 2019 | 17.70% |

IDA Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching IDA

Want to do more research on Idacorp Inc's stock and its price? Try the links below:Idacorp Inc (IDA) Stock Price | Nasdaq

Idacorp Inc (IDA) Stock Quote, History and News - Yahoo Finance

Idacorp Inc (IDA) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...