ING Groep N.V. ADR (ING): Price and Financial Metrics

ING Price/Volume Stats

| Current price | $18.57 | 52-week high | $18.66 |

| Prev. close | $18.35 | 52-week low | $12.44 |

| Day low | $18.33 | Volume | 2,439,659 |

| Day high | $18.58 | Avg. volume | 2,601,794 |

| 50-day MA | $17.69 | Dividend yield | 7.46% |

| 200-day MA | $15.36 | Market Cap | 64.96B |

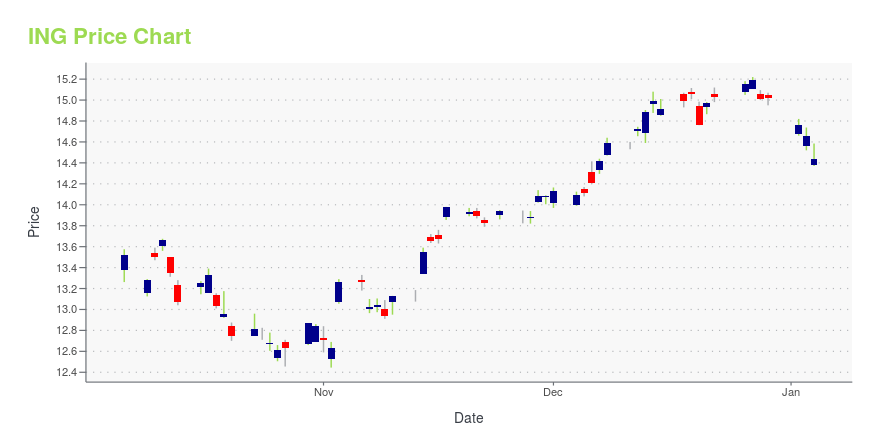

ING Stock Price Chart Interactive Chart >

ING Groep N.V. ADR (ING) Company Bio

The ING Group (Dutch: ING Groep) is a Dutch multinational banking and financial services corporation headquartered in Amsterdam. Its primary businesses are retail banking, direct banking, commercial banking, investment banking, wholesale banking, private banking, asset management, and insurance services. With total assets of US$1.1 trillion, it is one of the biggest banks in the world, and consistently ranks among the top 30 largest banks globally. It is among the top ten largest European companies by revenue. (Source:Wikipedia)

Latest ING News From Around the Web

Below are the latest news stories about ING GROEP NV that investors may wish to consider to help them evaluate ING as an investment opportunity.

Progress on share buyback programmeProgress on share buyback programme ING announced today that, as part of our €2.5 billion share buyback programme announced on 2 November 2023, the company repurchased 14,925,745 shares during the week of 18 December 2023 up to and including 22 December 2023. The shares were repurchased at an average price of €13.64 for a total amount of €203,527,667.46. For detailed information on the daily repurchased shares, individual share purchase transactions and weekly reports, see the ING website at www |

15 Best Auto Insurance Companies Heading into 2024In this article, we will look at the 15 best auto insurance companies heading into 2024. If you want to skip our detailed analysis of the auto insurance market, you can go directly to 5 Best Auto Insurance Companies Heading into 2024. Global Auto Insurance Industry Poised for Growth The auto insurance industry is a […] |

15 Best Term Life Insurance Companies Heading into 2024In this article, we will look into the 15 best term life insurance companies heading into 2024. If you want to skip our detailed analysis, you can go directly to 5 Best Term Life Insurance Companies Heading into 2024. Term Life Insurance Industry: A Market Analysis According to a report by Grand View Research, the […] |

15 Best Boat/Yacht Insurance Companies Heading into 2024In this article, we will look into the 15 best boat/yacht insurance companies heading into 2024. If you want to skip our detailed analysis, you can go directly to the 5 Best Boat/Yacht Insurance Companies Heading into 2024. Boat/Yacht Insurance Industry: A Market Analysis According to a report by Verified Market Research, the global boat/yacht […] |

ING takes next steps on energy financing after COP28ING takes next steps on energy financing after COP28 Phase-out of upstream oil & gas financing by 2040 Aim to triple renewables financing by 2025 ING announced today it is taking the next steps in our energy approach, phasing out the financing of upstream oil and gas activities by 2040 and aiming to triple new financing for renewable energy by 2025. These steps, updating our Terra approach, come after governments at COP28 agreed to transition away from fossil fuels and triple renewable energy ca |

ING Price Returns

| 1-mo | 9.30% |

| 3-mo | 16.50% |

| 6-mo | 35.66% |

| 1-year | 38.20% |

| 3-year | 81.29% |

| 5-year | 104.72% |

| YTD | 28.97% |

| 2023 | 30.71% |

| 2022 | -5.56% |

| 2021 | 54.08% |

| 2020 | -21.66% |

| 2019 | 19.13% |

ING Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching ING

Want to do more research on Ing Groep Nv's stock and its price? Try the links below:Ing Groep Nv (ING) Stock Price | Nasdaq

Ing Groep Nv (ING) Stock Quote, History and News - Yahoo Finance

Ing Groep Nv (ING) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...