International Seaways, Inc. (INSW): Price and Financial Metrics

INSW Price/Volume Stats

| Current price | $54.84 | 52-week high | $65.94 |

| Prev. close | $55.22 | 52-week low | $38.67 |

| Day low | $54.45 | Volume | 407,409 |

| Day high | $55.42 | Avg. volume | 557,617 |

| 50-day MA | $59.82 | Dividend yield | 0.83% |

| 200-day MA | $52.79 | Market Cap | 2.71B |

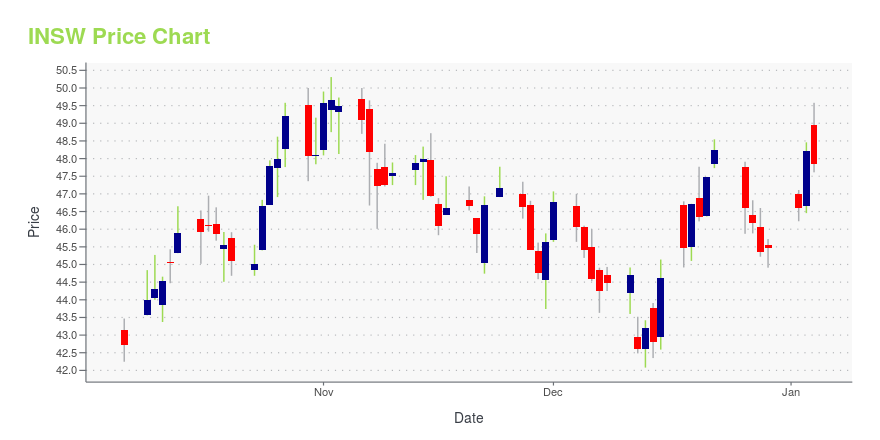

INSW Stock Price Chart Interactive Chart >

International Seaways, Inc. (INSW) Company Bio

International Seaways, Inc. and its subsidiaries own and operate a fleet of oceangoing vessels. The Company's oceangoing vessels engage in the transportation of crude oil and petroleum products in the International Flag trades. The company was founded in 1999 and is based in New York City, New York.

Latest INSW News From Around the Web

Below are the latest news stories about INTERNATIONAL SEAWAYS INC that investors may wish to consider to help them evaluate INSW as an investment opportunity.

7 Mid-Cap Stocks to Buy for Steady Gains in 2024You can go small or you can go big, but ahead of market ambiguities, investors may be best served with mid-cap stocks. |

Is Weakness In International Seaways, Inc. (NYSE:INSW) Stock A Sign That The Market Could be Wrong Given Its Strong Financial Prospects?It is hard to get excited after looking at International Seaways' (NYSE:INSW) recent performance, when its stock has... |

11 Best Cheap Stocks To Buy For Long TermIn this piece, we will take a look at the 11 best cheap stocks to buy now for the long term. If you want to skip our coverage of the latest stock market news and stock valuation, then take a look at 5 Best Cheap Stocks To Buy For Long Term. The stock market has […] |

Live Webinar on the Tanker Sector: Tuesday, November 28, 2023, at 10 a.m. ETShipping Executives to Discuss the Tanker Sector's Current Trends & OutlookNEW YORK, Nov. 20, 2023 (GLOBE NEWSWIRE) -- Capital Link will host a complimentary webinar on November 28, 2023, at 10 a.m. Eastern Time on the Tanker shipping sector. REGISTRATIONOnline attendance is complimentary. Please click on the link below to register.https://webinars.capitallink.com/2023/shipping/ FEATURED PANELISTS Paolo d’Amico, Chairman and CEO of d’Amico International Shipping (OTCQX: DMCOF) (Borsa Italiana: D |

13 Cheap Energy Stocks To BuyIn this piece, we will take a look at the 13 cheap energy stocks to buy. If you want to skip our overview of the energy industry and some recent trends, then check out 5 Cheap Energy Stocks To Buy. Despite the global push towards renewable energy and emissions free vehicles, the global fossil fuel […] |

INSW Price Returns

| 1-mo | -8.58% |

| 3-mo | 2.43% |

| 6-mo | 8.00% |

| 1-year | 56.60% |

| 3-year | 327.87% |

| 5-year | 341.02% |

| YTD | 27.40% |

| 2023 | 42.93% |

| 2022 | 162.53% |

| 2021 | -2.93% |

| 2020 | -44.43% |

| 2019 | 76.72% |

INSW Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching INSW

Here are a few links from around the web to help you further your research on International Seaways Inc's stock as an investment opportunity:International Seaways Inc (INSW) Stock Price | Nasdaq

International Seaways Inc (INSW) Stock Quote, History and News - Yahoo Finance

International Seaways Inc (INSW) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...