InterDigital Inc. (IDCC): Price and Financial Metrics

IDCC Price/Volume Stats

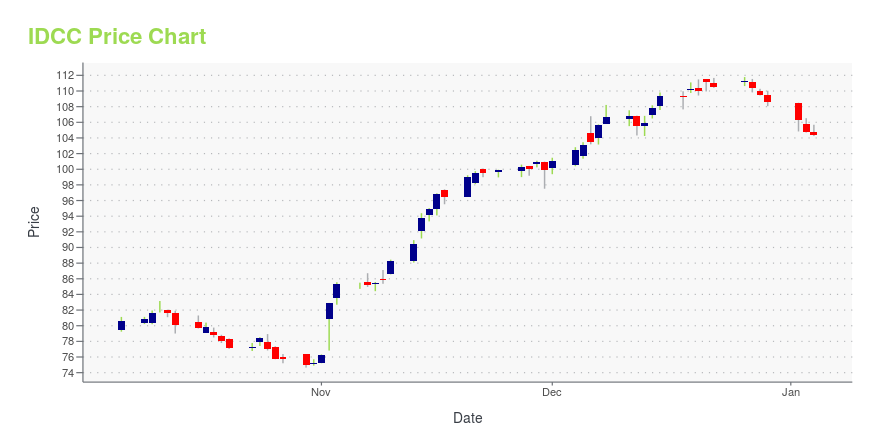

| Current price | $120.74 | 52-week high | $124.45 |

| Prev. close | $120.29 | 52-week low | $74.65 |

| Day low | $120.61 | Volume | 216,500 |

| Day high | $121.93 | Avg. volume | 470,857 |

| 50-day MA | $116.96 | Dividend yield | 1.3% |

| 200-day MA | $104.17 | Market Cap | 3.05B |

IDCC Stock Price Chart Interactive Chart >

InterDigital Inc. (IDCC) Company Bio

InterDigital, Inc. engages in the design and development of technologies that enable and enhance wireless communications, and capabilities. It focuses on mobile technology and devices, which includes cellular wireless technology, Internet of Things, technology, video coding & transmission, sensor and sensor fusion technology. It also offers digital cellular and wireless products and networks, including 2G, 3G, 4G and IEEE 802-related products and networks. The company was founded by Seligsohn I. Sherwin in 1972 and is headquartered in Wilmington, DE.

Latest IDCC News From Around the Web

Below are the latest news stories about INTERDIGITAL INC that investors may wish to consider to help them evaluate IDCC as an investment opportunity.

The Next Big Thing: 3 Tech Stocks Ready for a 500% Leap by 2027Are you looking for the next big thing in the stock-market? |

3 Telecom Stocks You Should Not Miss Adding to 2024 PortfolioU.S. Cellular (USM), Arista (ANET) and InterDigital (IDCC) are poised to benefit in 2024 owing to healthy growth dynamics and solid fundamentals. |

Jim Cramer Stock Portfolio: 12 Recent AdditionsIn this article, we discuss the 12 recent additions to the Jim Cramer stock portfolio. If you want to read about some more Cramer stocks, go directly to Jim Cramer Stock Portfolio: 5 Recent Additions. Jim Cramer, the host of Mad Money on CNBC, is one of the most well-known finance personalities on television. He […] |

InterDigital (IDCC) Is Up 2.49% in One Week: What You Should KnowDoes InterDigital (IDCC) have what it takes to be a top stock pick for momentum investors? Let's find out. |

Should You Be Adding InterDigital (NASDAQ:IDCC) To Your Watchlist Today?The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even... |

IDCC Price Returns

| 1-mo | 4.24% |

| 3-mo | 20.29% |

| 6-mo | 15.49% |

| 1-year | 35.00% |

| 3-year | 96.81% |

| 5-year | 103.29% |

| YTD | 12.50% |

| 2023 | 123.67% |

| 2022 | -29.25% |

| 2021 | 20.49% |

| 2020 | 14.28% |

| 2019 | -16.11% |

IDCC Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching IDCC

Here are a few links from around the web to help you further your research on InterDigital Inc's stock as an investment opportunity:InterDigital Inc (IDCC) Stock Price | Nasdaq

InterDigital Inc (IDCC) Stock Quote, History and News - Yahoo Finance

InterDigital Inc (IDCC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...