Icahn Enterprises L.P. (IEP): Price and Financial Metrics

IEP Price/Volume Stats

| Current price | $17.27 | 52-week high | $34.67 |

| Prev. close | $17.34 | 52-week low | $15.00 |

| Day low | $17.20 | Volume | 416,500 |

| Day high | $17.54 | Avg. volume | 678,244 |

| 50-day MA | $16.72 | Dividend yield | 22.84% |

| 200-day MA | $17.51 | Market Cap | 7.79B |

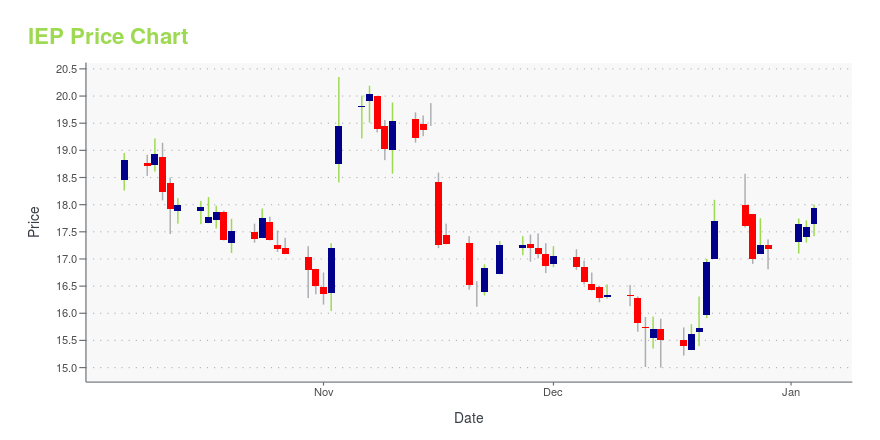

IEP Stock Price Chart Interactive Chart >

Icahn Enterprises L.P. (IEP) Company Bio

Icahn Enterprises L.P. is an American conglomerate headquartered at Milton Tower in Sunny Isles Beach, Florida. The company has investments in various industries including energy, automotive, food packaging, metals, real estate and home fashion. The company is controlled by Carl Icahn, who owns 88% of it. (Source:Wikipedia)

Latest IEP News From Around the Web

Below are the latest news stories about ICAHN ENTERPRISES LP that investors may wish to consider to help them evaluate IEP as an investment opportunity.

A Junk Bond Fund That Delivers High-Quality ReturnsManager David Sherman applies value-investing principles to high-yield bonds. It’s working out well for investors in the CrossingBridge Low Duration High Yield fund. |

Icahn Enterprises L.P. Announces Closing of $500 Million Senior Notes Offering and Additional $200 Million Senior Notes OfferingIcahn Enterprises L.P. (NASDAQ: IEP) – Icahn Enterprises L.P. ("Icahn Enterprises") announced today that it, together with Icahn Enterprises Finance Corp. (together with Icahn Enterprises, the "Issuers"), consummated their offering of (i) $500,000,000 aggregate principal amount of 9.750% Senior Notes due 2029 (the "Initial Notes") in a private placement not registered under the Securities Act of 1933, as amended (the "Securities Act") (such offering, the "Initial Notes Offering") and (ii) $200,0 |

Hindenburg’s Icahn, Adani Calls Mark Year of Prominent Bets(Bloomberg) -- Bearish wagers against the Adani Group and Icahn Enterprises Inc. have rounded out another remarkable year for activist short seller Hindenburg Research. Most Read from BloombergApple Races to Tweak Software Ahead of Looming US Watch BanApple to Halt US Sales of Smartwatches After Patent LossWhat If Putin Wins? US Allies Fear Defeat as Ukraine Aid StallsRecord Run in US Stocks Shrugs Off Fed Warnings: Markets WrapCiti Suit Raises #MeToo Claims at Wall Street’s Top LevelsThe US fir |

7 Dividend Stocks I Wouldn’t Touch With a 10-Foot PoleAvoid these seven dividend stocks to sell at all costs, as their payouts may not be a sustainable as they seem. |

Picking Through the Rubble of This Year's Hardest-Hit StocksA look at the worst-performing stocks |

IEP Price Returns

| 1-mo | 4.79% |

| 3-mo | 5.90% |

| 6-mo | 8.05% |

| 1-year | -35.48% |

| 3-year | -49.38% |

| 5-year | -49.55% |

| YTD | 11.95% |

| 2023 | -58.78% |

| 2022 | 18.76% |

| 2021 | 12.87% |

| 2020 | -3.55% |

| 2019 | 20.44% |

IEP Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching IEP

Want to do more research on Icahn Enterprises Lp's stock and its price? Try the links below:Icahn Enterprises Lp (IEP) Stock Price | Nasdaq

Icahn Enterprises Lp (IEP) Stock Quote, History and News - Yahoo Finance

Icahn Enterprises Lp (IEP) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...